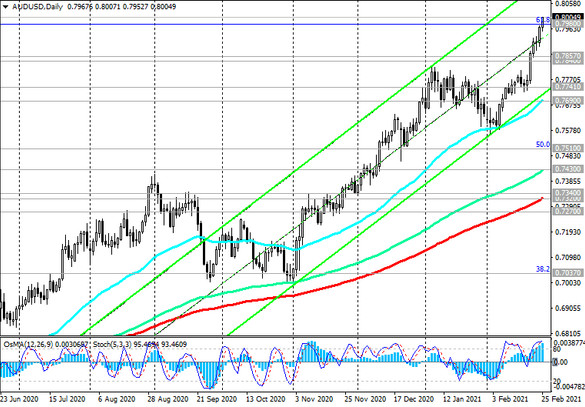

As we noted earlier, at the beginning of today's European session, the AUD / USD pair broke through the important psychological level of 0.8000 and retains the potential for further growth, primarily against the background of the continuing weakening of the US dollar.

In the zone above the key support levels 0.7430 (ЕМА144 on the daily chart), 0.7320 (ЕМА200 on the daily chart), 0.7270 (ЕМА200 on the weekly chart), the long-term positive dynamics of AUD / USD remains.

A breakout of the resistance level of 0.8000 will be a signal for the resumption of growth in AUD / USD towards the resistance levels of 0.8100, 0.8160.

In an alternative scenario, a signal for selling AUD / USD will be a breakout of important short-term support levels of 0.7741 (ЕМА200 on a 4-hour chart), 0.7857 (ЕМА200 on a 1-hour chart). A breakdown of the support level 0.7690 (ЕМА50 on the daily chart) will increase the risks of further decline towards the support levels 0.7430, 0.7320, 0.7270.

In the current situation and above the support level of 0.7980 (Fibonacci level 61.8% of the correction to the wave of the pair's decline from the level of 0.9500 in July 2014 to the lows of 2020 near the level of 0.5510), long positions remain preferable. Confirmed breakdown of the resistance level of 0.8000 will be a signal to build up long positions.

Support levels: 0.7980, 0.7857, 0.7840, 0.7741, 0.7690, 0.7430, 0.7320, 0.7270

Resistance levels: 0.8000, 0.8160

Trading Recommendations

Sell Stop 0.7940. Stop-Loss 0.8010. Take-Profit 0.7900, 0.7857, 0.7840, 0.7741, 0.7690, 0.7430, 0.7320, 0.7270

Buy Stop 0.8010. Stop-Loss 0.7940. Take-Profit 0.8100, 0.8160