Oil prices continue to rise as concerns about the omicron strain have eased. According to reports from South Africa, where the strain of the virus was first discovered, patients infected with the omicron strain are showing only mild symptoms, and investors have renewed hope that the new strain will be less damaging to the economy. Oil prices are also receiving support following recent decisions by the OPEC+ coalition not to exceed previously planned production ramp-ups (last Thursday, OPEC+ members agreed to increase production by 400,000 barrels per day in January, as previously planned) and in view of the reduced likelihood of a quick return Iranian oil to the market.

In addition, Saudi Arabia over the weekend raised its Arab Light sales prices in January for Asia and the United States to a 2-year high, likely anticipating strong demand next year.

In turn, the growth of oil quotes supports the shares of oil companies and quotes of commodity currencies, primarily the Canadian dollar.

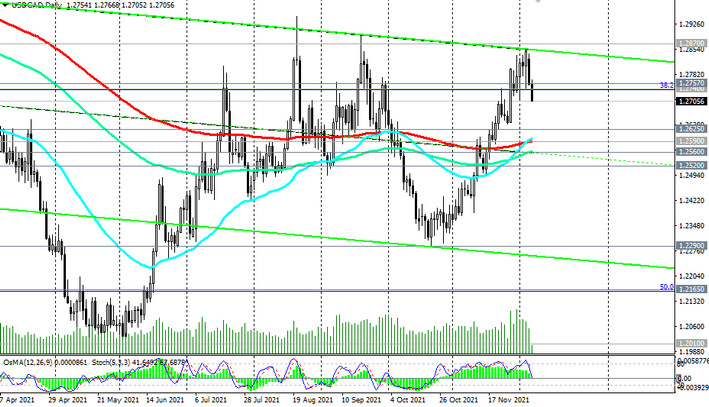

Today the USD / CAD pair is actively declining, largely duplicating the dynamics of oil prices (in inverse correlation).

Canada is the largest exporter of oil, and the share of oil and oil products in the country's exports is approximately 22%. Despite some uncertainty in the oil market due to the coronavirus, many leading economists predict a further increase in energy prices (coal, gas, oil), including due to expectations of a cold winter and rush demand in the gas market.

At the time of publication of this article, the USD / CAD pair is traded near the mark of 1.2707, accelerating the decline towards the support levels 1.2660, 1.2625.

The Canadian dollar also continues to receive support after the publication last Friday of a positive report by Statistics Canada on the country's labor market. According to the data presented, the number of jobs in Canada in November increased by 153,700 after rising by 31,200 in October (against the forecast of growth of 37,500). The unemployment rate fell to 6.0% against 6.7% in October (with the forecast of falling to 6.7%). Thus, unemployment in the country fell sharply, approaching pre-coronavirus levels, which is a positive factor for CAD ahead of tomorrow's meeting of the Bank of Canada.

According to data released by the National Bureau of Statistics, annual GDP growth in Canada in the 3rd quarter was +5.4% (against the forecast of +3.0%), although many economists have lowered their forecast for the growth of the Canadian economy in 2021.

At its meeting on Wednesday, the Bank of Canada is expected to maintain its neutral position and interest rate at 0.25%. The possible harsh tone of the accompanying statement by the Bank of Canada regarding the growing inflation and the prospects for further tightening of monetary policy will cause the Canadian dollar to strengthen.

However, even with the harsh tone of the Bank of Canada announcements, gains in the Canadian dollar against the US dollar are likely to be limited given the large-scale upward momentum of the US dollar. It is likely that the USD / CAD pair will need to break through the key support levels 1.2590, 1.2520 before moving to a sustained decline.

The most likely still seems to be the resumption of growth in USD / CAD against the background of expectations of further strengthening of the US dollar, since the completion of the Fed's QE program is shifted to an earlier date.

US Federal Reserve Chairman Jerome Powell made it clear last week that monetary tightening would be accelerated. If the American economy does not suffer from the new omicron strain and continues to grow, while market participants wait for the Fed to raise rates, then we should expect an inflow of funds in the US, as a result of which the demand for the US dollar will rise again.

Nevertheless, tomorrow, when the Bank of Canada's decision on the interest rate is published at 15:00 (GMT), we should expect an increase in volatility in the market, and especially in the CAD and USD / CAD quotes.

And today the volatility in this currency pair may increase at 13:30 (GMT), when the latest data on the foreign trade balance of the United States and Canada will be published.