USD Fundamentals: Dollar Rebound Extending

Much as we anticipated for some time, a broad USD rebound is finally starting to take place. We suspected this scenario based on the fact that the bearish USD narrative has already moved too far too soon. Moreover, the market was turning overly optimistic about the rest of the world compared to the US. This couldn’t last for much longer.

The mean reversion of the bearish USD narrative should extend the rebound further as traders realize that the US economy is still in better shape than the rest of the world. Being outright bearish on the dollar is unlikely to prove optimal in a global environment of high interest rates and “recessionary-like” economic growth of most of the world.

The US CPI report last week printed figures almost entirely in line with expectations. It seems this was a bullish surprise to the market, which seemingly got used to inflation reports coming below forecasts in the past few months. That trend might now be over, and a slower decline in inflation could be the new trend. This may provide a bullish USD impetus over the coming months.

The highlights on the calendar for the week ahead are the FOMC minutes (Wed) and the PCE inflation report (Fri). Some hawkish remarks in the FOMC minutes report are possible, and that could be enough to lift the dollar higher still. The PCE inflation report on Friday will be more important, and although it is not usually a big market mover (since the very correlated CPI report is released a week earlier), some firm figures in the PCE data could certainly boost the dollar across the board this week.

EUR Fundamentals: Watching the PMI Sentiment Surveys on the Calendar

The euro rally has lost much steam in recent weeks, though the currency still remains resilient and ended the past week marginally stronger. Fx market positioning turned long on the euro this winter, and this bullish sentiment seems to still persist. This seems to be keeping the currency supported for now.

Some of the recent correction is largely driven by profit-taking as the market realizes the EUR has already appreciated a lot in the past 4 months. Further gains were going to be much harder anyway. Now, it will be up to real economic data and actual strong fundamentals to pull the currency higher. That will, of course, be much harder to occur.

The tricky part is if the reality starts to again disappoint for Europe. Geopolitical tensions are again on the rise in recent weeks, and most major news outlets continue to speculate about a new Russian offensive in Ukraine. If Russia indeed intensifies the attacks, this surely won’t be a positive for the EUR currency, which rebounded during the autumn as Ukraine was regaining territory held by the Russian army.

A lot of attention will also remain on European economic data. The EUR-optimism crowd of investors is still convinced Europe will avoid a recession. The actual real economic data will now need to prove this, if the EUR is to hold the gains and if EURUSD is to stay above 1.05. A scenario where the Eurozone enters a serious recession, will likely knock EURUSD at least below 1.05 and likely below parity again (1.00).

Tuesday is in focus this week as both the German ZEW economic sentiment and the flash manufacturing and services PMI report will be released. These are early leading indicators of economic growth, and if those disappoint on Tuesday, recession fears in the EU will grow. Such a scenario will be bearish for the EUR currency.

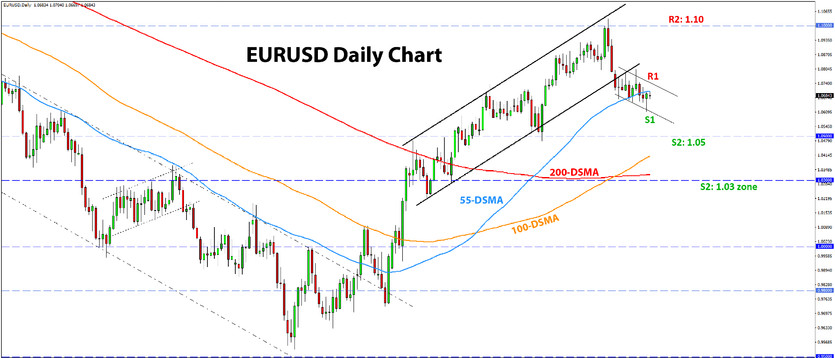

EURUSD Technical Analysis:

A notable development on the EURUSD daily chart last week is the break below the 55-day moving average (blue line on the chart). It is another bearish signal in a series of reversal signals since that high just above 1.10 earlier this month. Suddenly, the EURUSD picture doesn’t look so bullish and is now almost ready to turn fully bearish.

The rebound at 1.06 last week isn’t at a significant support area, which means this is unlikely to be the low. Further downside action can soon take EURUSD 1.05, which is the next important support zone. Further down, the 1.03 zone is a key technical support where the 100-day (red) and 200-day (orange) moving averages converge.

To the upside, moderate resistance is located at 1.0750 and 1.08. Firm resistance remains fortified at the 1.10 zone.

GBP Fundamentals: Trading Neutrally as Specific GBP Drivers Are Currently Muted

The outlook for the pound is similar to its bigger, though younger cousin, the euro. EURGBP remained unchanged over the past week and has been trading in a range for several months already. As global stock markets remain overall stable, there are no specific EU or UK drivers to pull the pair either higher or lower.

This means that EUR and GBP pairs remain highly correlated during the current times. A possible big stock market sell-off remains a risk scenario that could trigger a big decline in GBP. On the other hand, positive news on Brexit could be a big bullish catalyst. Brexit is getting more attention of late as new Prime Minister Rishi Sunak is making efforts to closen the UK’s relationship with the EU and Ireland.

The UK data calendar is very light this week, meaning GBP volatility won’t come from economic reports. Aside from some BOE speakers, the Fx market won’t be interested in the other calendar events.

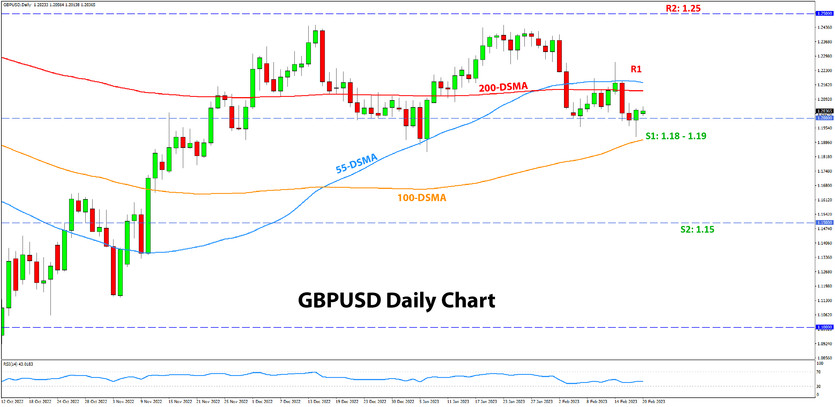

GBPUSD Technical Analysis:

GBPUSD also rebounded late Friday in tandem with EURUSD and managed to close the week above 1.20. However, the overall picture is not bullish at this stage, and the pair can best be defined as range-bound.

The 1.19 zone where GBPUSD rebounded last week is now stronger support since this is the 2nd reversal here following the one last month. So, this 1.18 - 1.19 zone is now solid support for GBPUSD. A break below it should clear the way for a faster decline toward 1.15.

To the upside, resistance is at the 1.22 zone ahead of the major peak at 1.25.

JPY Fundamentals: New Bank of Japan Governor Announced; Traders Closely Watching for Potential Direction Change

The speculation about the new Bank of Japan Governor is over. Last week, it was announced that Kazuo Ueda would succeed Kuroda in April. This initially triggered a rally in the yen but was quickly reversed later in the day.

Nonetheless, Kazuo Ueda is viewed as a more hawkish candidate than the current uber-dove Kuroda, who ran the largest monetary stimulus program in Japan’s history with his QE and QQE programs. The coming weeks and months could potentially be crucial for the longer-term trends of the JPY currency.

If any hints come that the new Governor Ueda plans to abandon the uber-dovish policies, the yen will surge massively. This means huge downside potential across JPY pairs. On the other hand, if Kazuo Ueda takes on a more neutral style, at least for the beginning of his term, some range-bound action in JPY pairs would be the more likely scenario.

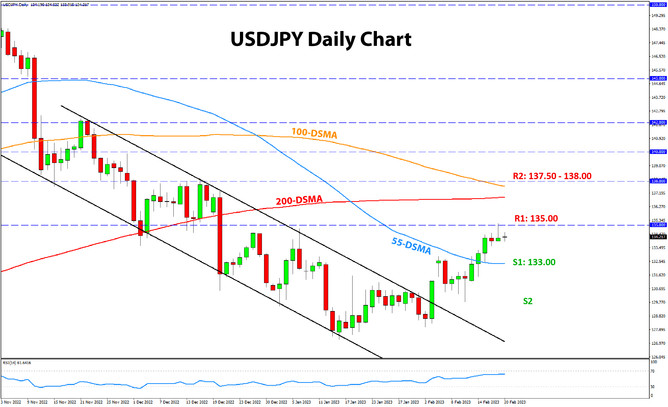

USDJPY Technical Analysis:

USDJPY extended the rebound and touched the 135.00 round number level last week. The initial reaction was a rejection here, and USDJPY is now trading close to 134.00. However, the short-term sentiment is still on the bullish side, and additional upside attempts are possible.

To the downside, 133.00 is a clear support zone and the first notable one in line. Lower, the 130.00 zone remains the crucial support to keep the current rebound intact.

Above 135.00, there is resistance for USDJPY at 137.50 - 138.00.