At the end of the meeting, which ended in early November, the leaders of the RBA left the key rate at a record low level of 0.10% (it has been at this level since the end of 2020) and announced that they will no longer manage the yield curve. This monetary policy instrument is known to be used by central banks to keep government bond yields (by purchasing them) from rising above a certain level. The purchase of government bonds by the central bank is, in fact, a quantitative easing instrument, which, in turn, reduces the value of the national currency.

"With other market interest rates shifting in response to the likelihood of accelerating inflation and lower unemployment, the effectiveness of yield targeting to lower the overall structure of interest rates has weakened", said RBA chief Philip Lowe.

This, of course, a positive factor for the quotes of the national currency, however, did not become a driver of strengthening the Australian dollar. On the contrary, the AUD weakened sharply, responding to the soothing statements of the head of the RBA Lowe. "Inflation has accelerated, but its core indicator remains low. Inflation pressures remain lower than in many other countries, not least due to modest wage increases in Australia", Lowe said after the central bank meeting, adding that the central bank willing to be patient with the interest rate hike, in part because it is not known how long supply chain disruptions will last.

The RBA also said it would continue to buy A $ 4 billion in government bonds a week at least until mid-February, and the key condition for a rate hike (sufficient wage and employment growth) is unlikely to emerge soon.

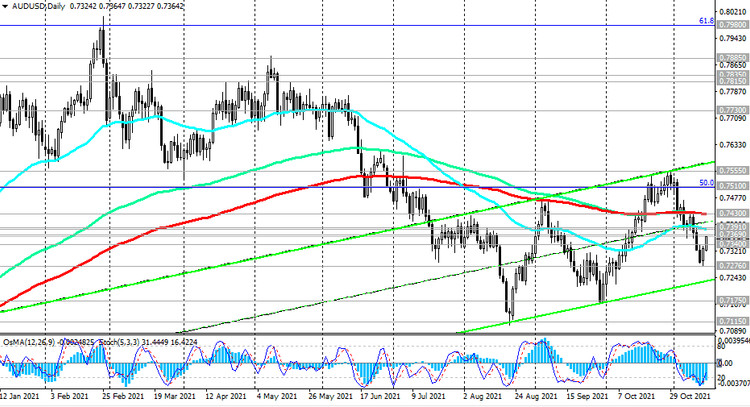

As a result, the AUD / USD pair has decreased since the beginning of the month by 2%, to the mark of 0.7362, although the local minimum was recorded much lower, near the mark of 0.7276. The pair bounced off this local low last Friday, when profit-taking in long positions on the US dollar began. The DXY dollar index declined also on Monday, retreating from its high since July 2020, reached on Friday near 95.27.

Investors decided to close part of their long positions in USD, taking advantage of somewhat disappointing statistics that came out at the beginning of the American trading session last Friday. Thus, the consumer confidence index from the University of Michigan in November fell to 66.8 (after falling to 71.7 last month and against the forecast of 72.4). Thus, the index of American consumer sentiment fell to its lowest level in a decade, as rising inflation increases pressure on that sentiment, economists say. At the same time, despite the drop in consumer confidence, consumers are in no hurry to cut spending significantly. US consumer inflationary expectations for the next 12 months rose to 4.9% from 4.8% in October. Inflation expectations for the next five years are 2.9%, and economists believe that the dollar will remain strong as expectations for a key US interest rate hike are strengthened.

The consumer price indices (CPI) released last week provided further evidence that core inflation is high and growing, including on the mood of Fed leaders, who are gradually leaning towards an earlier start of interest rate hikes.

Many economists believe that the prospect of an earlier move by the Fed to tighten policy will limit the magnitude of the dollar's weakening in the coming months if US inflation does not slow. As you know, the head of the Fed, Jerome Powell, has repeatedly stated that he considers the current rise in inflation to be a temporary phenomenon.

Federal funds futures traders now estimate the likelihood of a rate hike at more than 70% by June, up from just over 50% a week ago, according to the CME Group.

Meanwhile, the AUD / USD pair is still correcting after falling the day before, rising to the level of 0.7362 at the time of publication of this article.

Australia's 3rd quarter wage indices are due Wednesday (00:30 GMT). They are expected to rise by +0.5% (+2.2% yoy) after rising +0.4% (+1.7% yoy) in the second quarter. This is still below the 3% benchmark, at which, according to the RBA, interest rates should be raised. However, based on data on labor market, conditions and business sentiment, wage growth could be stronger, and it could determine the mood of the central bank in early 2022. Any signal that wage growth will accelerate could sharply heighten expectations of an interest rate hike next year. In addition, core inflation in the 3rd quarter turned out to be unexpectedly high, and the Reserve Bank of Australia decided to stop controlling the government bond yield curve.

It will also be interesting to hear the opinion of the head of the RBA Lowe on this matter. He will have the opportunity to express it tomorrow (at 02:30 GMT he will start speaking) after the publication (at 00:30 GMT) of the minutes of the November meeting of the RBA.

If the published minutes and Philip Lowe's speech contain unexpected information concerning the issues of the RBA's monetary policy, the volatility in the AUD quotes will grow. If Lowe does not touch on the topic of monetary policy, then the market reaction to his speech will be weak.