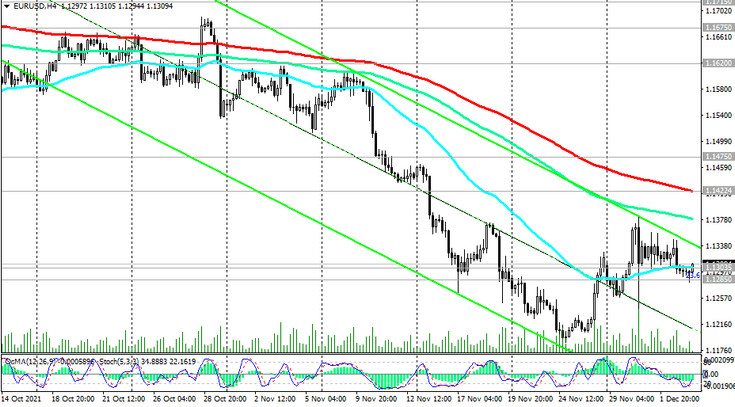

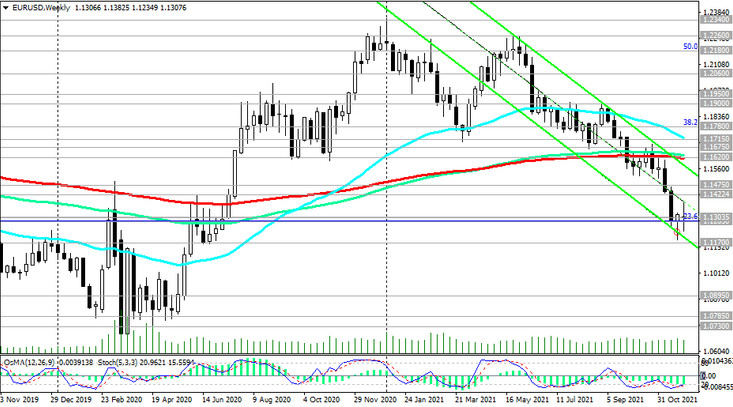

Today's positive statistics from the Eurozone provoked the strengthening of the euro at the beginning of the European session. The EUR / USD pair has broken through the important short-term resistance level 1.1303 (ЕМА200 on the 1-hour chart) and is making an attempt at further growth. Nevertheless, despite the recent gains triggered by a sharp drop in European stock indices, EUR / USD remains in the long-term bear market zone, trading below the key resistance levels 1.1620 (ЕМА200 on the weekly chart), 1.1715 (ЕМА200 on the daily chart), 1.1885 (ЕМА200 on the monthly chart).

The most likely resumption of the decline in EUR / USD. In view of this, short positions remain preferable, and the current corrective growth provides a good opportunity to enter short positions from the current levels, as well as in case of growth to the important short-term resistance level 1.1422 (ЕМА200 on the 4-hour chart and the upper border of the descending channel on the daily chart).

The breakdown of the support levels 1.1303, 1.1285 (Fibonacci level 23.6% of the upward correction in the wave of the pair's decline from the level of 1.3870, which began in May 2014, to the level of 1.0500) will be a confirmation signal for the renewal of the EUR / USD downward dynamics.

In an alternative scenario, the upward correction will continue towards the resistance level 1.1475 (ЕМА50 on the daily chart), from which sales are also possible.

Support levels: 1.1303, 1.1285, 1.1200, 1.1170

Resistance levels: 1.1422, 1.1475, 1.1620, 1.1675, 1.1700, 1.1715, 1.1780

Trading Recommendations

Sell Stop 1.1280. Stop-Loss 1.1390. Sell Limit 1.1410, 1.1470. Stop-Loss 1.1520. Take-Profit 1.1230, 1.1200, 1.1170, 1.1100, 1.1000

Buy Stop 1.1390, 1.1430. Stop-Loss 1.1280. Take-Profit 1.1470, 1.1500, 1.1620, 1.1670, 1.1700