There is a sharp correction in the market today. Market participants are deeply concerned about reports of the discovery of a new mutated strain of coronavirus in South Africa, which has raised concerns about new lockdowns that could negatively affect the pace of economic growth.

Today we are seeing a sharp drop in the quotes of commodities and commodity currencies and an increase in demand for protective gold, franc and yen.

The DXY dollar index also did not resist and after rising the day before to new 16-month highs near the mark of 96.94, today it fell sharply, mainly due to the weakening of the dollar against the yen and the euro, whose share in the DXY is about 14% and 57%, respectively.

Meanwhile, the strengthening of the euro, observed today, should be attributed so far only to the correction.

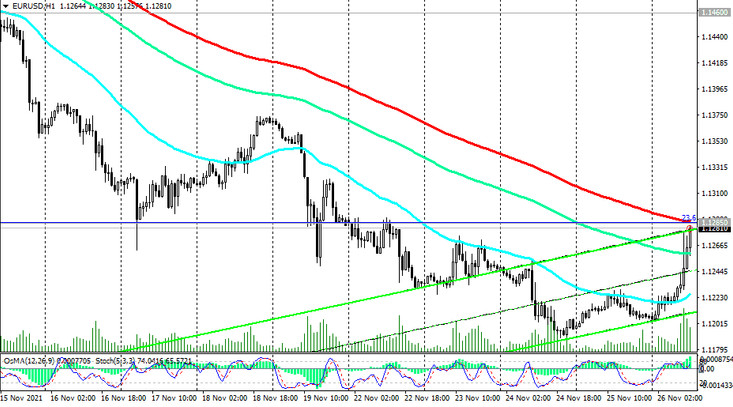

By the time this article was published, the EUR / USD pair rose to the mark of 1.1281, coming close to the strong resistance level 1.1285 (see Technical Analysis and Trading Recommendations).

But so far this is only a correction and, accordingly, a good opportunity to enter a position along the main trend, i.e. in the "short".

The downward dynamics of the euro and the EUR / USD pair still prevails.

Although large-scale vaccinations are underway in the Eurozone, the number of cases of coronavirus infection has reached record highs, and news of a new strain found in South Africa has already negatively affected the quotes of Asian and commodity currencies. It is possible that this wave will eventually reach Europe. But so far, market participants seem to have decided to prefer the euro to the rest of the major world currencies. A sharp downward correction in the European stock market today is likely to also strengthen the euro, as this currency is "funding" for it.

It is still premature to talk about the end of the downward dynamics of the euro and the EUR / USD pair, respectively. In the Eurozone, new quarantine measures may be required, and, according to economists, for example, a weekly quarantine will reduce the quarterly GDP of the Eurozone by 0.2% -0.5%.

But in the European macro statistics there are also positive (for the euro quotes) moments.

So, according to the statistics agency Destatis, in Germany, whose economy is the locomotive of the entire European economy, import prices rose by 21.7% (annualized) in October, and this growth would be the strongest since January 1980. Today, the ECB also announced an acceleration in the growth of bank lending to companies (in October, the growth of lending to companies in the Eurozone accelerated to 0.5% from 0.4% last month and to 2.5% from 2.1% in October in annual terms), which portends a significant increase in investment and (as well as the growth of import and export prices) contributes to the acceleration of inflation in the Eurozone. And this is a signal to the ECB about a possible revision of its extra soft approach to monetary policy. Accelerating inflation, just like the Fed, will sooner or later force the ECB to start curtailing the quantitative easing program (it’s probably too early to talk about an increase in the ECB's interest rate). In particular, the Bundesbank warned that inflation in Germany will soon reach 6%, which will require government intervention in monetary policy. But so far, low interest rates create favorable conditions for lending, and the accelerated growth of the European economy will allow it to quickly approach pre-pandemic levels.

At the same time, while the European Central Bank prefers to adhere to a wait and see position, the Fed has already begun to roll back its stimulus policy. As a result of the meeting ended on November 3, the leaders of the Fed decided to reduce the volume of purchases of assets, which amounted to $ 120 billion a month, by $ 15 billion in November and December. In their opinion, such a cut, "is likely to be appropriate every month", although they are willing to adjust the pace of the withdrawal of purchases, "if it is justified in view of changes in the outlook for the economy". If after the December meeting, which will be held on December 14-15, Fed leaders accelerate the pace of reduction in asset purchases, for example, to $ 30 billion a month, then the QE program may be completed by March, which will increase the likelihood of an increase in interest rates in the first half of next year. And this prospect creates the preconditions for further strengthening of the dollar, including in the EUR / USD pair. With inflation accelerating, which hit a 30-year high, other macro data suggest a continuing momentum for the US economic recovery, while labor demand is growing. The re-election of Jerome Powell to a second term as chairman of the Federal Reserve also boosted market expectations of a rate hike next year.

Banks and exchanges in the US were closed yesterday for Thanksgiving, and today the country has a shortened trading day as Thanksgiving continues. In view of this, the American trading session will also be shortened. Trading volumes in financial markets will sharply decline closer to its middle.