Introduction

Central Capital Futures, an experienced broker in the field since 2005, is headquartered in Indonesia and has been offering its Forex/CFD trading services to a broad clientele of over 4 million. The company prides itself on its commitment to client education and its additional analytical tools, establishing itself as a reliable choice for newcomers to trading. Our review will focus predominantly on the foreign exchange trading options provided by this broker. Central Capital Futures is also regulated by BAPPEBTI.

Account Details

In addition to their forex demo account, Central Capital Futures provides a Standard account. Factors like leverage and minimum deposit are crucial in managing your trading account effectively. On the topic of leverage, the broker provides a maximum leverage of up to 1:100. As for the starting capital, it is denoted in $. The leverage of 1:100 may appear low to some, but it's considered sufficient for most traders and simplifies computations. If you find yourself requiring higher leverage, you might be overstepping boundaries.

Regulation Standards

One key highlight of Central Capital Futures is its regulated status. Supervision is done by the Commodity Futures Trading Regulatory Agency (BAPPEBTI), and it's also a member of the Indonesian Derivatives Clearing House and the Jakarta Futures Exchange. This regulatory supervision ensures an additional layer of security for traders.

Trading Costs

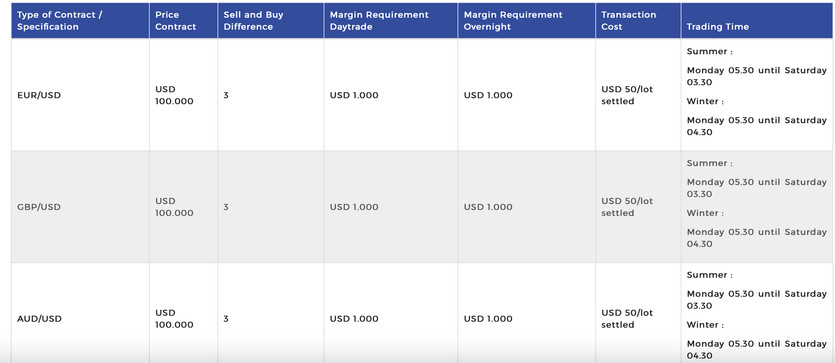

Trading costs with Central Capital Futures are fixed with a starting point of 3 pips on EUR/USD, coupled with a $50 commission per lot. Accounting for commissions and spreads, the effective costs per trade can reach up to 8 pips, which is higher compared to other brokers. With such high fees, even skilled traders may find it challenging to achieve substantial profits.

Available Instruments

Central Capital Futures offers a broad range of trading instruments, including a diverse set of currency pairs and Forex. However, keep in mind that trading conditions can vary between instruments, and your trading strategy should align well with your chosen instrument.

Trading Platforms

Central Capital Futures provides the MT4 platform, a tool that allows you to trade at your convenience with only a few clicks. This platform includes price charts and various analytical tools to assist you in analyzing price movements. This functionality will enable you to place strategic trades and enhance your profitability.

Moreover, Central Capital Futures offers three exclusive analytical features for its clients - an AI prediction platform, a news prediction system, and a currency strength index module. Although these features may not seem revolutionary to seasoned traders, they can be invaluable resources for those starting their trading journey.

Conclusion

Central Capital Futures has established itself as a trustworthy and client-centric broker with a focus on forex trading. Although it may offer a higher cost of trading, the educational resources, range of trading instruments, and analytical tools provided could make it an attractive choice for beginners in trading. The company's regulatory status further assures clients of its credibility and reliability in the field.