The fall on Friday of the American and world stock indices provoked the strengthening of the dollar. At the start of today's European session, DXY dollar index futures are traded near 90.21 mark, 18 points above the local intra-week low reached on Thursday near 90.03 mark.

Investors generally remain optimistic. However, at the end of the week, they probably decided to take profit on the results of a successful week in anticipation of the Fed meeting, as well as the publication of reports of a number of leading companies, including Facebook, Apple and Tesla and important macro statistics, including preliminary estimates of US GDP for the 4th quarter, next week.

Stock indexes are aimed at further growth, given the position of the world's largest central banks, including the Fed, and the US government to further support the economy amid the ongoing coronavirus pandemic. Expectations of successful vaccinations and a quick victory over the virus also keep investors optimistic and put pressure on a safe dollar.

And yet, the dollar is strengthening on Friday, with the exception, perhaps, of the EUR/USD pair, which is the only one among the major dollar currency pairs growing today.

Against the dollar and, accordingly, the euro, the pound is also actively declining today.

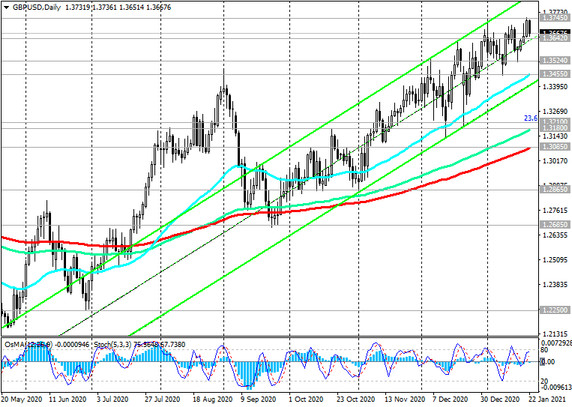

At the time of this article's publication, the GBP / USD pair was traded near the 1.3670 mark, while still maintaining a long-term positive trend.

The pound was also under pressure from the publication of weaker-than-expected macro statistics today, according to which retail sales showed moderate growth of +0.3% in December, instead of the expected +1.2% (after falling by -4.1% in November). UK Manufacturing and Services PMIs released today (09:30 GMT) also fell short of market expectations.

At the same time, the preliminary PMI index for the services sector, which accounts for the lion's share of UK GDP and which employs about 70% of Britons, came out in January with a value of 38.8 (against expectations of 45.0 and a value of 49.4 in December), signaling a sharp slowdown in activity in this area of the British economy (index values below 50 indicate a slowdown in activity). The disappointing macro statistics released have heightened fears of the UK economic recovery, while the country has tough quarantine measures that stifle business activity.

Meanwhile, according to IHS Markit, the purchasing managers' indices (PMI), which are due to be published at 14:45 (GMT), including the manufacturing and services sectors of the United States, continued to rise in January, indicating the ongoing recovery of the American economy, which should have a positive effect on American stock indices and the dollar.

In general, the positive dynamics of the GBP / USD remains so far, which is traded in the bull market zone. After the completion of the correction, its growth is likely to resume.