USD Fundamentals: High PCE Inflation Print Validates Need for Further Rate Hikes

The string of strong US economic data in February continued last week, pushing the dollar further higher in its current rebound. The key report was PCE inflation on Friday, which surprised higher, suggesting that inflation won’t be coming down so fast after all.

Both the core and headline PCE inflation reports were higher than the previous month and also significantly higher than consensus expectations. Naturally, market pricing for Fed rate hikes sharply adjusted higher, with at least three further 25bp hikes (in March, May, and June) now becoming a consensus forecast. This would bring the Fed policy rate at 5.25% - 5.50%, up from 4.75%, which was the consensus forecast only a few weeks ago. This adjustment in Fed rate hike forecasts is moving the markets now and pushing the USD dollar higher.

The calendar is oddly light for the first week of the month as we won’t get the Nonfarm Payrolls report until next Friday (March 10). So, this leaves the ISM manufacturing and services PMIs as the main drivers for this week. Following the previous month’s upside surprises, the expectations are for higher readings again - which, if met - should further lift the dollar.

EUR Fundamentals: China Reopening Story Faltering, Disappointment Coming for EUR Bulls?

The euro is trying to remain resilient in the current environment but is coming under pressure from several fronts, namely as it becomes apparent that the so-called Chinese reopening isn’t happening so smoothly after all and as Eurozone inflation also started to surprise lower recently.

The EUR-optimism euphoria is at the stage where the hard economic data (i.e., the reality) in the Eurozone will need to prove the economy will avoid a recession this year. However, that may be harder to come by than the solid PMI sentiment surveys (which are opinions from purchasing managers). The evidence is still lacking, and if the real Eurozone economic data starts to disappoint, this will certainly result in pricing out of ECB rate hikes. This would be a bearish scenario for the euro.

The focus on the European calendar this week is the flash CPI inflation release due on Thursday. A further decline is expected in the headline CPI figure, while forecasters project the core CPI measure will remain near the previous month’s 5.3% reading.

As noted above, the falling inflation in the Eurozone is another reason why the EUR has recently lost its bullish momentum. Thus, any miss in those CPI expectations this Thursday is likely to induce a new bearish impetus in the EUR currency.

EURUSD Technical Analysis:

As we anticipated, EURUSD extended the decline and is approaching the 1.05 level. The sharp reversal down in February is set to form a tall bearish engulfing on the monthly chart (the close is tomorrow). If EURUSD finishes the month below 1.06, it will send a strong bearish signal pointing to further losses for the pair.

The weekly chart shows the 1.05 zone is some moderate support here. Below it, the 1.03 zone is the next support ahead of the important parity (1.00) zone.

To the upside, the first resistance is at 1.07 and then 1.08. Next, the 1.10 zone remains the key resistance for EURUSD.

GBP Fundamentals: Sterling Rallying as Northern Ireland post-Brexit Deal Struck

Sterling also benefited from the positive surprises in the services and manufacturing PMI surveys last week and actually closed the week stronger versus all major Fx currencies except for the US dollar. Overall, this indicates the pound is doing relatively well in the current environment, and a large part of that is due to positive news regarding Brexit and the Northern Ireland protocol.

Indeed, today (Monday), EU and UK leaders announced that they agreed on a deal for Northern Ireland that will allow the smooth flow of trade in the region. Markets are celebrating the news, and both the pound and the euro are higher in the Fx market (GBP obviously stronger of the two).

However, while the current good news about Northern Ireland may drive some more gains in the very near term, the prospects beyond that are less clear. The pound remains a function of global risk sentiment, and that seems to be turning lower again. So, in this sense watching global stock markets and bond yields will remain important for GBP traders.

The UK economic calendar this week is very light.

GBPUSD Technical Analysis:

GBPUSD continues to play with the 1.20 zo, but without a distinct bullish or bearish signal yet. The pair closed the past week below 1.20 but is now rising back above it (see above for Brexit news). What happens next will be important as it will determine whether GBPUSD moves closer to 1.25 next or closer to 1.15.

To the upside, 1.22 is the first resistance zone, ahead of the key one at 1.25.

In the down direction, below 1.20, traders will be looking at 1.18 as the first support. Next is 1.15, which represents an important psychological zone.

JPY Fundamentals: New BOJ Governor Ueda Disappoints Hawkish Expectations

The testimony by the newly appointed Governor of the Bank of Japan, Kazuo Ueda was the central focus for JPY traders in the past week (he spoke on Friday). Expectations were building that Ueda would announce a complete termination of the dovish YCC and QE policies, but instead, he said that for now, he wouldn’t talk about any changes of BOJ policy. This was a disappointment for yen bulls, and the currency sold off after his speech.

In the meantime, US Treasury yields resumed the rise as US economic data is once again proving more robust than the pessimists forecasted. The combination of higher US yields and dovish news out of Japan was again a bullish cocktail for the USDJPY pair. It firmly crossed above 135.00 last week and is already attempting to move above 136.50 in the new trading week.

US yields and the broad appetite for dollars are likely to remain the dominant drivers of JPY pairs in the week ahead too. With both yields and the USD set for further gains, USDJPY should remain in an upward trajectory.

USDJPY Technical Analysis:

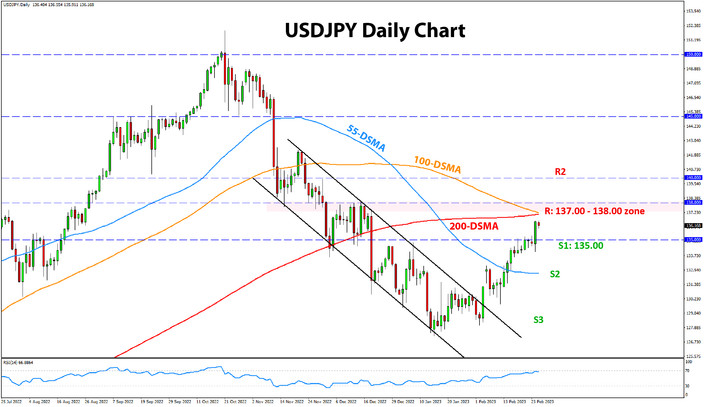

USDJPY pushed above 135.00 on Friday and is now trading within touching distance of the 100-day (orange) and 200-day (red) moving averages. The moving averages converge around the 137.00 level.

Slightly higher, the 137.50 - 138.00 zone is also an important resistance due to previous highs and lows here. Thus we can say that 137.00 – 138.00 is the nearest key resistance for USDJPY. Above it, 140.00 will be resistance, but aside from being a psychological round number level, there are no notable technical developments around this level.

To the downside, 135.00 is now the first support zone. The next one is 133.00, around the previous highs. The 130.00 zone remains the crucial support, which is significant on on larger timeframes such as the weekly.