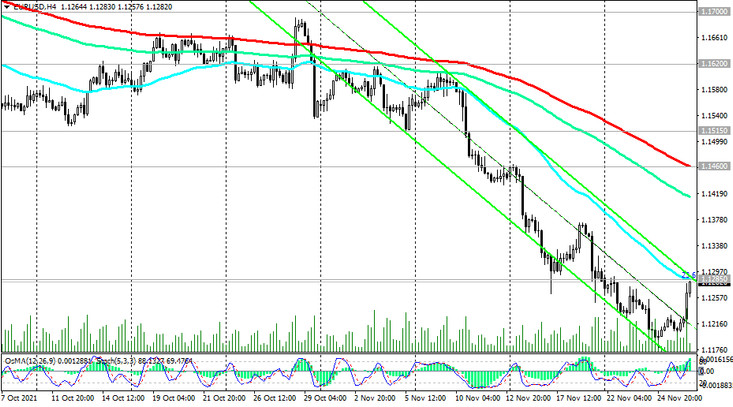

Despite today's growth, EUR / USD remains in the long-term bear market zone, trading below the key resistance levels 1.1620 (EMA200 on the weekly chart), 1.1735 (EMA200 on the daily chart), 1.1885 (EMA200 on the monthly chart).

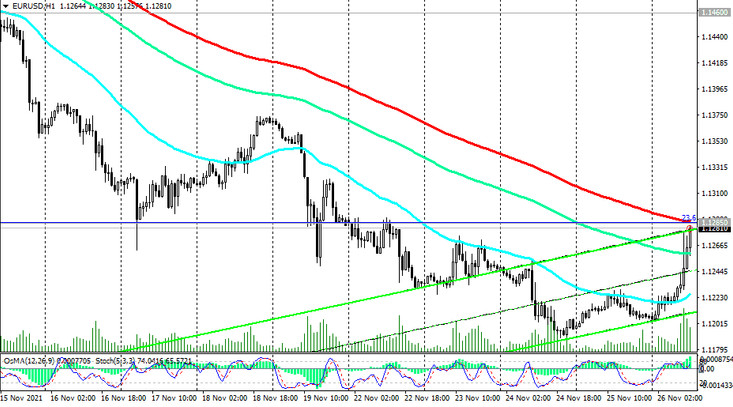

Further decline in EUR / USD is most likely. In view of this, short positions for this currency pair remain preferable, and today's corrective growth provides a good opportunity to enter short positions from current levels: at the time of publication of this article, it rose to 1.1281 mark, close to the strong resistance level 1.1285 (ЕМА200 at the 1-hour level and the Fibonacci level 23.6% of the upward correction in the wave of the pair's decline from the mark of 1.3870, which began in May 2014, to the mark of 1.0500). Nevertheless, we also do not forget about stops and set them above 1.1315.

In an alternative scenario, a confirmed breakdown of the resistance level 1.1285 will become a signal for the continuation of the upward correction towards the resistance level 1.1460 (ЕМА200 on the 4-hour chart).

However, only a breakdown of the key resistance levels 1.1735, 1.1780 (Fibonacci level 38.2%) will indicate a return of EUR / USD to the bull market.

Support levels: 1.1230, 1.1200, 1.1170

Resistance levels: 1.1285, 1.1315, 1.1460, 1.1515, 1.1620, 1.1700, 1.1735, 1.1780

Trading Recommendations

Sell Stop 1.1250. Stop-Loss 1.1315. Take-Profit 1.1230, 1.1200, 1.1170, 1.1100, 1.1000

Buy Stop 1.1315. Stop-Loss 1.1250. Take-Profit 1.1400, 1.1460, 1.1515, 1.1620, 1.1700, 1.1735, 1.1780