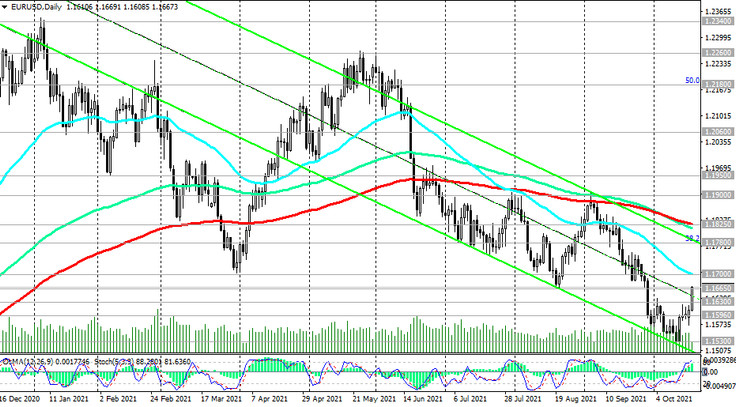

Against the background of a weakening dollar, the EUR / USD pair has been growing today for the 5th day in a row. At the time of publication of this article, the pair is traded near 1.1665 mark, through which a strong resistance level (EMA200 on the 4-hour chart) passes. If it is broken, the next target for corrective growth will be the important mid-term resistance level 1.1700 (ЕМА50 on the daily chart), which will be very difficult to overcome.

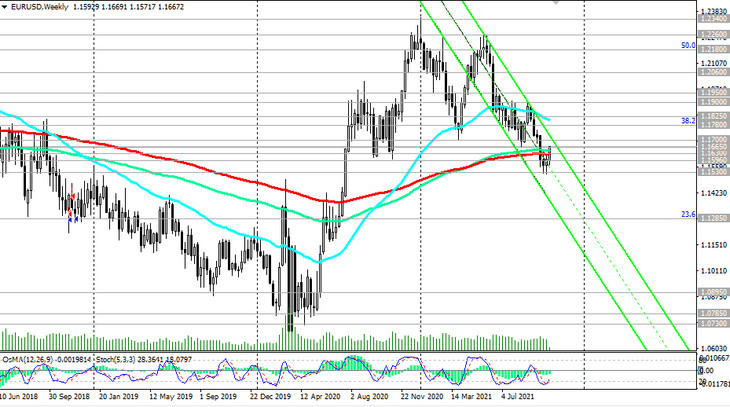

Being in the zone below the important resistance levels 1.1780 (the upper line of the descending channel on the daily chart and the Fibonacci level of 38.2% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, to the level 1.0500), 1.1825 (ЕМА144, ЕМА200 on daily chart), EUR / USD remains in the long-term bear market zone.

Only a breakdown of the key resistance level 1.1825 will indicate a return of EUR / USD to the bull market. Below the resistance levels 1.1665, 1.1700, short positions remain preferable.

Therefore, the breakdown of the key support level 1.1630 (ЕМА200 on the weekly chart) will be a signal for the renewal of EUR / USD sales. After the breakdown of the local support level 1.1530, the next downside target will be the support level 1.1285 (the lower line of the descending channel on the weekly chart and the Fibonacci level of 23.6%).

Support levels: 1.1630, 1.1596, 1.1530, 1.1400, 1.1285

Resistance levels: 1.1665, 1.1700, 1.1780, 1.1825, 1.1900, 1.1950, 1.2060, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600

Trading Recommendations

Sell Stop 1.1620. Stop-Loss 1.1675. Take-Profit 1.1596, 1.1530, 1.1400, 1.1285

Buy Stop 1.1675. Stop-Loss 1.1620. Take-Profit 1.1700, 1.1780, 1.1825, 1.1900, 1.1950, 1.2060, 1.2180, 1.2260, 1.2340, 1.2450, 1.2580, 1.2600