USD Fundamentals: Fx Traders Watching Midterm Elections and CPI Inflation This Week

The dollar had a mixed week and wasn’t able to hold onto gains, despite the hawkish Fed last Wednesday and rather solid NFP/jobs reports Friday. The main reason seems to be a general lift in risk sentiment driven by various factors, but also as the markets chose to focus on the positives instead of the negatives in the current environment.

A mixture of positive developments in other parts of the world is certainly behind the USD’s inability to climb to fresh highs on the hawkish Fed and (still) robust Nonfarm Payrolls report. Namely, the severity of the European energy crisis has subsided due to the warm weather for this time of year (more below); and there are rumors China is considering a full reopening of its economy after three years of harsh Covid lockdowns. The positive risk sentiment is reflected across all markets, with stocks remaining well off the September lows. In what is a usual reaction, the recovery in risk sentiment is denting demand for the US dollar.

In the short term, the USD may consolidate for a while longer given the current circumstances; however, a sustainable end to the bull trend doesn’t seem likely yet. The situation in Europe remains frangible (with the War still raging and gas supplies for next year still at high risk), while continued rising interest rates are no good news for the global economy. The likelihood of a global recession is increasing as central banks keep on with their hawkish policies. This is an environment that is likely to eventually switch the mood back to risk aversion, which will lead to a resumption of demand for safe-haven US dollars.

Fx traders will be watching the midterm elections (Tue) and CPI inflation on (Thur) on the US calendar this week. The events will be a source of volatility but should not be game-changers for the long-term bullish USD trend.

EUR Fundamentals: Warm Weather Alleviates Gas Crisis in the Short Term

The euro continues to hold up well, even against the mighty dollar in recent weeks. The perceived improvement in risk sentiment is certainly helping the euro; and, in particular, an improvement in the European energy crisis for the outlook this winter. Funnily enough, the main reason for that is the much warmer weather for this time of the year across the European continent, which has helped to keep gas consumption at a minimum. For example, Germany is still recording daily temperatures above 15 °C.

Speculation out of China about ending Covid lockdowns is also helping sentiment in Europe, especially given the correlation with China due to the big trade between the two economies (China is Europe’s largest partner). This, combined with the fact that Europe will not freeze this winter surely has lifted sentiment and helped the EUR currency recover.

However, beyond the short term, the outlook remains grim. Europe is going into a deep recession (and ECB officials have now started to admit that), and the energy crisis is far from over. While there is enough gas for this winter, the supplies are much more uncertain for next year, and prices remain painfully high. This will continue to be a big negative factor for the economy and ultimately be reflected in the EUR currency, which cannot stage a big recovery when the economy is that weak.

A light calendar this week with mostly 2nd-tier events will keep traders’ attention on events elsewhere. Several ECB officials are scheduled to speak, though it’s unlikely that any hawkishness from the ECB can affect the euro since, as discussed above, other factors remain the primary drivers.

EURUSD Technical Analysis:

After an attempt to break above parity in late October, EURUSD returned below it last week and is now playing with this all-important level. The attempt for an upside breakout seems to still be ongoing, given the late Friday rebound and EURUSD now being again close to 1.00.

Still, there are further levels that need to be cleared for a successful breakout. For instance, the October high of 1.01 (also the 100-day SMA) is notable resistance, and this zone could again prove strong enough to hold the attempt. Above there, the 1.0350 and 1.05 zones are the next resistance zones based on the weekly chart.

To the downside, 0.97 is the important support now following last week’s rebound here. The next support is at 0.95.

GBP Fundamentals: BOE Hikes 75bp but Issues Dovish Guidance

The Bank of England raised rates by 75bp last week but delivered dovish guidance, which was overall much in line with what markets expected. The pound still got hammered along with the few who hoped the BOE would be hawkish in the face of above 10% inflation readings.

The enthusiasm following the election of Rishi Sunak seems to be fading quickly, and GBP was a relative underperformer over the past week. This was to be expected, as we discussed last Monday; the UK is in a very bad spot, probably even worse than the Eurozone, which means downside pressures on sterling won’t abate any time soon. The UK economy is also going into recession, and Rishi Sunak’s Government will now have to double down on austerity and prudent budget spending following Liz Truss’ fiscal debacle last month. In the short term, this could mean more pain for the economy and the currency.

The UK economic calendar is relatively quiet, except on Friday when the latest GDP data will be released. This is expected to be the first official report of contraction, which will confirm the narrative of the weak UK economy. Potentially a big negative surprise could be a catalyst for another downside leg in GBP.

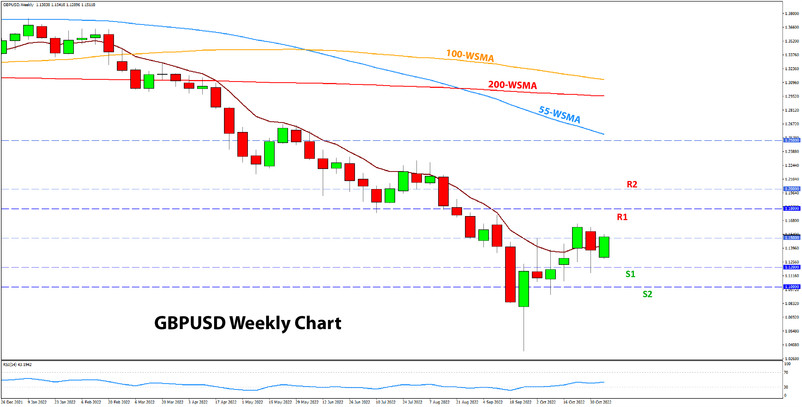

GBPUSD Technical Analysis:

GBPUSD is extending the rebound from late Friday into this week and is now making a go above the 1.15 level again. If this continues, the pair could surpass the previous local high of around 1.1650. An extension of the broad USD correction will likely be needed to support GBPUSD further higher.

The 1.18 zone would come into focus as resistance in such a scenario. An extension much further higher from there will likely be more difficult to come. The 1.20 zone is the next resistance higher.

To the downside, 1.12 is now solidified as support after last week’s bounce from this zone. Although the actual low was closer to 1.1150, 1.12 as a support zone can still be considered to have held. Below it, 1.10 will be important support if the market goes there again.

JPY Fundamentals: USD Correction Helps Yen Recover

The yen was a relative outperformer in the past week in what was overall mixed trading with no clear winner or loser among major currencies. The yen was marginally stronger on the close though, which comes as a relief for Japanese policymakers who’ve recently been fighting against JPY weakness with intervention.

USDJPY now remains well below the 150.00 level, which appears to have triggered the intervention last month. The yen may remain relatively firm in the current environment if the USD correction prolongs from here and bond yields remain range bound. However, the trend of JPY weakness is unlikely to be over yet, mainly because the Bank of Japan still remains the sole, most dovish central bank in the world. As long as they keep their policy dovish, the risk of further JPY weakness remains alive.

Economic data on the Japanese calendar, such as wage growth and PPI inflation, will be worth watching. Though, as usual, it is unlikely Japan’s economic reports will move JPY pairs much.

USDJPY Technical Analysis:

USDJPY continues to consolidate between the 150.00 and 145.00 levels following the currency intervention on October 21 from a high near 152.00. Interestingly, the price has now again broken below the 9-period EMA (purple line), indicating that the short-term sentiment may have shifted bearish. This could be interpreted as another sign that this USDJPY retracement could be a prolonged consolidation.

However, the 145.00 zone is not far, and it will provide strong support when reached. As can be seen on the chart, several factors form the support here, such as the 55-day SMA (blue) and the rising support line of this year’s bullish trend channel. A possible break below 145.00 would mean that an even deeper correction is on the cards. The next support is down at 140.00.