USD Fundamentals: Focus on GDP and PCE Inflation Data This Week

The dollar was trading strong for most of the past week until late on Friday when intervention from Japanese authorities to curb yen weakness triggered a broader correction in the US dollar as well. Also on Friday, rumors stemming from a WSJ article that Fed officials are considering a slower pace of tightening after the interest rate reaches the so-called “terminal rate” of around 4.5% - 0 5.0% in December.

This is the first more concrete speculation that the Fed is thinking about shifting to a more neutral stance from the very aggressive hawkish stance that they have held for 7-8 months already. Still, this is no surprise, and it was obviously well-known in advance that the Fed would tone down the hawkishness after they’ve quickly taken interest rates to around 4.5%. We are still not there, but US Fed interest rates will likely be at least 4.5% or higher by the end of the year.

Crucially, the Fed taking a pause with the rate hikes in no way changes policy to dovish (the so-call “pivot”). In fact, with QT running in full swing and interest rates of around 5%, Fed policy is the most hawkish it has been in decades. In line with this, last week’s dollar decline is still best to be viewed as a correction within the bull trend.

On the calendar, the focus is on the advanced GDP data (Thur) and PCE inflation reports (Fri). Both are likely to signal a further need for a hawkish Fed, as the US economy is still outperforming most other developed countries (higher GDP y/y), and PCE inflation is to remain much too high.

EUR Fundamentals: Fx Traders Watching ECB but not expecting any fireworks

The euro continues to hold up relatively well on a broad basis while remaining largely in a downtrend against the mighty US dollar, although even EURUSD corrected higher last week. Much of the EUR’s retracement recently has to do with the fact that a lot of the dismal expectations related to the energy crisis and war in Ukraine are already priced in the Fx market. This is likely the main factor offering an opportunity for the euro currency to take a break and consolidate.

Still, the prospects for the Eurozone economy remain grim. The manufacturing and services PMI surveys (released this morning) already confirm that the Eurozone economy is in contraction. All reports are below the 50.00 level, which is the dividing line between economic expansion and contraction.

On the calendar this week, the main attention is on the ECB meeting Thursday. They are likely to deliver a 75bp hike also, but all of this is fully priced, and the market reaction is likely to be muted. Importantly, unlike the Fed, this could be the last 75bp from the ECB before they pause tightening early next year too.

In addition, the ECB is still doing QE; thus, the divergence between them and the Fed remains wide and in favor of a lower EURUSD exchange rate. A continuation of the downtrend and an eventual break below 0.95 still appears as a likely scenario here.

EURUSD Technical Analysis:

EURUSD continues to trade well within the bearish channel, although mainly retracing in consolidation since the start of the month. Nonetheless, no key resistance levels have been broken, and the trend remains down here.

Since mid-October, the pair has been trading in a very tight range of 150-200 pips, roughly between 0.97 and 0.9850. It has been retracing higher last week again but has hit the strong resistance from the multi-month, long-term falling trendline that currently sits at the 0.99 zone (see chart). The resistance is holding so far and looks like another attractive opportunity for establishing fresh short positions.

Above 0.99, parity (1.00) should also be a key technical zone that will provide strong resistance. To the downside, 0.97 is the first support in line ahead of the more important one at 0.95. A break of 0.95 should clear the way for downside continuation, potentially toward 0.92.

GBP Fundamentals: PM Truss Resigns, but Pound Not Out of The Woods Yet

There is no end to the UK political circus, with the currency swinging wildly up and down ever since Liz Truss took the Prime Minister position in early September. She has now resigned, which should be a positive development for UK financial markets and the pound sterling.

When Truss took office on September 6, GBPUSD was trading around 1.15 and EURGBP around 0.86 - 0.8650. Both pairs have now returned to those levels after the 500 - 1000 pip swings on the budget announcement debacle. Essentially, the pound is back to square one now.

Former Chancellor of the Exchequer Rishi Sunak is the top candidate expected to take over the Prime Minister position. This should be more good news for GBP in the long term, as he is considered a fiscally responsible candidate. However, in the very short term, it’s hard to see the pound strengthening more than it already has, especially now that all the Truss-induced losses have been erased.

The damage to credibility has already been done, and Sunak will now have a tougher job than if he had become Prime Minister in September. Moreover, that job was already hard as the UK economy - like the Eurozone - is headed for a deep recession amid the energy crisis and fallout with Russia. Considering all of this, the pound is likely to remain under pressure, and the downtrend in GBPUSD is likely not over yet. The pair could still slip toward 1.10. However, a return to the all-time lows around 1.0350 is indeed very unlikely now that Liz Truss is gone.

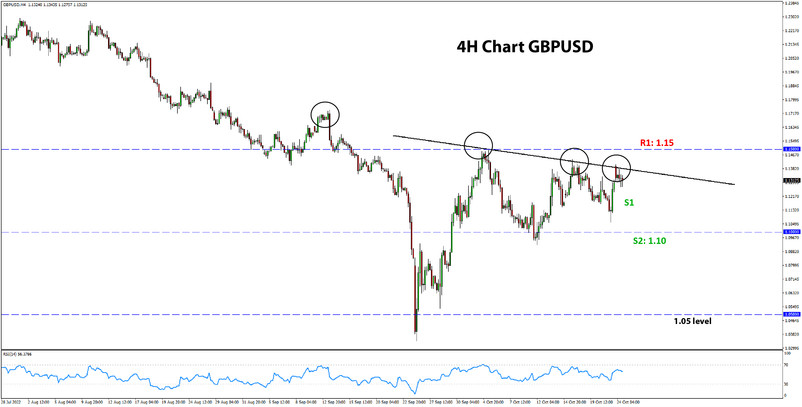

GBPUSD Technical Analysis:

After almost hitting the 1.15 level as part of the sharp bounce off the all-time lows, GBPUSD has been trading in a wider range between 1.10 and 1.15. Considering the overall technical picture, it appears that GBPUSD can continue to trade in this range for a while.

Scenarios outside of this range would include either a bullish case (break above 1.15) or a bearish case (break below 1.10). If.15 breaks first, the focus will shift to the 1.17 and 1.18 zones as the next resistance zones higher.

To the downside, firstly 1.12 is moderate support, while 1.10 is the key technical zone and also the bottom of the current trading range. Below it, the focus turns to 1.08 and then the “big” 1.05 level ahead of the all-time lows reached a month ago at 1.0335.

JPY Fundamentals: Intervention Triggers 650 Pips Move in USDJPY; Watching BOJ meeting on Friday

Japanese authorities didn’t immediately intervene as USDJPY pushed through 150.00 and did so only after the price broke some 200 pips higher. So, in the end, 150 was a line in the sand but not a clear-cut level that they would want to defend (more on this in the next section). As we said last week, it’s always tricky to trade central bank interventions as many hard-to-predict variables are at play and the volatility is extreme.

The Bank of Japan meeting this Friday will be particularly of interest to traders in the current context. What will they say about intervention, and will they maybe consider adjusting their policy stance?

Indeed, as we have said in our past weekly Fx editions, only a change of BOJ policy can actually save the yen. However, that is still an unlikely outcome. The BOJ is expected to keep its dovish settings fully in place at the meeting on Friday, changing nothing fundamental for the JPY currency.

Friday’s intervention above 150.00 only confirms the widely-held view in the markets that Japanese authorities don’t intend to stop the yen from falling but only slow down the pace of the depreciation. Still, traders should stay very careful about intervention – since, as we saw late Friday – the market can quickly move by 500 - 1000 pips when central banks activate intervention operations.

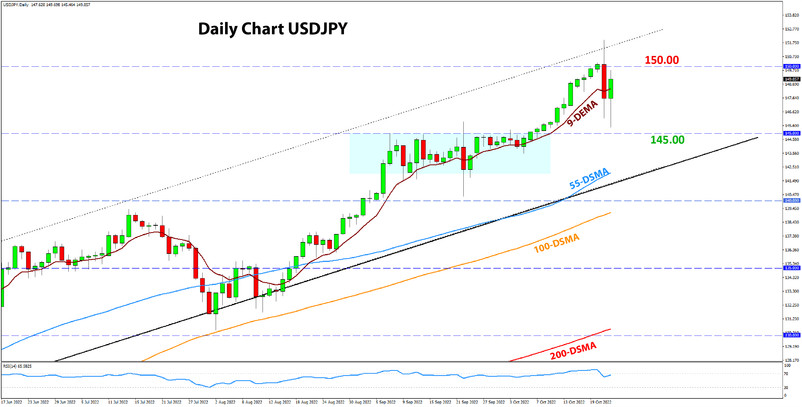

USDJPY Technical Analysis:

USDJPY reached a high of 151.93 on Friday before intervention from the Japanese authorities triggered a sharp correction down, some 650 pips lower. It seems there was another intervention overnight following the market open today (Mon) as there was a 400 pips reaction in USDJPY. However, Japanese officials have not officially confirmed they intervened on Friday and today, but the size of these moves can not be anything else other than central bank intervention.

It’s particularly notable that the 150.00 level itself was not a clear trigger point for the intervention. We warned about this in the previous weekly Fx last Monday. The BOJ may have done this purposefully as the last thing they need now is speculators attacking a specific level they are defending. They probably prefer not to defend a specific level, which is why they waited for USDJPY to move well above 150.00 before coming into the market to reverse the move. In a way, the BOJ may want to make the job for Fx traders harder.

Considering all this, it’s hard to determine clear support and resistance zones for USDJPY, especially when the volatility is so high. Nonetheless, the 150.00 and 145.00 zones will remain important, and we can probably still expect some reaction when USDJPY gets to those levels.