Today's trading day began with a sharp strengthening of the dollar, accompanied by a fall (for the third trading day in a row) in futures for major US stock indices, commodity prices and a decline in commodity currencies.

As of this writing, the DXY dollar has climbed to 93.00, which is in line with the highs of the past 15 weeks.

Investors seem to have ignored statements by US Federal Reserve Chairman Jerome Powell that "the time has not yet come to cut stimulus". Speaking to Congress last week, he said there was still a long way to go to cut monetary stimulus as the labor market cannot overcome the consequences of the pandemic in any way. Powell again, and more than once, called high inflation a short-term phenomenon, provoked by a shortage of supply amid strong growth in demand.

The dollar is receiving support from continued strong macro data from the US and from heightened fears about the outlook for global economic growth amid the rapid spread of Covid-19.

Thus, last Friday, strong data on retail sales in the United States were published, which increased by 0.6% in June against the forecast of their decline by 0.4%. Excluding autos, sales rose a record 1.3%.

Meanwhile, today the pound is unexpectedly declining despite the fact that since Monday the UK government has finally lifted restrictions, fully opening the economy. According to British authorities, about 67% of UK residents are vaccinated with at least one component of the vaccine. However, it is alarming that the latest statistics indicate that the daily increase in the incidence of the mark of 50 thousand is exceeded for the first time in the last six months. Market participants hope for further acceleration of the British economy, however, they are alarmed by the increase in the incidence of coronavirus in the country, which could lead to a new lockdown.

Today, the pound is actively declining not only against the dollar, but also in cross-pairs, and even against the euro, although, as you know, the next meeting of the ECB will take place this week, where, as is widely expected, the central bank leadership will maintain the current super-soft monetary policy without changes.

Eurozone GDP is still about 5% lower than before the pandemic, and so far, none of the forecasts suggest a return to pre-crisis levels. The eurozone economy is far from full recovery, economists say. In their opinion, the consequences of a possible withdrawal of stimulus in the current economic and political environment will be disastrous for the European economy.

Nevertheless, fears of a more rapid spread of coronavirus in the UK (according to some reports, the number of cases of infection in the UK per population is 4.4 times more than in the Eurozone, and 6.4 times more than in the United States) make the pound to decline, including against the euro.

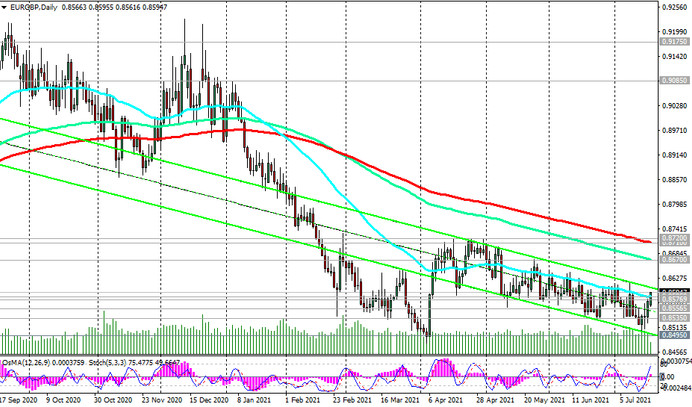

At the time of publication of this article, the EUR / GBP pair was traded near the 0.8595 mark, by making a request for further growth (see Technical Analysis and Trading Recommendations).