The dollar is actively declining on Thursday, and the yield on US government bonds is falling.

After the DXY dollar index hit a local multi-month high of 94.57 on Tuesday, DXY futures are traded close to 93.87 today, as of this writing, 31 points below today's opening price.

The core consumer price index (Core CPI), which excludes volatile food and energy prices, rose 4% (YoY) in September, following a similar rise in August, according to Labor Department data released Wednesday. Annual inflation rates have remained the highest in the United States in 13 years since May 2021, putting pressure on the value of the dollar.

The pressure on the dollar is also increasing from the US labor market. The decline in the number of jobseekers in the labor market and the inability of employers to find new employees, despite the proposed higher salaries and other bonuses, postpone the prospect of a full recovery of the labor market and its return to pre-pandemic levels to a later date.

"For a number of non-monetary reasons, I do not expect employment to return to pre-coronavirus levels anytime soon", Fed representative Michelle Bowman said Wednesday.

Currently, the number of jobs in the country is almost 5 million lower than in February 2020. And the full recovery of the labor market is the determining factor for the FRS to start curtailing the stimulus program. Now, high inflation has joined the pressure on the dollar, well above the Fed's target of 2%.

Nevertheless, despite today's decline, the positive dynamics of the dollar and the demand for it as a defensive asset remain. Investors and buyers of the dollar still do not lose hope that at a meeting on November 2 - 3, the Fed will announce the beginning of a reduction in purchases on the bond market, which should support the dollar. “Asset purchases have been an important response to the economic impact of the pandemic, but they have already served their purpose”, Bowman said Wednesday. Now she supports the Fed's intention to begin phasing out its bond buying program next month. The continuing rise in asset prices, including in the housing market, signals that "the potential negative effects of stimulus measures now outweigh the potential benefits", according to Bowman.

Now, market participants will carefully study the incoming macro statistics from the United States, especially regarding inflation and the state of the labor market, before the November meeting of the FRS, in order to more accurately determine its intentions regarding the prospects for monetary policy, and therefore the dollar. In this regard, market participants today will pay attention to the publication (at 12:30 GMT) of weekly data from the US labor market with statistics on the number of jobless claims. It is expected that the number of initial applications for unemployment benefits in the United States in the week to October 8 fell to 319 thousand from 326 thousand, 364 thousand, 351 thousand, 335 thousand in previous reporting periods, which is a positive factor for the dollar. However, a higher-than-expected result would indicate instability of the labor market recovery, which will negatively affect the dollar.

A little later, at 15:00 (GMT), the Energy Information Administration (EIA) of the US Department of Energy will present a weekly report on the dynamics of oil and petroleum product reserves in the country's storage facilities. A relatively small increase in oil inventories is expected in the week of October 8, by 0.702 million barrels after rising by 2.346 million, 4.578 million in the previous reporting periods. On the eve, the American Petroleum Institute announced an increase in oil reserves by 5.213 million barrels. Despite the rise in inventories, oil quotes continue to rise.

A monthly report from the International Energy Agency (IEA), released Thursday morning, said skyrocketing prices for natural gas and coal are fueling increased demand for oil from power plants and manufacturing industries. Amid the ongoing energy crisis, oil demand could rise by 500,000 barrels a day from September to the first quarter of next year, IEA analysts said, while raising their forecast for global oil demand growth this year and next by 170,000 and 210,000 barrels per day, respectively. In their opinion, next year oil consumption will exceed pre-pandemic levels. “The acute shortage of natural gas, LNG and coal amid the global economic recovery has triggered skyrocketing energy prices and a large-scale transition to the use of oil and petroleum products for power generation”, the IEA said. Agency also downgraded its outlook for non-OPEC+ supply growth this year and next, citing limited production capacity due to Hurricane Ida and scheduled maintenance in the oil sectors of Canada and Norway.

There has been an increase in oil demand from power plants, fertilizer producers, industrial plants and refineries, the IEA added.

Relatively low gas reserves for this time of year and weak winds in Europe coincided with the economic recovery from the effects of the pandemic, a coal shortage in China and the prospect of a cold winter in the Northern Hemisphere, as a result of which gas prices rose sharply.

IEA executive director Fatih Birol said on Wednesday that extreme weather events are also exacerbating the energy crisis. Such phenomena include Hurricane Ida in the Gulf of Mexico, droughts in China and Brazil that hampered the operation of the hydropower sector, and floods in several regions of the world.

IEA analysts note a more active transition of power plants from natural gas to petroleum products, also pushing oil prices up.

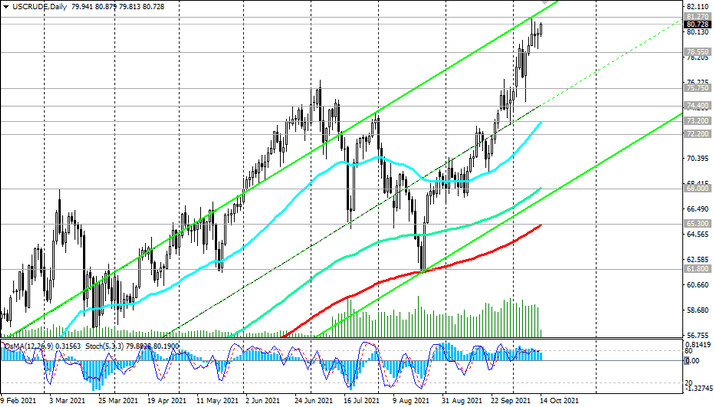

On Monday, Brent crude oil futures renewed 36-month highs above $ 84.21 a barrel, and WTI - highs since November 2014 above $ 81.25 a barrel.

Today, the rise in oil prices after the correction the day before continues again. At the time of this posting, Brent crude futures are traded above 83.70 and WTI - above 80.70, and their gains may accelerate amid limited other energy supplies.

However, there are also negative factors for oil prices. As fresh macro data show, the outlook for the global economy is weakening, amid data indicating slower growth in the third quarter as a result of supply chain problems, sharply accelerated inflation and the impact of the spread of the delta strain of coronavirus.

IHS Markit's downgraded forecast showed that U.S. GDP growth slowed to 1.4% in the third quarter, due in part to a sharp cut in consumer spending, while the U.S. economy grew by an average of 6.5% per quarter in the first half.

Economists also expect a sharp slowdown in the growth of the Eurozone and China in the third quarter as a result of isolated outbreaks of Covid-19, widespread power outages and a weakening of the real estate market. According to economists' forecast, China's GDP grew by 5.1% (in annual terms) in the third quarter after growing by 7.9% in the second quarter.

Also, in particular, the International Monetary Fund this week downgraded its forecast for global economic growth in 2021 to 5.9% from 6.0%, saying that the outlook has deteriorated as problems in global supply chains do not allow satisfying the rapidly growing consumer demand in rich countries.