An Introduction to Fondex

Hailing from the city of Limassol, Cyprus, Fondex is a prominent forex brokerage company renowned for its powerful trading performance and groundbreaking technology. Fondex, formerly known as Kawase, took off in 2017 and since then, has garnered recognition for its stringent regulatory practices under the Cyprus Securities and Exchange Commission (CySEC) and Seychelles' Financial Services Authority (FSA). Moreover, Fondex ensures the safety of its European clientele with the Investment Compensation Fund (ICF), providing a safety net in the unfortunate event of corporate bankruptcy.

Fondex's Connection with TopFX

Fondex operates under the umbrella of TopFX, an international brokerage that tailors its services to provide premium liquidity and regulated institutional services. Since launching in 2010, TopFX extended its services to retail clients in 2015, furthering its footprint in the financial market.

The Unique Offerings of Fondex

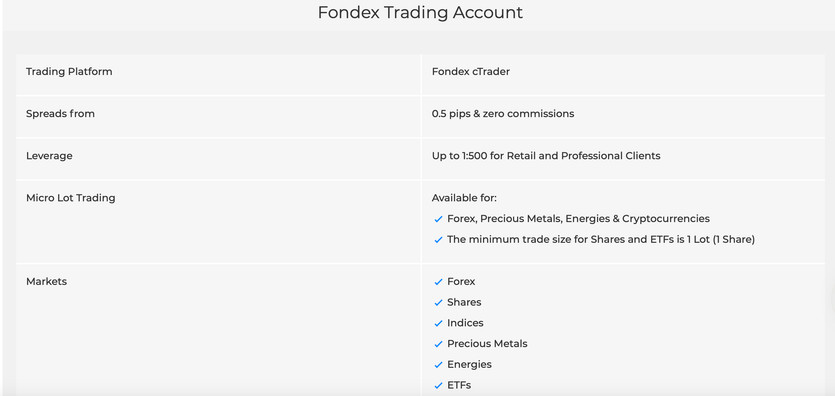

Fondex opens the door to over 1,000 trading markets, enabling traders to connect with top-notch liquidity providers worldwide. It offers a single account type - the Fondex Account, which includes swap-free provisions tailored for Islamic traders. The proprietary aggregator engine gives traders access to competitive prices from Tier-1 banks and global exchanges.

A trading account with Fondex, much like a forex account, is established mainly for the purpose of currency trading.

The Simplicity of Transactions at Fondex

Fondex stands out for its zero-fee policy on deposits or withdrawals, offering three convenient payment methods: Visa/Master Card, Bank Wire Transfer, and Bitcoin Wallet. Transactions are facilitated through the cTrader trading platform. Bitcoin Wallet transactions are notably swift, while Bank Wire Transfers may require a processing time of 1 to 5 business days. However, it is important to note that withdrawals via Bank Wire Transfer carry a minimum limit of 25 EUR.

Commission Structure and Trading Assets

At Fondex, the commission depends on trade volume, meaning higher trading volumes attract lower commissions. Fondex offers a wide selection of over 1000 tradable assets, ranging from forex, shares, indices, energies, and precious metals to ETFs and cryptocurrencies. This brokerage boasts the unique cTrader platform, accessible via desktop, web, and mobile applications, and offers ultra-low spreads from 0.0 pips. Fondex also takes pride in its competitive commissions, which are some of the lowest among global cTrader brokers, and provides advanced charting tools suitable for both beginners and seasoned traders.

Per every 100 USD traded volume for Forex, Energies, and Precious Metals, the commission charged is 2.5 USD, while 1 USD is charged per side for 100 Shares and ETFs. Trading of Indices and Cryptocurrencies, however, attracts no commission.

Leverage Regulations

Leverage, denoted as ratios such as 50:1, 100:1, or 500:1, determines the trade size a trader can make relative to their deposit. For instance, a trader with 1,000 USD in their account trading 500,000 USD/JPY equates to a leverage of 500:1.

Being regulated by CySEC, Fondex adheres to strict leverage restrictions. Depending on their geographical location, retail clients may be limited to a maximum leverage of 1:30 for major currencies, 1:20 for minor currencies, and 1:10 for commodities.

Account