While the DXY dollar index remains in a tight range in the last days of the expiring year, the heat in the financial markets does not seem to be abating. For example, the American broad market S&P 500 index closed on Monday at a record 4795.0, and today S&P 500 futures continue to rise in the morning, breaking through 4800.0.

The positive news that the omicron strain of the coronavirus is unlikely to lead to tough quarantine measures has sparked investor enthusiasm and damped demand for the dollar as a safe haven asset.

At the time of publication of this article, the dollar index DXY fell to the lower part of the range between local highs near 96.94 and local lows near 95.54, reached at the end of November.

Nevertheless, the DXY dollar index still generally remains fairly stable, while the dollar rallies against the yen and slightly declines against the euro (the shares of the yen and the euro in the DXY index, which estimates the value of the dollar against a basket of 6 major currencies, are approximately 14% and 58%, respectively).

The growing demand for assets in the US stock market is also helping to strengthen the dollar for which these assets are bought.

However, the thin market, the absence of large players on it and low liquidity in the last week of the year are also likely to help speculators lift the indices to new highs.

While many economists have downgraded their growth forecasts for the first quarter of 2022, there is confidence in the markets that the omicron strain will not undermine the economic recovery.

The traditional pre-New Year rally, when American stock indices are mainly growing in the last days of the outgoing year, also seems to be making itself felt.

Against the backdrop of the growth in the stock market and the weakening of fears about the omicron-strain of the coronavirus, trading in the oil market is also going with an increase in quotations.

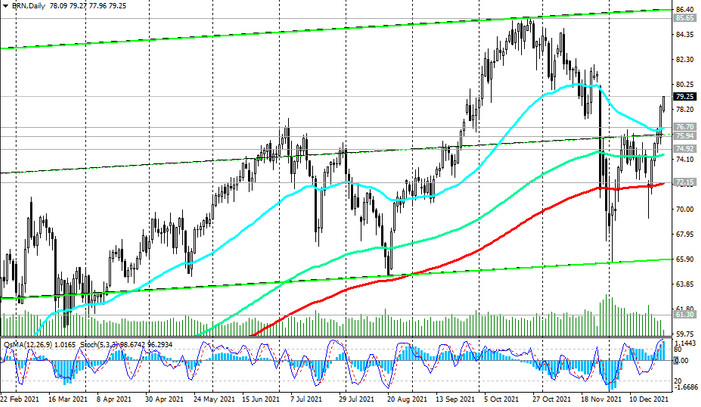

So, futures for Brent oil rose in the previous 4 days by 9.3%, to 78.40 dollars per barrel, and today they continue to rise, trading before the start of the American session near the mark of 79.27 dollars per barrel.

In general, oil market analysts believe that energy prices will maintain positive dynamics, trading above current levels, based on expectations of a cold winter amid a shortage of other energy resources, in particular natural gas, and limited oil supplies by OPEC+ countries.

Today, oil market participants will pay attention to the publication (at 21:30 GMT) of the report of the American Petroleum Institute (API) on oil reserves (in the week until December 24). If this report points to another decline in crude oil and oil product inventories (gasoline, kerosene, distillates and fuel oil), it is likely that this will be followed by a further increase in oil prices, including Brent.

Earlier, the volatility in the dollar and, accordingly, oil quotes will rise at 14:00 (GMT), when the house price indexes of the Federal Reserve Board of Housing and S&P will be published. Economists expect the indices to rise in October due to limited supply, which will indicate growing inflationary pressures and are likely to support the dollar.

Despite the New Year holidays, oil market participants are likely to continue to closely monitor the latest news about the new strain of coronavirus and the latest data on oil reserves from the Energy Information Administration of the US Department of Energy, which will be published tomorrow (at 15:30 GMT). And next week, an important event for the oil market will be the OPEC+ meeting, which will be held on January 4.