USD Fundamentals: Upside Inflation Surprise Fuels Further Hawkish Fed Pricing

The dollar (as measured by the broad DXY index) ended the past week only marginally higher, following a rather unusual reaction to the higher than expected CPI inflation report Thursday. Namely, all components of the CPI report were higher than the consensus forecasts, with the core CPI measure printing a fresh high at 6.6%!

The Fed surely won’t like this inflation report, and rightly markets have moved to reprice hawkish expectations further higher. The chances for a giant 1.00% hike in two weeks’ time are starting to increase (Fed meets on November 2), although a 0.75% rate increase still seems like the most likely outcome. Nonetheless, the Fed can amp up the hawkish stance in different ways, and they can do another 0.75% hike in December instead of 0.50% as was expected before the CPI report last week. Reflecting the hawkish repricing, expectations for the terminal Fed rate are now around 5.00, up from 4.75% the week before.

All in all, the economic data continues to suggest a very hawkish Fed for longer, which supports the case for steady and continued USD strength. In line with this, a new high in the DXY index and a break below the 0.9535 low in EURUSD looks like the probable scenario for the coming weeks. The US calendar this week is much quieter, with only housing data like building permits, home sales and housing starts in focus.

EUR Fundamentals: EURUSD Likely Destination Remains 0.95

The euro has stabilized in recent weeks following the sharp losses in late September as markets are realizing the worst-case scenarios for Europe’s energy crisis this winter is pretty much priced in already. Gas reserves are full enough in most EU countries to be able to get through this winter. Europe will most likely NOT freeze this year. This could mean that negative news about gas supplies may start to have a smaller or no bearish impact on the EUR currency from now on.

However, that is far from saying that the EUR is out of the woods yet or that it can rebound soon. The energy crisis is not the only factor that is driving the single currency lower this year. Other factors like the (likely) incoming recession and the continued widening yield differential with the US are likely to keep the EUR currency pressured over the coming weeks and months.

The war in Ukraine and severing relations with Russia will have a long-lasting impact on the EU economy. Thus from the perspective of the Fx market, the euro is doomed and will likely stay in a downtrend vs the relatively stronger currencies like the US dollar.

The EUR calendar is light this week, with no 1st tier reports scheduled for release.

EURUSD Technical Analysis:

Not much has changed in the EURUSD technical picture. The pair remains well within the bearish channel that clearly defines much of the downtrend this year.

Another retracement attempt seems to be underway as EURUSD creeps above 0.98 again. However, the falling trendline is providing resistance lower now, at the 0.99 zone. Perhaps, this could be another good point for fresh short entries.

To the downside, 0.97 is emerging as moderate support. This is where EURUSD rebounded last week. The more important support, of course, remains at the 0.95 zone. A break under it should clear the way for an extension lower, perhaps to 0.92.

GBP Fundamentals: Finance Minister Kwarteng Has Been Fired, Pound Jumps

Prime Minister Liz Truss seems to have gotten the message from markets that cutting taxes and pursuing stimulative fiscal policies when inflation is running at around 10% is not the smartest of ideas. She fired finance minister Kwasi Kwarteng and replaced him with Jeremy Hunt over the weekend, who should run a more orthodox fiscal policy.

The pound immediately rebounded on the news that Kwarteng has been fired in anticipation that the UK will abandon the unusual plans for large budget spending. Indeed that is what is now transpiring, and there is news that PM Liz Truss may also be replaced soon as the markets have started to view her as rather incompetent following the fiscal debacle.

Nonetheless, the pound can celebrate the turnaround in the Fx market, and the rebound likely has some further fuel to run, especially if it is confirmed that the Government will do a full U-turn on its fiscal plan. This means that GBPUSD could reach levels above 1.15 while EURGBP could fall toward 0.85.

The highlights on the UK economic calendar are CPI inflation (Wed) and retail sales (Fri) reports as well as speeches from BOE members throughout the week. However, given all the political developments in the Government, any market reaction to these calendar events may be muted.

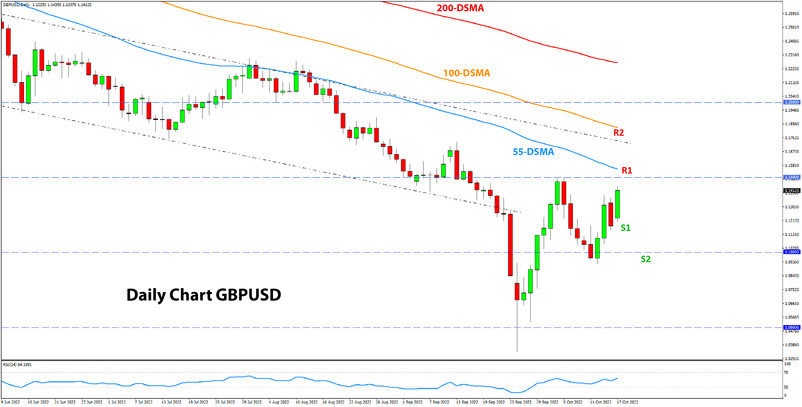

GBPUSD Technical Analysis:

Cable is approaching the 1.15 level after testing the 1.10 support last week. Following the sharp rebound in late September from the big sell-off under 1.05, this latest move to the upside could be a more serious attempt for a recovery. The price action is also showing signs of stabilization. GBPUSD now may enter a wider trading range, for example between 1.10 and 1.15.

To the upside, if 1.15 doesn’t hold, the focus will shift to the 1.17 and 1.18 zones as the next resistance zones higher. To the downside, 1.12 is moderate support, but 1.10 has now been solidified as the more important support zone.

JPY Fundamentals: USDJPY Intervention Threshold Has Moved Higher

Not only USDJPY pushed above the 145.00 level last week, and is approaching the 150.00 level already early in the new trading week. Japanese authorities intervened to push USDJPY below 145.00 the last time, but on this occasion, they have not intervened to stop a break above 145.00. This confirms our narrative from recent weeks that Japan’s officials don’t want to reverse the uptrend in USDJPY but only slow it down.

With this in mind, their next intervention trigger may be the 150.00 level exactly. In fact, it is highly probable that that’s the case but they have not expressed that officialy. So, there is no way to know for sure where they will intervene. In any case, we should prepare accordingly and be extra careful holding long positions if USDJPY gets very near to 150.00.

Trying to short in the face of the uptrend in the hopes of intervention is a trickier task. Going short before an intervention is actually announced can be very risky as we can’t know for sure at what level Japan’s authorities will intervene. It could be 150.00, 155.00, or 160.00. That can make a big difference to the distance to your stop loss and, thus your risk on the trade.

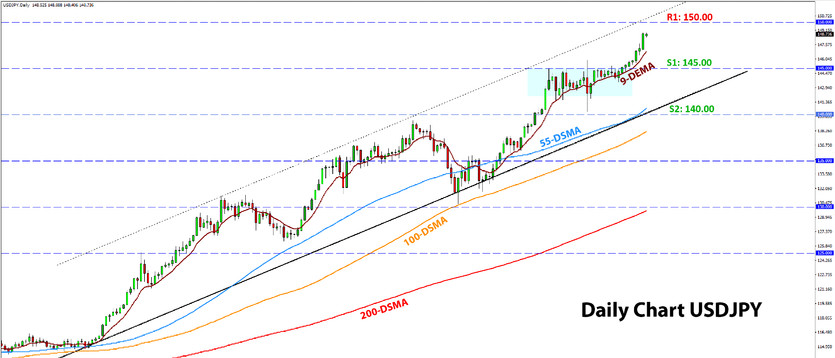

USDJPY Technical Analysis:

Following the successful break above 145.00, USDJPY is steadily approaching the 150.00 zone, arguably the next crucial psychological level higher. Some strong resistance could exist there, especially intervention risk, as discussed above.

It’s interesting to note here how the 9-day exponential moving average (DEMA) has accurately defined each leg of the uptrend. Since moving above the 9-DEMA in August, USDJPY has only dipped below it once, and that was on September 22 during the intervention. So, it seems as long as USDJPY stays above the 9-DEMA, the short-term trend is up and intact.

To the downside, 145.00 is now the nearest support zone. Further lower, 140.00 also remains an important support in case the market gets that far.