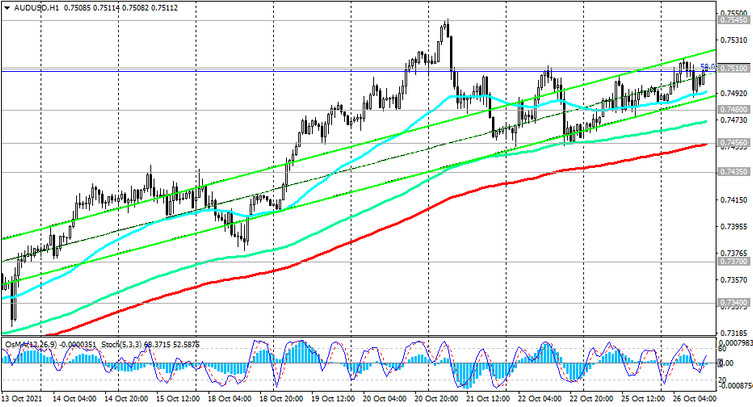

Today AUD / USD has been growing for the 4th week in a row, bouncing off the local 5-week lows near the 0.7175 mark, reached at the end of last month.

At the time of this posting, AUD / USD is traded near 0.7515, in an important 0.7510 resistance zone (Fibonacci 50% retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), above important short-term support levels 0.7370 (ЕМА200 on the 4-hour chart), 0.7456 (ЕМА200 on the 1-hour chart) and long-term support levels 0.7435 (ЕМА200 on the daily chart), 0.7340 (ЕМА200 on the weekly chart), which indicates the resumption of the long-term upward dynamics of the pair.

Confirmed breakdown of the long-term resistance level 0.7815 (ЕМА200 on the monthly chart) is likely to complete the AUD / USD's transition into the long-term bull market zone.

In an alternative scenario, the growth of AUD / USD will stall near the resistance level 0.7545 (the upper border of the ascending channel on the daily chart), and the breakdown of the short-term important support level 0.7456 will be the first signal for the implementation of a negative scenario with intermediate targets at the support levels 0.7435, 0.7340, 0.7300.

Support levels: 0.7480, 0.7456, 0.7435, 0.7370, 0.7340, 0.7300, 0.7175, 0.7115

Resistance levels: 0.7510, 0.7545

Trading Recommendations

Sell-Stop 0.7450. Stop-Loss 0.7530. Take-Profit 0.7435, 0.7370, 0.7340, 0.7300, 0.7175, 0.7115

Buy Stop 0.7530. Stop-Loss 0.7450. Take-Profit 0.7575, 0.7700, 0.7775, 0.7800