USD Fundamentals: Expect Volatile Trading with Fed and NFP Due

After two weeks of sideways action, the Fx market will wake up with a busy calendar schedule featuring, among else, three major central bank meetings (Fed, ECB, BOE) and the Nonfarm payrolls report. The packed calendar guarantees volatile trading this week and potentially sharp reversals of the moves that are currently in force.

The dollar decline is already quite sharp, and the major bull trend of 2022 has now retraced substantially. Further losses will likely need a new big catalyst considering that USD positioning in the futures markets is now at “very” neutral levels (as shown in the CoT report). Additional dollar losses can’t be driven by liquidation of stretched long positions anymore. This alone should help to stabilize the trend and potentially offer some reversal in the coming weeks and months.

The Fed meets on Wednesday and is expected to deliver a 25bp rate hike and signal another 25bp hike in March. Market expectations (pricing) are less hawkish than this, so there is some scope for the Fed to deliver a hawkish message. However, the now rapidly falling inflation has weakened the Fed’s case for hawkish policy, which is why the dollar is in a steep downtrend. Thus, it may be hard for the Fed to deliver a big boost to the greenback at this meeting. But, equally, further losses don’t seem likely from current levels.

Given that the Fed has communicated their planned actions well in advance, the Nonfarm payrolls and other economic data this week may have a bigger impact on the USD. The NFP and other job reports should show the US labor market is still strong. The forecasts are 190K for NFP and 3.6% for the unemployment rate. These are numbers that are consistent with a strong economy.

Much focus will also be placed on the ISM manufacturing and services PMI reports. These are leading indicators for the economy and, in the last few months, contributed to an extension of the USD sell-off. Some strength here will certainly help to provide some support to the greenback.

EUR Fundamentals: Flash CPI inflation and ECB meeting

The euro is remains near its highs across several Fx pairs as it’s holding onto the gains from recent weeks and months ahead of a key volatile week in the Fx market. The so far less severe than feared damage to Europe from the energy crisis is the main factor that drove the euro higher in the past 4 months.

The EUR calendar this week sees the release of flash GDP (Tue) and CPI inflation (Wed) reports. The ECB meeting on Thursday is the key event of the week. A combination of weaker GDP and CPI inflation reports could be a catalyst to take some steam out of the EUR’s rally, though it is unlikely to be enough for a full reversal for now.

The ECB meeting is front and centre on traders’ radar. They should hike another 50bp and signal that more rate hikes are to come in the next months. Anything less than communicating another 50bp hike in March may be interpreted as dovish by the markets. This is the risk for bulls who hold long EUR positions into this meeting.

The fact is that Eurozone CPI inflation is also starting to fall rapidly, which makes sense as it lagged US inflation by 3-4 months from the start. This is the first sign that the fall in inflation will be faster than many now think. And with the Fed, RBA, and other central banks stepping down to 25bp hikes, it could soon make sense for the ECB to do the same.

Thus, the euro currency may not be far from its peak. A serious recession in Europe still remains a real possibility, and the war in Ukraine continues to be a drag. Such an environment is not optimal for sustainable and long-term gains in the EUR currency.

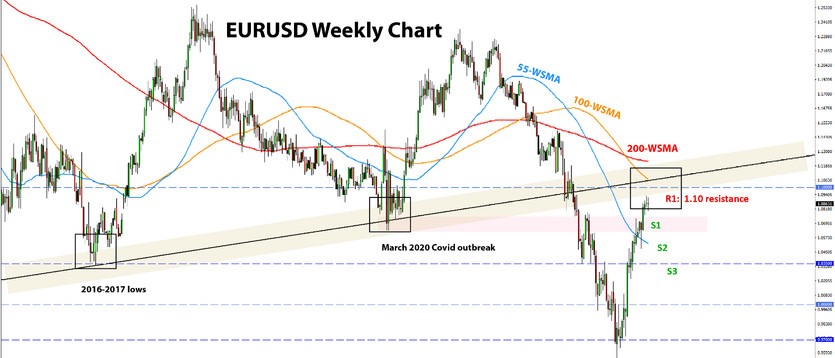

EURUSD Technical Analysis:

EURUSD has reached the highest levels since April last year as it briefly traded above 1.09 last week. It is now entering the most critical technical resistance area during this move to the upside.

Following the break above the 1.0620 - 1.0750 resistance, it was clear that EURUSD could realistically reach 1.10. That may still come, though even if it doesn’t reach the 1.10 level itself, the current levels close to 1.09 are part of a wider resistance area of 1.10.

Thus, we can say EURUSD is already testing this critical 1.10 resistance. It is indeed critical due to several factors. Most significantly, it represents the major breakout point that occurred last year after Russia started the war in Ukraine. EURUSD is now testing the entire bear trend of recent years. A break higher above the 1.10 area will be a significant sea change in the EURUSD technical situation.

On the other hand, if 1.10 holds as a resistance area, then the major bear trend will remain intact. In this case, EURUSD can move down toward 1.05 again (1st support zone) and potentially test parity again (1.00).

GBP Fundamentals: BOE to Hike by 50bp on Thursday

The pound remains supported in an overall positive environment for global risk appetite. Stocks and bonds remain near recent highs and the dollar near its lows. The risk-sensitive GBP is unlikely to give up its gains as long as risk appetite is in the driving seat.

The big focus on the calendar is the Bank of England meeting on Thursday. They should deliver another 50bp rate hike which will take interest rates to 4.00%, the highest in 14 years. Still, the impact on GBP may be muted as all of this has been well-communicated in advance and is in the price of GBP and other markets.

GBP may remain in its ranges this week, with the outlook for GBPUSD largely determined by the Fed. The global risk environment will continue to be the main factor for where the pound moves broadly in the Fx market.

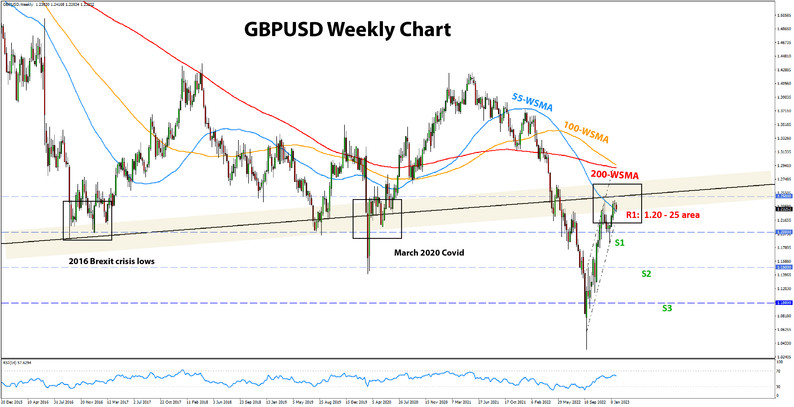

GBPUSD Technical Analysis:

GBPUSD is trading around 1.23 at the end of the month, closing the candle right on the wider 1.20 resistance area on the monthly chart. This is not yet a breakout above this critical resistance on the long-term charts. While surely seriously challenged, for the multi-year resistance area to be broken, GBPUSD will need to sustainably trade above 1.25.

Currently, the pair is testing the 1.23 highs and could potentially form a double top here. The current area remains a critical resistance, and GBPUSD could climb as high as 1.25 and still not break through it.

To the downside, 1.18 will be the key support zone as soon as GBPUSD crosses back under 1.20. Below it, traders will watch 1.15.

JPY Fundamentals: Taking a Pause After a Volatile Period

The BOJ’s decision to expand the YCC band higher and allow Japanese interest rates to move up – and with that, the yen to strengthen – is still the dominant story among JPY traders. The currency has stabilized in recent weeks, following the massive moves in the past two months. The yen fundamentals have shifted bullish and remain clearly bullish.

While in the short-term, some retracement higher could come, USDJPY is widely expected to fall further over the coming months, likely to at least reach the 125.00 area. This will be driven by further hawkish adjustments in Bank of Japan policy in the QE and YCC programs.

Traders also watch the incoming announcement for the new Governor of the BOJ. Kuroda’s term ends in April, and his successor could be announced on any day (there is no set date by Japanese law when this should be done). For JPY, it will be key whether the new BOJ Governor will be a hawk or a dove. That could trigger the next major move in JPY exchange rates later this year.

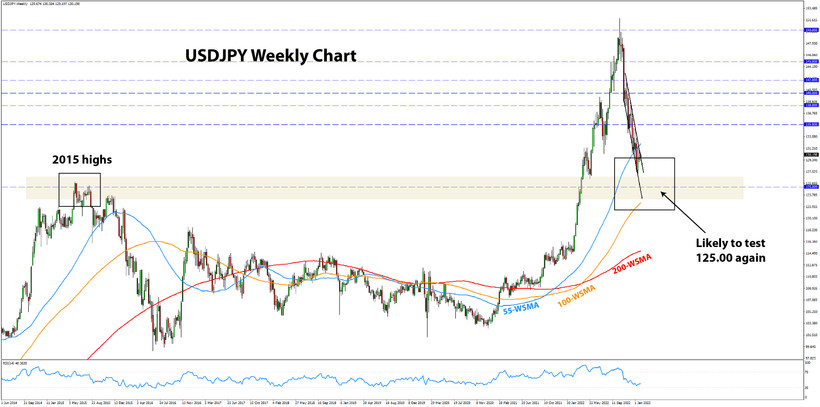

USDJPY Technical Analysis:

Like the rest of the Fx market, USDJPY is also approaching a significant area. It is located around the 125.00 level, as we discussed a few weeks ago. You can find that weekly Fx edition here.

Below, we are showing the weekly chart where we can see the 2015 peak on the left side. If and when USDJPY reaches the 125.00 area, a bigger price reaction is likely there. And judging by the technical situation on the charts, it is probable that USDJPY will reach 125.00 over the coming months.

So, this could be taken as a script – USDJPY firstly falls further to 125.00, where we can then expect a bigger bullish reaction. Multiple trading opportunities could come on USDJPY from here.

In the very near term, USDJPY is testing the resistance line of the downward channel around 130.00 (see chart). A break above it will end this bearish leg and could take USDJPY to the next resistance higher at 135.00. If the channel resistance holds, then the road to 125.00 will remain clear