USD Fundamentals: Dollar Rally Pauses Ahead of Powell’s Testimony and Nonfarm Payrolls

Following four weeks of steady gains, the dollar rally paused last week and closed lower, marginally retracing. The gain for the month of February is still significant, however, and perhaps the retracement makes sense due to month-end flows and given that we are heading into high-risk events this week and the Fed meeting on March 22.

The overall undertone remains USD bullish, nonetheless. The US calendar is getting pretty busy this week. Fed Chair Powell’s testimony before Congress (two days, Tuesday and Wednesday) and the Friday Nonfarm Payrolls will get the main market attention.

The previous stellar NFP report and the high inflation prints in February (both CPI and PCE) clearly set the stage for a sizable dollar rebound. The events this week will determine whether this rebound will extend just as sharply higher still, or rather some bigger correction or consolidation will come. The near-term sentiment has shifted to USD bullish, which should favour further dollar upside, barring significant disappointments in this week’s US events.

EUR Fundamentals: Another Upside Inflation Surprise Pushes ECB Hawkish Expectations Higher

Between the hawkish repricing in the US for Fed rate hikes, and a similar hawkish repricing in Europe, the natural result for EURUSD is a directionless trend (similar levels like in January). This is exactly what we are currently seeing, although the bias has rightly shifted to slightly bearish recently as the hawkish shift at the Fed is greater than that at the ECB.

Last week CPI inflation from the Eurozone again printed high numbers, with a new record for the core CPI measure at 5.6 y/y. This inspired a new wave of hawkish rhetoric from ECB officials. This hawkish messaging is keeping the euro currency resilient for now.

This week’s Eurozone calendar is lighter, but the market attention will already be switching to the March 16 ECB meeting the following week. Thus, we can expect most Fx volatility this week to be driven by the US high-impact events of Fed Powell’s testimony and the NFP report Friday.

EURUSD Technical Analysis:

The chart is starting to reflect the land-locked fundamental dynamics for the pair. Following the brief peak above 1.10, EURUSD is back in some short-term fair value range between 1.0550 and 1.07.

However, the most important development is bearish for the pair. Namely, a head and shoulders pattern is forming. We will release a trade idea based on this pattern later this week, so stay tuned for this.

Support near the previous lows around 1.0530. The zone is 1.05 – 1.0530. A bearish break here should open the road for a faster decline toward 1.03.

To the upside, resistance is at 1.07.

GBP Fundamentals: Bearish Pressures Mount for Sterling

The pound fell last week as some dovish comments from BOE Governor knocked it lower. Our short GBPUSD trade idea that we sent last Thursday is now triggered, with the break below 1.19 in GBPUSD.

The hawkish repricing for the Fed is weighing on risk sentiment globally and additionally pressuring the pound. This trend is gaining traction this week, and the pound should likely stay under pressure.

The UK economic calendar is very light this week, except for the GDP report on Friday. All others are practically 2nd tier, less market impactful events. And the GDP report usually doesn’t move markets much, so GBP trends in the Fx market will remain driven by risk sentiment and BOE rate hike expectations (both of which have turned more bearish just recently).

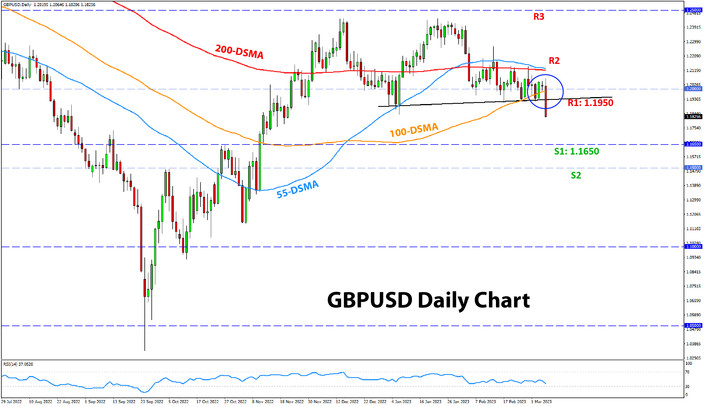

GBPUSD Technical Analysis:

As we noted above, our short GBPUSD idea from last week is now triggered (sent on March 2 in the profitable FXTR newsletter). GBPUSD broke below 1.19, which effectively clears the way for the first target at 1.1650 to be reached.

The 1.18 zone is moderate support, but the technicals look decently bearish, so it’s unlikely 1.18 will hold. The 1.1650 zone is a stronger support, and some bounce here can be expected.

To the upside, the previous lows and today’s breakout point at 1.1950 are the resistance.

JPY Fundamentals: The Last BOJ Meeting Before Kuroda’s Departure

JPY crosses were a little calmer last week following the disappointment of hawkish expectations by the newly appointed Governor Ueda. USDJPY continues to be pulled higher, but other JPY pairs remain range-bound.

Overall, the market continues to expect a hawkish shift from the BOJ in the coming months. The current fragile risk environment is also keeping a slight bullish undertone under the yen. However, the Japanese currency still remains by far the lowest-yielding currency in the Fx market (rates are still negative). This is a counter–bearish factor for the currency, considering new Governor Ueda disappointed expectations for rate hikes out of negative territory.

The Bank of Japan meets this week. It will be current Governor Kuroda’s last meeting. Thus, the market expects no fireworks and no big decisions. This means we may see little impact on the JPY from this meeting. In such a case, the currency will continue to be driven by global factors, and if US Treasury yields continue to move higher, USDJPY is likely to be pulled further up too.

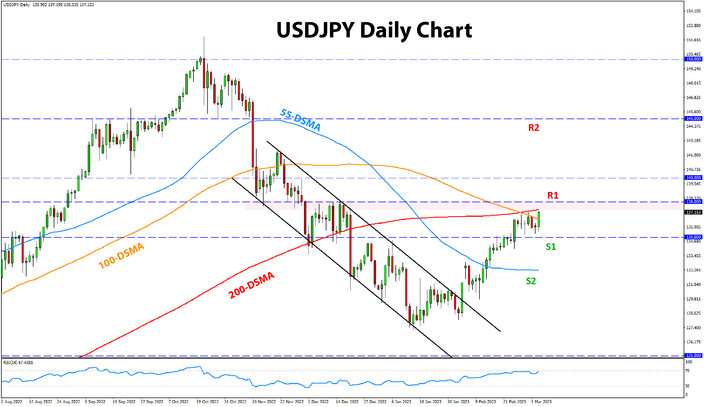

USDJPY Technical Analysis:

USDJPY is now trading firmly above 135.00 and marching toward the 138.00 level. This is a resistance zone due to several past highs and lows. In addition, the 100-day (orange) and 200-day (red) moving averages are converging here, making it a tougher resistance.

In a scenario of an upside break, traders will look toward the 140.00 zone as resistance. Above it, there is no resistance until 145.00.

To the downside, 135.00 is the nearest support zone. The next one remains pinned at 133.00, around the previous highs.