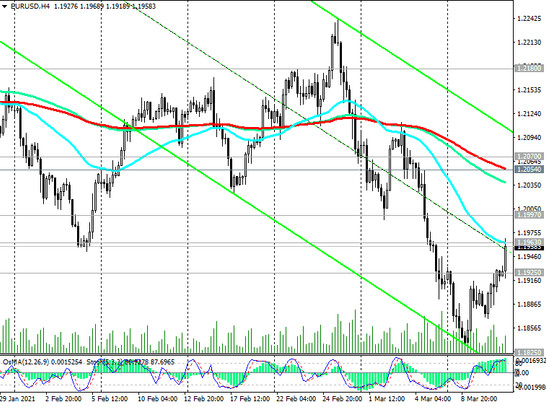

At the beginning of today's European session, EUR / USD is growing, traded at the time of this article's publication near the 1.1963 mark, through which a strong short-term resistance level (EMA200 on the 1-hour chart) passes.

Its breakdown may open the way for growth towards the resistance levels 1.2054 (ЕМА200 on the 4-hour chart) and 1.2070 (ЕМА200 on the monthly chart).

The pair is growing amid a weakening dollar, which, in turn, is declining amid falling yields on US bonds. If the weakening of the dollar stops, then, most likely, the growth of EUR / USD will also stop.

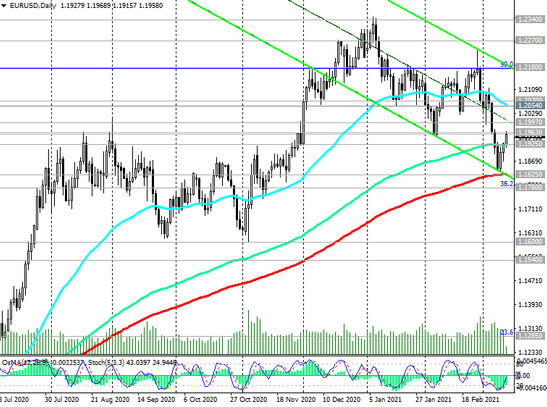

A return into the zone below the support level 1.1925 (ЕМА144 on the daily chart) may provoke a further decline in EUR / USD to the lower border of the descending channel on the daily chart and ЕМА200 on the daily chart).

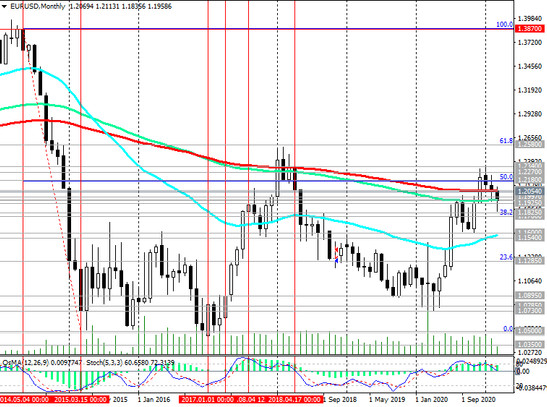

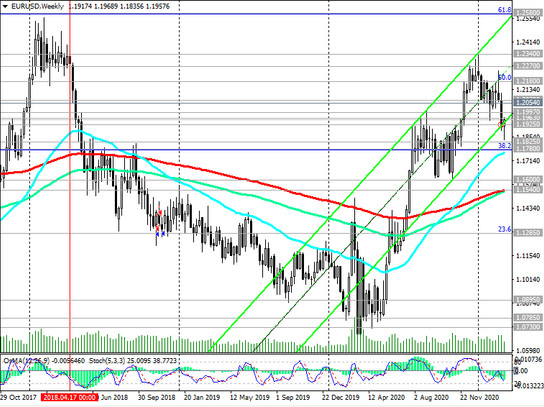

The breakdown of the support levels 1.1825 and 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014) will increase the risks of a resumption of the long-term bearish trend in EUR / USD.

Support levels: 1.1925, 1.1825, 1.1780, 1.1600, 1.1520, 1.1285

Resistance levels: 1.1963, 1.1997, 1.2054, 1.2070, 1.2100, 1.2180, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.1915. Stop-Loss 1.1980. Take-Profit 1.1825, 1.1780, 1.1600, 1.1520, 1.1285

Buy Stop 1.1980. Stop-Loss 1.1915. Take-Profit 1.1997, 1.2054, 1.2070, 1.2100, 1.2180, 1.2270, 1.2340, 1.2555, 1.2580, 1.2600