The dollar strengthened last Thursday, and today its growth continued during the Asian session and at the beginning of the European one.

At the time of publication of the article, the DXY dollar index was near the mark of 90.80, corresponding to the levels of the beginning of last month, and 17 points above the closing price of yesterday's trading day.

The dollar is receiving support from both renewed growth in US government bond yields and positive macro statistics released on Thursday, which indicated that the US economy continues to rebound steadily from the coronavirus crisis.

In particular, this was indicated by the US GDP dynamics index published yesterday, according to which the country's GDP in the 1st quarter of 2021 grew by 6.4%, which is higher than the forecast of 6.1% and higher than the previous value of 4.3%.

Investor sentiment regarding the strengthening dollar has slightly deteriorated due to the weekly data published on Thursday from the US labor market, according to which the number of initial applications for unemployment benefits turned out to be higher than expected (553,000 against the forecasted 549,000). Market participants and dollar quotes are sensitive to news from the American labor market, because along with the data on GDP and inflation indicators, they are decisive for the Fed in determining the parameters of its monetary policy.

Investors are now focused on the publication (at 12:30 GMT) of data on personal income and spending in the United States, PMI in Chicago (at 13:45 GMT) and the University of Michigan Consumer Sentiment Index (at 14:00 GMT) ). In general, the indicators are expected to rise, which is likely to also provide short-term support to the dollar.

As for the dynamics of the pound, investors will follow the course of the next meeting of the Bank of England, which will be held next week (on Thursday) and will be devoted to issues of monetary policy.

Most likely, the bank's executives will decide to leave the interest rate at the current level of 0.1%. But according to economists' forecasts, the volume of purchases of government bonds may be reduced from 895 to 875 billion pounds, which may indicate the beginning of the revision of the current policy of the bank towards its tightening. The bank can also noticeably raise forecasts regarding the pace of economic recovery. Thus, according to the latest published data, unemployment in the UK fell by 0.1% over the last 3-month reporting period, to 4.9%. And all these are positive factors for the pound.

In addition, market participants positively assess the prospects for the recovery of the British economy against the backdrop of an active vaccination campaign and the lifting of some of the quarantine restrictions.

Almost 30 million people have already been vaccinated in the country, moreover, more than 2.5 million people received two doses of the drug against coronavirus. Such a high rate of vaccination should lead to a faster recovery of the UK economy and labor market.

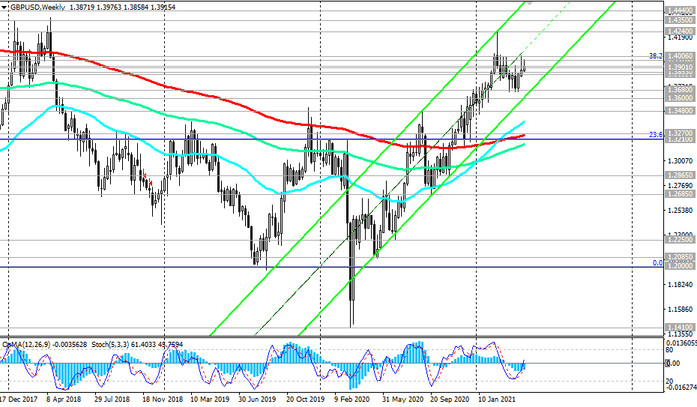

Since mid-May 2020, the GBP / USD has been in a steady uptrend, which is reflected by an upward channel on the weekly price chart.

And if today's decline in GBP / USD stops near the current mark of 1.3900, then this week may become the third consecutive week of growth after the corrective decline observed last month.

It is also worth noting that today is the last trading day of the week and month. Therefore, during the American trading session, sharp movements in the market are possible associated with the correction of positions in traders' portfolios.