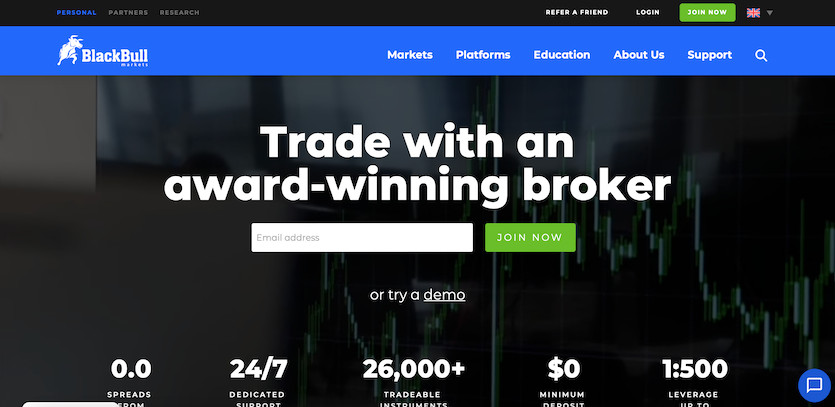

BlackBull Markets, initially serving institutional clients, has broadened its horizons to now cater to retail traders as well. Nestled in Auckland, New Zealand, the brokerage extends its global footprint with an additional office in Kuala Lumpur, Malaysia, and trading facilities via Equinix in both London and New York.

Account Types and Features

BlackBull Markets provides three essential account categories: Standard, Prime, and Institutional, each distinguished by the initial deposit. The Standard account, devoid of commission fees, requires the least initial investment but entails the highest spreads. On the contrary, the Prime account levies a commission but promises more favourable spreads.

For clients adhering to Islamic faith, BlackBull Markets offers a Sharia-compliant account that adheres to Islamic prohibitions against receiving or paying interest by not calculating swaps for open positions. All account types allow trading in micro lots.

Regulatory Compliance and Financial Security

BlackBull Markets, as a Non-Dealing Desk broker, offers over-the-counter trading services for forex and commodities CFDs. BlackBull Group Ltd, operating under the BlackBull Markets brand, is a registered provider of financial services under New Zealand’s Financial Markets Conduct Act 2013.

Currently, there is no mandatory capital requirement for brokerage firms, a standard of financial health common in most jurisdictions. However, legislative revisions later this year will mandate Forex brokers to maintain net tangible assets of at least $1,000,000, strengthening the New Zealand regime.

In its commitment to transparency, BlackBull Group Ltd declares that it maintains client funds in segregated accounts and adheres strictly to Anti-Money Laundering (AML) policies.

Furthermore, BlackBull Markets is a recognized member of the NZ Financial Services Complaints Limited (FSCL), an independent dispute resolution company affiliated with NZ FMA, capable of granting up to $200,000 in consumer compensation.

Trading Conditions and Costs

To start trading with BlackBull Markets, a minimum initial deposit of $200 is needed, which is an average amount compared to other NZ-based brokerages.

As a Straight Through Processing (STP) / Electronic Communication Network (ECN) broker, BlackBull Markets offers fluctuating spreads, differentiated by account type. For instance, the commission-free Standard account begins with spreads from 0.9 pips on the EUR/USD pair, while the Prime account starts at 0.2 pips, plus a commission of 6 per lot round turn. Hence, the average trading costs for both account types for the EUR/USD pair range between 1.0 – 1.3 pips, which is quite competitive.

BlackBull Markets provides a high leverage level of up to 1:500, surpassing the typical leverage offered by most brokers of 1:200 or 1:400. However, restrictions on leverage exist in certain jurisdictions, such as in the USA, where the maximum leverage allowed is 1:50.

Trading Platforms and Tools

BlackBull Markets offers the widely used MetaTrader 4 (MT4) platform in both desktop and mobile versions. The platform boasts 85 pre-installed indicators, varied chart setups, a plethora of Expert Advisors (EAs) for automated trading, and a comprehensive back-testing environment for these EAs.

To run EAs, a Forex Virtual Private Server (VPS) is essential, and BlackBull Markets offers this service free to clients with balances over $1000 USD, provided they trade at least 20 standard lots per month.

Additionally, BlackBull Markets has partnered with MyFXBook to provide the AutoTrade platform, specialized in copy trading at no additional charge. However, a balance of $1000 or more is required to utilize this platform.

Other partnerships include Institutional Analysts Daily FX, providing clients with a morning newsletter that includes a market outlook on key areas, encompassing institutional-level technical analysis strategies from Trading Central, as well as market updates every two hours on major trading pairs and commodities.

BlackBull Markets also offers Multi-Account Manager (MAM) and Percent Allocation Management Module (PAMM) services. Furthermore, it's introducing a Social Trading Plugin, allowing clients to peruse and select Money Managers (MM) to invest in, providing an opportunity for investors to earn without having to trade themselves.

Payment Options and Deposit Currencies

When it comes to payment options, BlackBull Markets offers a variety of methods: Credit/Debit cards (Visa, MasterCard), bank wire, Skrill, Neteller, China UnionPay, and WebMoney.

The broker accommodates a broad spectrum of deposit currencies: South African Rand (ZAR), United States dollar (USD), Euro (EUR), Great British Pound (GBP), Japanese Yen (JPY), Australian Dollar (AUD), New Zealand Dollar (NZD), Singapore Dollar (SGD), and the Canadian Dollar (CAD).

For Skrill account holders, USD is the primary currency. Funding through Neteller can be done with: USD, AUD, EUR, GBP, CAD, JPY, and SGD.