USD Fundamentals: Dollar to Stay in Demand

Last week’s economic data confirmed the narrative that the US economy is still in good shape, therefore supporting the case for continued Fed hawkishness and US dollar strength. Nonfarm payrolls came in at 263K, close to the consensus forecasts, while the unemployment rate fell back to the historic low of 3.5%. Earlier in the week, the ISM manufacturing survey surprised lower, but the services ISM index beat expectations. Overall, the signal from hard economic data cannot be clearer - more and persistent Fed tightening is needed to rein in inflation, and the FOMC is not hesitant to deliver that.

Already last week, we got confirmation of this, with several Fed Presidents pushing back against any speculation for early rate cuts next year (the so-called “Fed pivot”). Nearly all FOMC officials who spoke last week reiterated last week that interest rates will need to rise to at least 4.5% and stay there throughout 2023. This amount of hawkishness should be enough to keep the US dollar supported in the current environment over the coming weeks and months. Fresh cycle highs – EURUSD below 0.95, DXY index above 115.00 – still look probable.

This week is all about inflation, and the main attention will go to the CPI report on Thursday. Both the headline and core measures will be important, but chances are that they will show inflation remains “high”. Fed tightening expectations and hawkish rhetoric will remain intact, barring a big miss in the CPI report, which should keep the dollar underpinned this week too.

Other events worth watching on the calendar will be the FOMC meeting minutes (Wed) and retail sales (Fri).

EUR Fundamentals: EURUSD Resumes Downtrend

The euro remains weak but broadly is faring better, with the weakness still being most pronounced versus the currently “strong” currencies such as the US dollar and Swiss franc. This is reflective of the fact that the euro is also party a “safer” currency compared to the British pound. This is why during risk aversion episodes, the tendency for pairs like EURGBP, EURAUD, and EURNZD is to move higher.

The EU and the ECB are also running more orthodox fiscal and monetary policies compared to the UK. Still, the euro weakness is not about the lack of ECB rate hikes (they are already hiking), but about the weak economy and incoming recession. Ultimately, the ECB can’t and won’t need to hike interest rates as much as other countries which are not economically hit by the developments in Ukraine. When it comes to the Fx market, Europe is still doomed, and European currencies are likely to remain in a downward trajectory.

The calendar this week is light on economic data but has several ECB speakers scheduled. They will keep the hawkish rhetoric, but none of this is likely to help the EUR currency when the region is facing its worst-ever energy crisis, which is also chopping off a large % of Eurozone GDP. The likely path for EURUSD remains down, with 0.95 looking like an achievable near-term target.

EURUSD Technical Analysis:

EURUSD retraced up almost as high as the 1.00 level last week before it was rejected and slid back to 0.98. Ultimately, this bullish move should still be viewed as a correction within the overall downtrend, as no key resistance zones or trend lines have been broken (see chart).

Thus, 1.00 is now solidified as resistance. The falling trendline is now coming below parity and closer to the 0.99 level, which could mean this will become a stronger resistance in the near future.

EURUSD is already falling fast this week and trading below 0.97. To the downside, the focus remains at 0.95 as a key target – which if reached – will likely also open the way for an extension lower toward 0.92 and 0.90.

GBP Fundamentals: Bearish Pressures Already Returning

GBP extended the retracement much higher than most traders probably expected. GBPUSD tested the 1.15 zone, and EURGBP reached 0.8650, both more than offsetting the plunge from the Government’s budget announcement.

Interestingly, while Liz Truss’ Government did announce they are giving up on some of the controversial fiscal measures that were initially announced, this is far from a complete U-turn. Thus, in this sense, the complete reversal of the GBP’s losses doesn’t make sense as the Government still plans to expand budget spending to deal with the energy crisis, a problematic strategy for the UK which is already a highly indebted country. So, the pound is finding itself falling again early this week, and it will be no surprise if this extends toward the all-time lows reached last month. The fundamentals remain bearish, with the UK facing the same severe energy crisis like the rest of Europe.

The GBP calendar features employment data tomorrow (Tue) and GDP on Wednesday. But perhaps speeches from BOE officials will be more interesting, given the high volatility in bond markets and the threat to financial stability in UK markets. Traders will continue to closely follow these, with Governor Bailey and several other members of the BOE’s committee scheduled to speak throughout the week.

GBPUSD Technical Analysis:

The upside correction to touch the 1.15 level was almost as fast as the move down from 1.14 to the all-time low of 1.0335. The volatility surely left many traders confused, but GBPUSD is now back trading toward the 1.10 level, indicating the bears are gaining control here again.

The 1.10 level should remain an important technical zone and could be viewed as a middle line within this wider range of 1.15 - 1.0335. The 1.10 zone is likely to act as support ahead of the next key zone at 1.08.

To the upside, 1.15 is now the clear and key resistance to watch. Ahead of it, 1.12 could provide moderate resistance.

JPY Fundamentals: Bearish Factors Intact, Intervention Can Only Bring Temporary Respite

The JPY continued to trade broadly neutral, preserving the less volatile trading conditions following the BOJ intervention last month. Nonetheless, the fundamentals remain firmly bearish due to the BOJ’s uber-dovish stance, and thus it’s no surprise that bearish pressures on the yen have already re-emerged. USDJPY is pressing toward the highs just under 146.00 already this Monday morning.

Indeed, intervention alone can’t overpower the fundamentals to reverse the uptrend in USDJPY, nor is it intended to. Instead, Japanese authorities only want a more gradual, orderly decline in the yen instead of the rapid freefall that transpired for much of this year. As long as the yen’s decline (USDJPY uptrend) is slow, the BOj and MoF are unlikely to care much and may not even intervene.

Based on this, it’s fair to assume that any fall in USJDPY due to intervention is unlikely to go too far. Thus, such retracements can be used to establish fresh long positions, potentially targeting the 150.00 zone. Still, we should keep in mind that such long USDJPY trades come with the risk that the BOJ and MoF may resist further fast appreciation of the exchange rate.

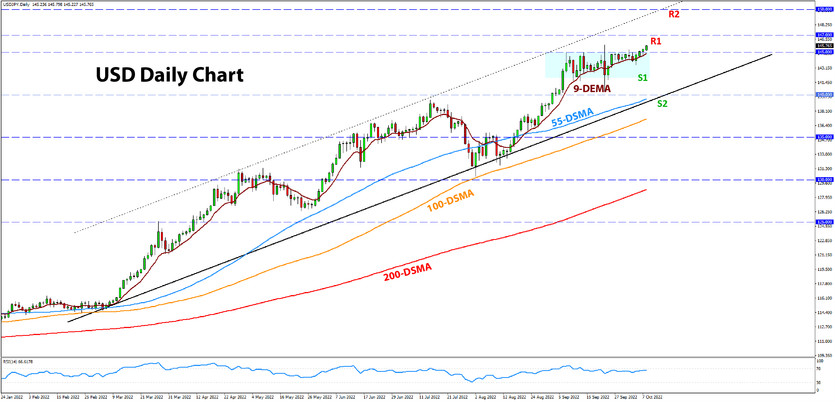

USDJPY Technical Analysis:

USDJPY has almost not done anything over the past week, except for the attempt to climb above 145.00. But the break lacks any momentum or volatility, which could mean it is not a true breakout. But if it is a true breakout, the move could extend toward 150.00.

The 146.00 147.00 zone to the upside should remain important. Heavy resistance is likely to exist here, potentially also triggering another round of MoF/BOJ intervention (see above section). Further higher, 150.00 should be the next crucial technical zone for USDJPY.

To the downside, 142.00 is the first support zone in sight, followed by the more important one at 140.00.