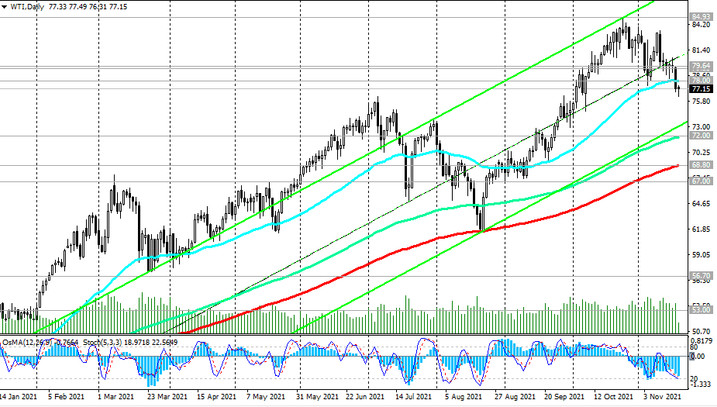

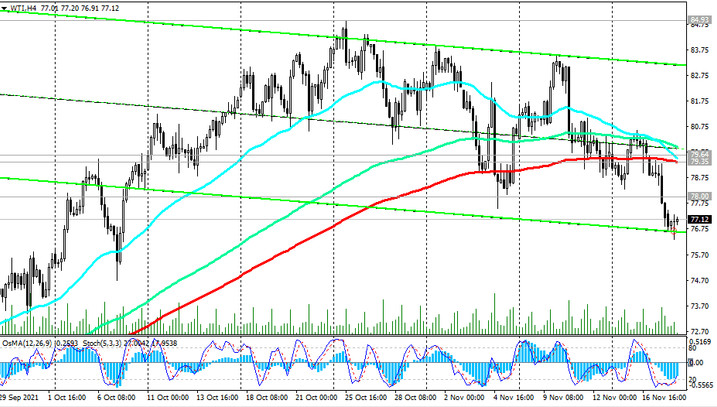

Against the backdrop of strong fundamentals, the price of oil rose significantly in the previous two months. At the end of October, WTI futures rose in price to the mark of 84.93 dollars per barrel, updating a 36-month high. In early November, the price rolled back from the levels reached, dropping to the zone below the important support levels 79.64 (ЕМА200 on the 1-hour chart), 79.35 (ЕМА200 on the 4-hour chart), 78.00 (ЕМА50 on the daily chart).

If a downward correction develops and a further decline, the price may drop into the zone of key support levels 72.00 (ЕМА144 on the daily chart), 68.80 (ЕМА200 on the daily chart). The lower border of the ascending channel on the weekly chart also passes between these marks.

Nevertheless, despite the current decline, oil prices are expected to remain positive, trading above current levels, based on cold winter expectations amid shortages of other energy resources, in particular natural gas, and limited oil supplies by OPEC+ countries.

The first signal to resume long positions will be a breakdown of the important short-term resistance level 79.64 (ЕМА200 on the 1-hour chart), and in case of a breakdown of the local resistance level 83.30, the price will move towards new multi-year highs above 84.93.

Only a breakdown of the key support level 56.70 (ЕМА200 on the weekly chart) will bring WTI oil back to the bear market.

Support levels: 72.00, 68.80, 67.00, 56.70, 53.00

Resistance levels: 78.00, 79.35, 79.64, 83.30, 84.93

Trading recommendations

Sell Stop 76.30. Stop-Loss 78.10. Take-Profit 72.00, 68.80, 67.00, 56.70, 53.00

Buy Stop 78.10. Stop-Loss 76.30. Take-Profit 79.35, 79.64, 83.30, 84.93, 85.00, 86.00, 90.00