In conditions of low activity of traders and trading volumes today, the dollar is strengthening in the foreign exchange market. At the time of publication of this article, the DXY dollar index is approximately in the middle of the range between local highs near 96.94 and local lows near 95.54, reached at the end of November, in general, maintaining positive dynamics and potential for further growth. Why growth and not decline?

In the middle of this month, the US central bank announced that it was accelerating the pace of winding down its stimulus program. This will allow it to be completed by March next year and to start raising the interest rate in the spring of 2022. Fed officials plan to raise interest rates three times in the coming year, while the world's other major central banks will lag behind the Fed in the process. The growing divergence of monetary policy trajectories in the US and elsewhere in the world will tilt the market towards the dollar. Higher interest rates and the course for further tightening of the FRS monetary policy will provide significant support to the US dollar.

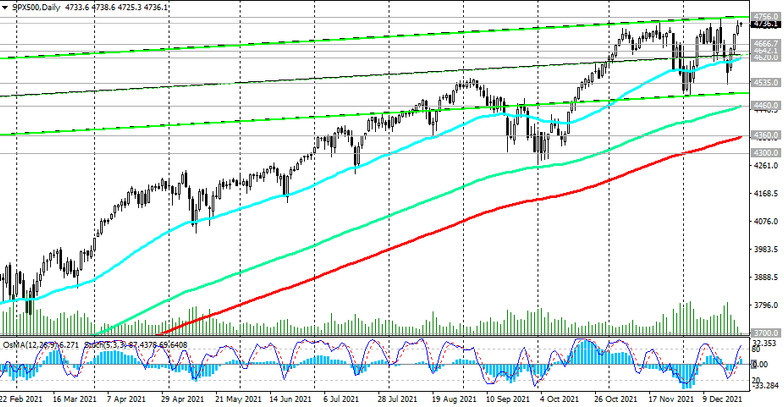

Meanwhile, US stock index futures remain in the zone of all-time highs reached earlier this month and last.

Thus, futures for the American broad market S&P 500 index reached a new record high in mid-December near the mark of 4756.0. Then a downward correction began, as the Fed confirmed the intentions of its leaders to complete the stimulus program in March 2022 and start raising interest rates. This is a bearish signal for the US stock market.

However, the S&P 500 rallied again last week, returning to its all-time highs, and today S&P 500 futures are traded near 4735.0 mark, maintaining positive momentum.

Very positive macro data continues to come from the USA. So, last Wednesday, the US Bureau of Economic Analysis published the final estimate of the dynamics of US GDP for the 3rd quarter of this year. It reflected the growth of the national economy by 2.3%, which is 0.2% better than previous preliminary estimates. At the same time, data published also last week showed that the number of initial jobless claims in the United States remained at its lowest level in several decades, 205 thousand, orders for durable goods, implying large investments, increased by 2.5% in November, while new home sales increased markedly - by 12.4% after falling by 8.4% in October. US consumer sentiment improved in December despite rising coronavirus infections and high inflation. Thus, the final consumer sentiment index in December was 70.6, which is higher than the preliminary value of 70.4 and the November value of 67.4.

Economists are more optimistic about the prospects for the American economy compared to other major economies in the world. This creates the prerequisites for an increase in demand for American assets and the dollar from foreign investors, for which these assets are purchased.

The dynamics of trading on world exchanges this week is likely to be restrained due to the lack of data and financial news, as well as during the holiday period. At the end of the week, exchanges and trading will be closed, and the world will prepare for the New Year. Trading will resume in full next week, already in the new 2022.