The dollar continues to decline after the Fed meeting ended last week, following which, as you know, the leadership of the American central bank decided to start curtailing the quantitative easing program. This process will begin in November and should be completed by June next year. The Fed will cut bond purchases by 15 billion in November and another 15 billion in December. According to the Fed, such a reduction in the volume of acquired assets "is likely to be appropriate every month", although it is ready to adjust the pace of curtailment of purchases, "if it is justified in view of changes in the outlook for the economy". Interest rates, however, remained at the same level: the target range of the federal funds rate remained within the range of 0.00% -0.25%.

At the press conference, Jerome Powell reiterated that the central bank will not rush to raise interest rates, since the labor market has not yet fully recovered, and the increased inflation in the Fed is still considered a temporary phenomenon.

It looks like market participants were expecting a tougher decision from the Fed leaders, and, despite the strong report on the US labor market for October, published last Friday, the Fed's restrained position, which does not plan to rush to raise interest rates, is putting downward pressure on the dollar.

Today, the DXY dollar index is near 93.93, 71 points below the local nearly 14-month high reached last week near 94.64.

Now, the Fed's position may again shake in the direction of further tightening of policy, if inflation in the United States continues to gain momentum, and the labor market - to recover at the same pace.

Therefore, market participants will carefully study the macro statistics coming from the US in order to catch the slightest change in the sentiments of the Fed leadership regarding their future plans.

So, this week investors will wait for the publication of a block of statistics on manufacturing and consumer prices in the United States. On Wednesday (at 13:30 GMT) consumer price indices will be published, and on Tuesday, also at 13:30 - data on producer prices, which may increase fears about inflation in the United States. Sooner or later, the Fed will still have to respond to accelerating inflation.

Federal Reserve Bank of Philadelphia President Harker said Monday that if inflation does not slow down next year as he expects, the Fed may be forced to raise short-term interest rates.

"I do not expect the federal funds rate to be raised before the stimulus rollback is complete, but we are monitoring inflation very closely and are ready to take action if justified", Harker said.

Another Fed spokesman and vice chairman, Richard Clarida, said on Monday that he expects inflationary pressures to ease as the supply and demand imbalance gradually recedes. He reiterated that he expects the emergence of suitable economic conditions for raising interest rates only by the end of 2022. The Fed's new forecasts point to stable rate hikes in 2023 and 2024, and Clarida believes this is in line with the new approach to monetary policy that the Fed adopted last year.

Fed Chief Powell, speaking Monday, did not comment on monetary policy or the outlook for the economy. He will speak again today at 14:00 (GMT). Market participants will, of course, pay attention to this. However, if he does not touch on the topic of monetary policy, the market reaction to his speech will be weak.

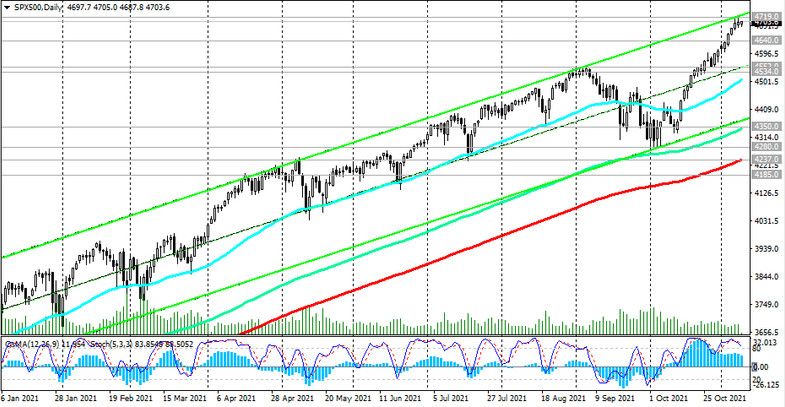

Meanwhile, given the soft position of the FRS leadership regarding the prospects for monetary policy and against the background of positive corporate reporting of American companies, American stock indices are hitting new records.

Thus, the S&P 500 stock index closed on Monday at a new record high, above 4700.0. The Nasdaq Composite rose on Monday by 10.77 points to 15982.00, and the Dow Jones Industrial Average rose 0.3% to 36432.00.

Today, futures for major US stock indices remain positive. As of this writing, S&P 500 futures are traded near 4704.0.

Thus, investors maintain a positive outlook, while S&P 500 futures - positive dynamics and a tendency to further growth against the backdrop of a favorable fundamental background.