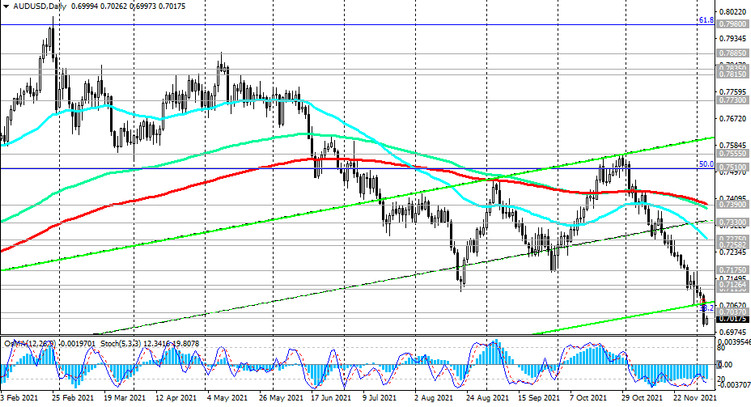

Since the beginning of this month, the AUD / USD pair has continued to decline, remaining in the long-term bear market zone below the key resistance levels 0.7730 (ЕМА200 on the monthly chart), 0.7390 (ЕМА200 on the daily chart), 0.7330 (ЕМА200 on the weekly chart).

Technical indicators OsMA and Stochastic on the daily, weekly, monthly charts are also on the sellers' side, signaling in favor of short positions.

A further decline in AUD / USD is most likely from both a technical and a fundamental point of view. A signal for new sales will be a breakdown of the local support level 0.6992 (lows of the previous week), and the decline may be another 20% and, possibly, more to the current level 0.7020 (the lows of the recent wave of decline are near the mark of 0.5510).

In an alternative scenario, the decline in AUD / USD will stop near the current level. But a signal for buying AUD / USD may be a breakdown of the important short-term resistance level 0.7126 (ЕМА200 on the 1-hour chart).

In this case, the corrective growth may continue towards the resistance levels 0.7258 (ЕМА200 on the 4-hour chart), 0.7275 (ЕМА50 on the daily chart).

However, only a rise into the zone above the key long-term resistance level 0.7390 (ЕМА200 on the daily chart) will indicate the resumption of the long-term bullish trend in AUD / USD. Immediate growth targets after that will be located at resistance levels 0.7510 (Fibonacci level 50% retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510) and near the local 3-month high 0.7555, reached at the end of October.

Support levels: 0.6992, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Resistance levels: 0.7037, 0.7115, 0.7126, 0.7175, 0.7258, 0.7275, 0.7330, 0.7390

Trading Recommendations

Sell Stop 0.6990. Stop-Loss 0.7055. Take-Profit 0.6900, 0.6800, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.7055. Stop-Loss 0.6990. Take-Profit 0.7115, 0.7126, 0.7175, 0.7258, 0.7275, 0.7330, 0.7390