The US dollar has strengthened sharply immediately after the Fed announced on Wednesday night its decision to keep interest rates unchanged and to cut monthly purchases of Treasury bonds and mortgage-backed securities. The DXY dollar index hit a 15-day high at 96.89 yesterday, but then the dollar also weakened sharply, and the DXY index returned to yesterday's opening levels at 96.48.

At the start of today's European session, DXY dollar futures are declining again, returning to the middle of the range between local highs near 96.94 and local lows near 95.54, reached in late November, trading near 96.34.

The Fed cut its monthly purchases of $ 20 billion in Treasury bonds and $ 10 billion in mortgage-backed securities to $ 40 billion and $ 20 billion, respectively, following Wednesday's meeting, stating that “similar cuts in net asset purchases are likely to be appropriate every month, but it is ready to adjust the pace of purchases if this is required by changes in the prospects for the economy". From January, purchases will decrease by $ 30 billion per month. The decision to accelerate the phasing out of stimulus is explained by "the dynamics of inflation and further improvement in the state of the labor market".

Thus, in January, Treasury and mortgage-backed securities will be purchased for $ 60 billion, and the stimulus program will be fully completed by March next year, which will create conditions for an increase in interest rates (previously, the head of the Fed, Powell, has repeatedly stated that before the start of raising interest rates, quantitative easing program will first be phased out). Now, most of the leaders of the US Federal Reserve System yesterday signaled that they are ready to raise the short-term interest rate three times next year to slow inflation.

Probably, market participants will analyze the Fed's yesterday's decision for some time. However, it was already largely taken into account in the prices and quotations of the dollar and therefore did not cause a stronger strengthening of the dollar.

Nonetheless, most economists expect the dollar to strengthen more than it will decline: the importance of higher Fed interest rates and the prospect of widening divergence in US interest rates (relative to other advanced economies in the world) are coming to the fore.

Today, 3 largest world central banks will make their decisions on interest rates at once. The decision of the Swiss National Bank will be published at 08:30, the Bank of England at 12:00, and the ECB at 12:45 (GMT).

No surprises are expected here from the actions of the management of these banks. Most likely, their monetary policies will remain unchanged.

In particular, the leaders of the Bank of England, most likely, will not dare to change: the volume of purchases of assets and the interest rate will remain at the same level, 895 billion pounds and 0.1%, despite the recently published optimistic macroeconomic statistics. Thus, the consumer price index in the UK in November rose by 0.7% after rising by 1.1% in October. In annual terms, the growth rate of consumer inflation accelerated from 4.2% to 5.1%, also being better than the forecast of 4.7%.

However, weak data on employment in the country may force the Bank of England to postpone the increase in the key interest rate for now, economists say. According to official data released on Tuesday, the unemployment rate in the UK fell to 4.2% in August-October from 4.3% in July-September. However, this may not yet be sufficient, and restrictions introduced in connection with the spread of the omicron strain of coronavirus may negatively affect employment. Despite an extensive vaccination campaign, the UK has recorded a record number of cases of Covid-19 infection. Yesterday, 78,600 cases of infection were recorded (in January (previous record) there were 68,053). A health official warned that the rapidly spreading omicron strain has become the most significant threat since the start of the pandemic.

Given the uncertainty surrounding the omicron strain of Covid-19 and its economic implications, the Bank of England is likely to keep rates unchanged. This decision is likely to put pressure on the pound, although much will also depend on the rhetoric of the accompanying statements regarding the outlook for the monetary policy of the Bank of England.

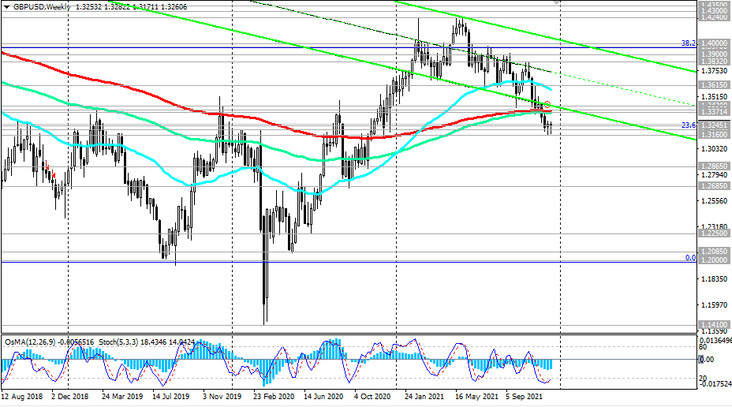

In the meantime, short positions on the GBP/USD pair seem to be more preferable to us.

A breakdown of the local support level 1.3160 will open the way for a decline towards 1.3000, 1.2700. But the corrective growth of GBP / USD will most likely be limited by the resistance levels 1.3370, 1.3430.

Recall that the decision of the Bank of England and the report on monetary policy will be published today at 12:00 (GMT).