For many decades, trade wars have proved to be the cause of significant global economic changes. Depending on the situation, they helped the rise of a nation over others, or they sank the financial growth of a country.

Some trade wars were more relevant than others in the history of the world economy, but even the smallest conflict through trading goods have affected it somehow.

Trade Wars

It is a conflict between two or more countries about imports and exports of goods and products. The tools these countries use are from raising the trade tariff of the products they import to creating other trade barriers to prevent the exchange and cut the trade flow between them.

Read More Top Real-Time (Instant) News Feed Apps for Forex Traders 8/19/2020

As a trader, you need at least a base on what is happening in the world right now. This information was something that people before the internet and globalisation didn't have. Still, today it is effortless to find out about the different events that are currently affecting the global economy.

Changes in the economy of a country will affect specific markets, altering the values of the assets. Short-term traders follow these daily changes in the economy and markets, and try to translate them into profitable selling or buying.

If you want to trade with assets like oil, gold, or Forex, it is essential to have access to a news feed that can keep you updated to the daily news.

Especially if you are day-trading or scalping, an instant news feed can make a huge difference in your trading.

Read More Top Financial Media News Sources for Traders and Investors 8/12/2020

Investors make sure to pay close attention to daily financial news because many global events have a direct or indirect effect on the world's economy and markets, lowering or raising the values of different assets.

Following and studying the news can help predict the upcoming changes in financial markets. Therefore, those interested in making the correct investments need to have access to the news as fast and as accurate as they can.

Why is it essential to follow news feed for traders and investors?

Time is a crucial factor in any trading market. Sometimes values can change in a matter of hours or even minutes. Hence, traders and investors need to have the best information available as soon as they can so they can use it successfully in their investments. Following the global developments is the best way to know how a market is going to react. It provides clues that traders can relate to past events and how they affected the economy, which assets gained or lost value during those times, and what are the logical movements some stocks will make in those scenarios.

Read More Forex Order Flow Trading - Taking Advantage Of Order Book 8/5/2020

Traders and investors in Forex need to manage different tools, charts, and strategies to investigate the likely changes in the market before they happen

Many strategies vary depending on the approach that the investors want to take, like price action trading, where traders make their analysis based on the market value and predict the next movement for that stock or in foreign exchange, the currency. Other traders, however, place the transaction according to order flow trading strategies.

What is Order Flow in Forex trading?

Order flow, also known as transaction flown, is a strategy used by some traders where they determine the way the price will move (or "flow") depending on the reasons why people will place, buy or sell orders at specific times.

Read More Learn Price Action Trading and Find High Probability Trades Like a Pro 7/31/2020

You may have heard that professional traders use price action analysis to gain an edge over the competition.

A robust trading methodology, price action can help you to increase your chances of winning in today’s markets. The great advantage is that price action analysis is incredibly straightforward to apply.

Yet, so many new traders think that fancy indicators on complex-looking charts are helping them win at this game. Most often, however, the reality is diametrically the opposite.

Learn to Trade Price Action Like a Pro

While straightforward to use, there is a lot of misleading and outright wrong info circulating on the web. To gain the maximum benefits, you must learn and apply the price action techniques correctly.

Read More Financial Astrology: Using the Planets to Predict Market Cycles 7/29/2020

Through eras, different cultures and races have used the movement of planets and the positions of constellations to predict future events in various aspects of life. It shouldn't come as a surprise that also in these times, some traders and investors trust the astrological wisdom and apply it to their financial transactions. Financial astrology gives the best dates to invest in specific markets, and also which investments should be avoided.

What is Financial Astrology?

Financial Astrology, also known as Astro-Economics, is a method used to calculate through mathematical psychology the way a market will react on a specific month or date. It is also used in different businesses to know when is the best moment to launch a new product or to open a new store.

Read More Basics Of Natural Gas Trading – Ways To Make Money With Energy Investments? 7/22/2020

Natural gas is not akin to oil, even though both are the most traded energy products. There are reasons why traders choose to invest in this fossil fuel in this current climate. There are still benefits and opportunities to take advantage of getting into the natural gas market.

As we know, Natural gas is often mistaken for a product derived from crude oil, along with gasoline and heating oil. But, in reality, it is not. Natural gas exists alongside oil reserves, but it does not process from crude oil like gasoline or other oil-related products.

Currently, investing in natural gas is not a complicated process. Operators can speculate on the price of natural gas online using CFDs to position themselves both long and short.

CDFs are, in short, negotiable instruments that reflect the movement of the underlying asset and allow you to position yourself without having to take ownership of any raw material. It is worth noting that CFDs enable traders to place themselves short if they think that the price of natural gas is going to drop, and thus continue to benefit from the leverage offered by the broker even in bear markets.

Read More How to Trade Copper? – Making Money With Industrial Metals 7/15/2020

Copper is one of the best known and used metals in the world. Some countries still use this metal in their currency. However, its most common use in the modern world relates to industrial applications of all kinds. After all, copper is one of the best and cheapest electric conductors.

Now, trading copper is a favourite among operators in the sector. That is because the prices of this raw material are subject to a healthy amount of volatility in the short term. Although, like its more expensive counterpart (gold and silver), copper is very stable in the long run. One could even argue that the current price of copper is linked to the United States dollar.

In this article, we will give you the necessary strategies that you should know for trading copper.

Read More Safe Haven Currencies – Profiting In Times Of Risk Aversion? 7/8/2020

In times of crisis, such as now, the currency market and its different types of currencies can be the most precious assets of all the financial and investment markets that exist in the world.

Significant declines in conventional assets such as stocks, bonds or commodities, drive up the demand for cash enormously, which causes the value of the currency to increase. When there are such market sell-offs, it is essential to know that there are safe-haven currencies that maintain the same value or even increase it in times of crisis or instability.

This form of refuge is ideal in crises because they tend to have an inverse relationship with the performance of risky assets such as stocks, which further guarantees the stable value of their currency.

These are the 4 currencies in the FX market that are considered the safest:

Read More Market Cap Of Gold: How Liquid Is The Safe-Haven Yellow Metal? 7/1/2020

Many experts and analysts have come up with many arguments about gold volatility and its falling prices. This argument has woken up the curiosity of many people and has made them ask questions such as; how big is gold on the market? Is gold still valuable? Or maybe, what role does gold play in the financial system?

To obtain these answers, we must analyze the different perspectives that we have and consider how significant is the size of the global gold market.

According to the World Gold Council (WGC), at the end of 2014, the remaining gold reservoirs were determined to be approximately 180,000 tons. Calculating it to the current dollar price, that is equivalent to about 6.3 trillion dollars.

Read More Struggling To Make It In This Market? – Keep Your Trading Strategies In Check 6/24/2020

Surely as a beginner trader you are looking for the super winning Forex strategy that will produce profits with your trades. Let me tell you right from the start, this super strategy does not exist.

When it comes to trading, success is not a guarantee. What may work for someone else can be a disaster for you. On the contrary, if someone else discards a Forex strategy, maybe it could be the best for you.

Therefore, testing is necessary to discover the Forex strategies that work. Vice versa, you can discard those that don't work for you. Even after a lot of experimentation, the market may not go as you thought, and your strategy still studied and analyzed, may not give the expected results.

Trading strategies

Read More What is a Bear Trap? - Stock, Forex, Commodity Trading 6/22/2020

Intro

Investing in or trading the markets is a great way to increase your monthly incomes. However, trading involves the use of different strategies, not all of them nice for the other traders.

Traders and investors lookup for their finances, even if they have to trick others into obtaining the upper hand. One of these strategies is the Bear Trap.

Read More IG Client Sentiment: A Useful Tool For Fx Traders 6/17/2020

Generally speaking, the term market sentiment refers to the state of mind of the market during the current trading session. We can compare the sentiment in the market with the mood of the people. It can change quickly for different reasons, as well as various thoughts, feelings and actions.

The sentiment to a certain degree determines the demand and supply for a particular currency, stock, or commodity. If the market is favourable on the current outlook, then people start buying more, increasing demand, and therefore pushing the price to new highs. We can call it a bull market.

Alternatively, if the market is pessimistic, the price can drop. In this case, the sentiment is bearish.

Therefore, there are trading methods based on sentiment analysis. We can measure market sentiment using several tools, such as sentiment indicators (which we are going to explain later) or by simply observing the movement of the markets. One such tool that many retail Forex traders are using is the IG client sentiment data.

Read More Traders & Investors Reactions To Trump - The President's Impact On Markets 6/15/2020

Intro

Before he became president of the US, Donald Trump was already a successful and renown businessman. He also has no shame to give his crude opinion about how the stock market behaves and his predictions on how it will react in the future.

Through his twitter account, Trump bombards those who follow him with his perspective and opinion daily, most of the tweets with original content and not retweets. Do these actions have any impact on the stock market? They do.

Read More Trading The W Pattern - How To Buy The Market Profitably? 6/10/2020

In the current age of trading, we can find many tools and guides to get more profit. One of the most widely used tools are the price graphs to determine the best points for a trade. Many traders are studying the charts by different means, like for example technical or intuitive.

The price behaviour can produce various formations on the charts, such as the popular head & shoulders, triangles, wedges, flags, etc. Among the classical patterns, we can also find the M and W price behaviour, which is very similar to the double tops and double bottoms.

In this article, we will only focus on the W pattern to know how it works and the special moment of a transaction.

What is the “W” pattern?

The W formation is a pattern that in many cases precedes a rise in market prices in an exponential way. At the moments when the lows are reached, high demand to buy the asset can occur. The great explosion in buying bids causes prices to rise abruptly thereafter.

The question is to know how to take advantage of the moment and to remain in a favourable position. For many, it is just a matter of waiting for the right kind of behaviour and then buying.

Read More What Are The Russell Indexes? – A Deeper Look At The Stock Market 5/27/2020

In case you are looking for other stock market indicators to guide you in making investments, one of the most popular ones are the Russell indexes.

In this article, we’ll take a look at the different Russell stock market indexes and how you can use them.

Read More How To Trade US30? - Basics About The Dow Jones Industrial Average Index 5/25/2020

Trading is one of the most profitable yet risky businesses in the world. It can be the key to achieving stability if done right.

To reduce the risks, traders work with different tools that help them recognise the signs of a change in the stock market. Some of the best tools for traders are the indices. An index is a list of different companies in the stock market, where a trader can see how the stocks of those companies are behaving as a group.

The oldest of these indices is the Dow Jones Industrial Average index.

Read More How To Trade Profitably With Renko Charts? 5/20/2020

In the world of trading cryptosystems or physical assets such as oil, it is always advisable to have tools. Many platforms have diagrams of market behaviour, allowing you to predict market behaviour.

Renko charts are one of the newest options that investors have to decide and stay in the best possible position. Renko charts are diagrams based on blocks or bricks of the famous game Genka. The chart establishes a place on a brick only that base on the money.

The chart shows your initial position, along with the probabilities of rising or falling prices. In this case, you can decide to sell and be in a better place or wait for the next block. The time between each block is very variable and can take hours or even days, so a lot of patience is required.

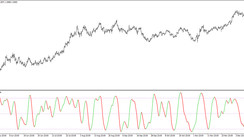

An example of a Renko chart - EURUSD weekly timeframe

Read More How To Trade Gold? – Some Basics About Buying And Selling The Yellow Metal 5/18/2020

Gold, almost since forever, is a highly valued and desired precious metal. Its high value worldwide makes it an essential asset in times of economic uncertainty. In the physical aspect, it is very much bought and sold depending on its purity.

In the current era, not only the physical sale is done in the marketing of gold, now it is done at the digital level too. The buying and selling of gold through trading is the form that currently predominates in the world. The reason is that it allows you to buy and sell digital gold contracts easily regardless of your location.

Read More Trading Forex With Woodies Pivot Points 5/13/2020

Forex or foreign exchange is one of the most accessible trade markets that you can find among traders. Trading Forex is based on the interest rates of different currencies and the impact they generate on other currency policies.

Forex traders must pay attention to different indicators and information that the Central Banks provide about the economy of different counties. Between the many tools and strategies that you can use to help you predict how the Forex market is going to move, you can find the Woodie pivots points.

Woodie Pivots Points

Read More Fiat Vs. Crypto Money: What Is Fiat In Crypto And How They Compare? 5/11/2020

Since the appearance of Bitcoin, closely followed by different other cryptocurrencies, the world has adapted and accepted this form of digital currency to make purchases and send money around the globe. Many online businesses today offer the option to pay using cryptocurrency.

Is digital money going to replace fiat currency?

Although some may think that the answer is yes, there are still some things that people must consider before deciding to exchange their money into crypto.

Read More How Tariffs Affect Currency Exchange Rates? 5/6/2020

Forex traders and investors are paying attention carefully to the different world events that could affect the foreign exchange market. One of these events that started in July 2018 is the trade war between the US and China.

To understand how this and other similar events affect the Forex market, it is essential to know about the impact that import tariffs have on currency exchange rates.