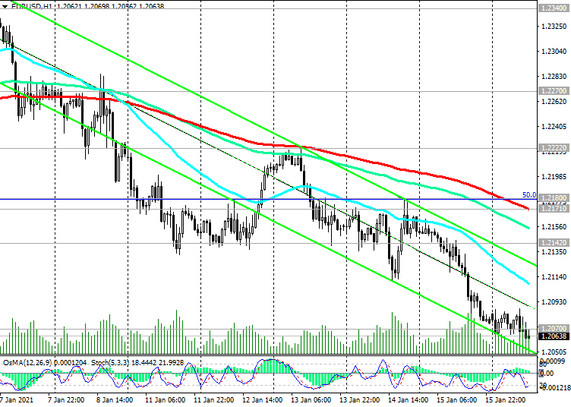

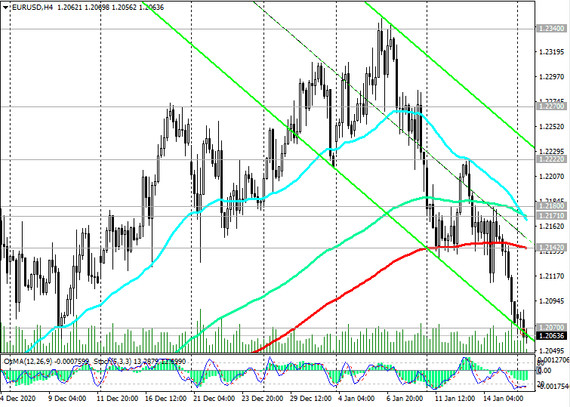

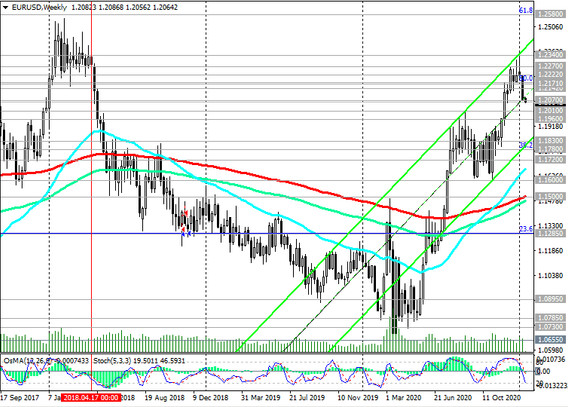

At the beginning of today's European session, EUR / USD is traded near the 1.2070 mark, through which the support level in the form of EMA200 on the monthly chart passes.

Its breakdown will strengthen the downward trend of the pair, which has already broken through two important short-term support levels 1.2171 (ЕМА200 on the 1-hour chart), 1.2142 (ЕМА200 on the 4-hour chart).

Below these levels, short positions are preferred.

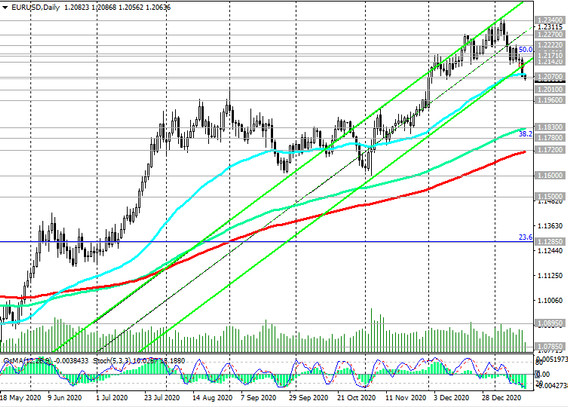

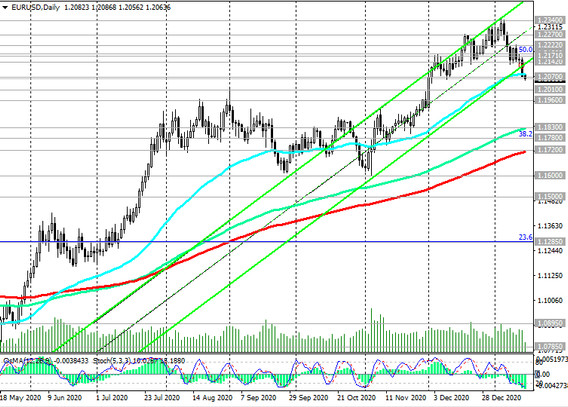

If downward dynamics develops, EUR / USD may decline to long-term support levels 1.1830 (EMA144 on the daily chart), 1.1780 (38.2% Fibonacci level of the upward correction in the wave of the pair's decline from 1.3870 that began in May 2014), 1.1720 (ЕМА200 on the daily chart).

The breakdown of the support levels 1.1500 (ЕМА200 on the weekly chart), 1.1285 (Fibonacci level 23.6%) will finally return EUR / USD to a long-term downtrend.

At the same time, given the still long-term positive dynamics of EUR / USD, the resumption of long positions is also possible, but only after the pair grows into the zone above the resistance level 1.2142.

The breakdown of resistance levels 1.2171, 1.2180 (Fibonacci level 50%) will confirm the renewal of the EUR / USD uptrend. After exceeding the local 32-month maximum near the level of 1.2340, the targets will be the resistance levels 1.2500, 1.2580 (the upper border of the channel on the weekly chart and the Fibonacci level of 61.8%), 1.2600.

Support Levels: 1.2070, 1.2010, 1.1960, 1.1830, 1.1780, 1.1720, 1.1600, 1.1500, 1.1285

Resistance Levels: 1.2142, 1.2171, 1.2180, 1.2222, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.2050. Stop-Loss 1.2110. Take-Profit 1.2010, 1.1960, 1.1830, 1.1780, 1.1720, 1.1600, 1.1500, 1.1285

Buy Stop 1.2110. Stop-Loss 1.2050. Take-Profit 1.2142, 1.2171, 1.2180, 1.2222, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600