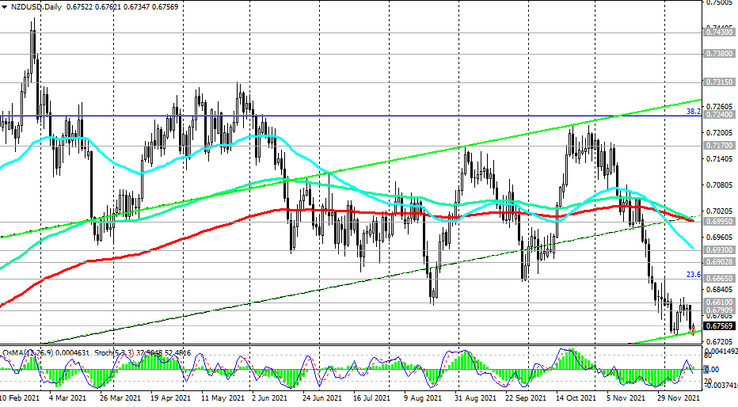

On Monday, the New Zealand dollar, like other major commodity currencies, declined against the US dollar. Last month, the NZD / USD pair broke the key support level 0.6865, entering the long-term bear market zone, and during today's Asian trading session, it renewed its 13-month low at 0.6735.

At the beginning of the European session, there is an upward correction in NZD / USD against the background of some weakening of the US dollar. At the time of this posting, DXY dollar futures are traded near 96.14, remaining in the 16-month local highs area and in the middle of the range between local highs near 96.94 and local lows near 95.54, reached at the end of November.

By the time this article was published, the NZD / USD pair managed to rise to the mark of 0.6762. Nevertheless, the pair's downtrend prevails, primarily due to the strengthening of the US dollar on the eve of the Fed meeting, which starts today and ends on Wednesday with the publication (at 19:00 GMT) of the decision on interest rates.

Market participants are waiting for decisions from the American central bank aimed at changing the current course of monetary policy. Based on the results of a two-day meeting of the Committee on Open Market Operations, the Fed is expected to double the pace of its stimulus rollback, cutting the volume of purchases by $ 30 billion monthly (previously the bank announced a decrease in purchases by $ 15 billion monthly), with the postponement of the completion date of this program to March since the summer of 2022. Many economists expect two rate hikes next year, while market participants expect three hikes. "The economy is in very good shape, inflationary pressures are high, so, in my opinion, it is advisable to consider shifting the curtailment of asset purchases, which we actually announced at the November meeting, for a few months earlier", said Fed Chairman Powell last month. According to him, the rise in inflation is no longer temporary, while the situation in the American labor market also continues to improve. Thus, the data on applications for unemployment benefits published last week showed a decrease in applications to 184 thousand, the lowest level since 1969. It is likely that U.S. unemployment will eventually reach pre-coronavirus levels of 3.5% by mid-2022, with core inflation at around 3% at the end of next year, economists say. Also, in their opinion, to tame inflation, the Fed will implement two rate hikes in 2022, then three more in 2023 and four in 2024. While this is a very steep trajectory by historical standards, there is a possibility that the US central bank will chart an even larger rate hike. This prospect creates serious preconditions for the further strengthening of the American dollar. If price pressure eases, it could moderate the need for an urgent rate hike. But if this does not happen, then the Fed will have to act decisively. Although, here, too, many questions now arise. One is whether high interest rates will then be able to withstand inflation created by a supply shortage shock while strong demand is fueling a price spike.

Returning to the dynamics of the NZD, we note that economists expect a fall in New Zealand's GDP in the 3rd quarter of 2021 by -4.5% (after growing by +2.8% in the previous quarter). The last time a negative value of GDP in the country was recorded in the 4th quarter of 2020 (-1.0%). Another drop in this important indicator may put significant pressure on the NZD quotes (in annual terms in the 3rd quarter, a fall of -1.6% is also expected). New Zealand GDP data will be released on Wednesday (at 21:45 GMT) after the Fed's meeting and press conference.

Thus, tomorrow, in the period from 19:00 to 22:00 (GMT), one should expect a sharp increase in volatility in the financial market, and especially in the quotes of the US dollar and in the NZD / USD pair. And today in the NZD quotes volatility may increase at the beginning of the American trading session, when the report of the New Zealand real estate agency REINZ on the cost of housing in the country is published, and at the end of the American trading session (at 21:45 (GMT) the Bureau of Statistics of New Zealand will publish data on the country's trade balance for the 3rd quarter). In general, the downward dynamics of NZD / USD prevails, on which our main trading strategy should be based.