Although the index of business activity in the manufacturing sector of the Federal Reserve Bank of Philadelphia published yesterday (at 12:30 GMT) somewhat disappointed investors (in October, the indicator fell to 23.8 from 30.7 in September, which turned out to be worse than the forecast of 25), published at the same time weekly data from the US labor market increased the likelihood that the Fed will begin to reduce the volume of purchases on the bond market at a meeting on November 2-3. According to the US Department of Labor, the number of initial applications for unemployment benefits decreased to 290 thousand against the forecast of 300 thousand and previous values of 296 thousand, 324 thousand, 364 thousand, 351 thousand, 335 thousand). The number of applications remains at the lowest levels since the beginning of the pandemic (the previous minimum of 293,000 applications was reached in the week of October 1-8). This is a positive factor for the dollar.

The number of repeat applications also fell from 2.603 million to 2.481 million, which also turned out to be better than the 2.55 million forecast.

Upbeat data from the US labor market supported the dollar, which strengthened on Thursday, while the DXY dollar index rose 0.17%.

As you know, data from the US labor market is a priority for Fed leaders when deciding on monetary policy, and they indicate a gradual improvement in indicators. A report by the Ministry of Labor, published at the beginning of the month, indicated a decrease in the unemployment rate in the country to 4.8% from 5.2% in August.

In August, Fed Chief Powell said most executives believed the inflationary progress needed to curtail asset purchases had been made, and employment remained a major hurdle. As far as the Fed's employment target is concerned, “I think it is almost achieved”, Powell also noted.

Nevertheless, on Friday, in the first half of the trading day, the dollar declines again, remaining under the pressure of the rapidly growing inflation in the US.

As of this writing, DXY futures are traded near 93.63, 12 pips below yesterday's close, moving towards a local 20-day low of 93.48 hit during yesterday's Asian trading session.

Market participants are also assessing the degree of influence on the dynamics of the dollar of the expected reduction in the volume of the QE program by the FRS. Despite the prospect of a soon start to reduce the volume of the stimulus program, the Fed's monetary policy remains soft, which is a negative factor for the dollar.

Only half of 18 executives expect interest rate hikes to be required by the end of 2022, and almost all executives anticipate another rate hike in 2023, according to the minutes from the September 21 - 22 Fed meeting released last week. Thus, the Fed's interest rates will remain at the current, close to zero, levels for at least a few more months.

At the same time, quite contradictory macroeconomic data has been coming from the US over the past two weeks, and market inflation expectations have reached a 9-year high. So, earlier this week, disappointing statistics on industrial production and sales in the secondary housing market came from the United States, which intensified the talk that the Fed will not rush to further tighten monetary policy.

However, it is probably not worth waiting for a deeper decline in the dollar. It remains a defensive asset, including against the backdrop of the fight against COVID-19, and one of the most demanded currencies in international settlements.

Today, during the American trading session, investors will focus on the statistics on business activity in the manufacturing and service sectors of the United States (its publication is scheduled for 13:45 GMT) and the speech (at 15:00 GMT) of the Fed Chairman Jerome Powell. Also, a little later, the Fed's monthly report on the state of the US federal budget for September is due.

The US Manufacturing and Services PMI (from Markit) for October is expected to change only marginally from September, remaining well above the 50 mark separating growth from slowdown, 60.3 and 55.1. accordingly, which is likely to provide short-term support for the dollar.

Volatility in dollar quotes will also increase if Powell makes unexpected statements regarding the prospects for the Fed's monetary policy.

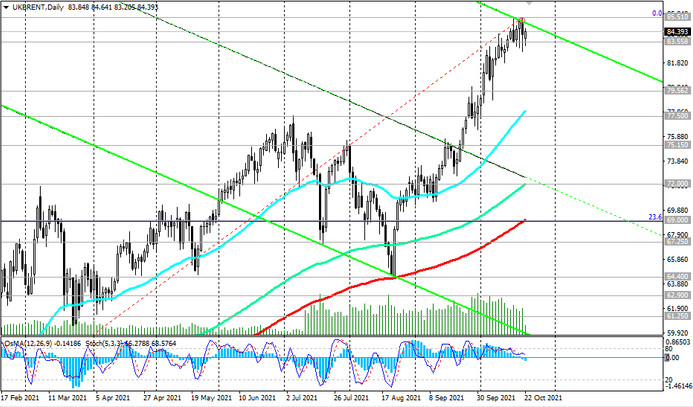

Meanwhile, amid the current weakness of the dollar and continued high demand for energy (with a continuing deficit for them), oil prices are rising again today, after hitting new 36-month highs earlier this week. So, Brent oil futures reached $ 85.51 per barrel yesterday, and WTI - $ 83.70 a barrel, the highest since November 2014. At the start of today's European session, Brent oil futures are traded near 84.40, remaining in the bull market.

Although oil prices have slightly declined from previously reached multi-year highs, which is also partly due to profit taking in long positions, oil market analysts predict further price increases amid expectations of a cold winter amid increased energy demand and limited oil supplies by OPEC+ countries.

According to experts, stocks of oil in storage are below normal values for this time of year, and to return to 5-year averages will require an increase in supply over a number of months. Meanwhile, OPEC+ has not yet managed to achieve the rate of growth in oil supply, when this summer the coalition countries agreed to gradually increase production, in total by 400,000 barrels per month.

A monthly report from the International Energy Agency (IEA), released last week, said skyrocketing prices for natural gas and coal are driving up demand for oil from power plants and manufacturing industries. Amid the ongoing energy crisis, oil demand may increase by 500,000 barrels per day in the coming months, IEA analysts said.

“The acute shortage of natural gas, LNG and coal amid the global economic recovery has triggered skyrocketing energy prices and a large-scale transition to the use of oil and petroleum products for power generation”, the IEA said.

Today, oil market participants will also, as usual, pay attention to the publication (at 17:00 GMT) of the weekly report on oil platforms from the oilfield services company Baker Hughes. Previous data from Baker Hughes reflected an increase in the number of active rigs to 445 units (versus 433, 428, 421, 411, 401, 394, 410, 405, 397 in previous reporting periods). It is obvious that the number of oil companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil quotes, however, it will only have a short-term character.