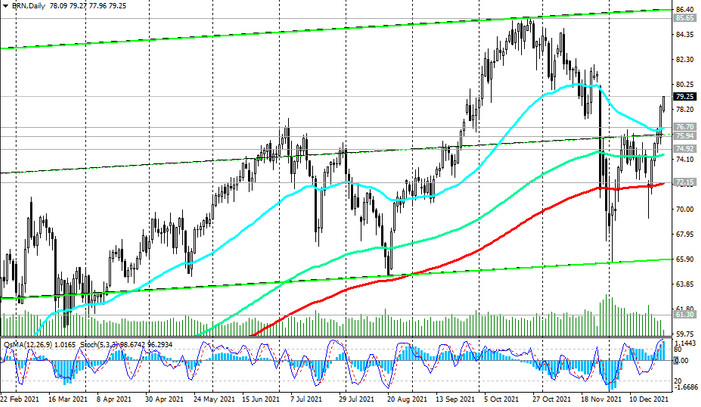

As we noted above, oil prices have risen significantly over the past few days, remaining in the bull market and trading above long-term support levels.

At the time of publication of this article, Brent crude oil futures are traded near 79.27 mark, again tending towards the local multi-year maximum reached in November near the 85.65 mark.

A breakdown of this local resistance level will cause further price growth, while oil market analysts predict that the oil market will continue to positive dynamics amid expectations of a cold winter amid increased demand for energy and limited oil supplies by OPEC+ countries.

In an alternative scenario and in case of a breakdown of the support level 76.70 (ЕМА50 on the daily chart), the price may decline to the long-term support level 72.15 (ЕМА200 on the daily chart).

The breakout of the key long-term support level 61.30 (ЕМА200 on the weekly chart) will increase the negative dynamics and the likelihood of a return to the long-term downtrend.

Support levels: 76.70, 75.94, 74.92, 72.15, 61.30

Resistance levels: 82.00, 84.00, 85.65

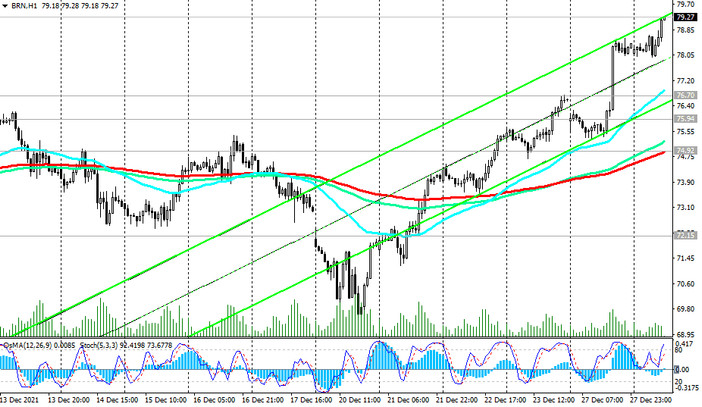

Trading recommendations

Brent: Sell Stop 77.90. Stop-Loss 80.25. Take-Profit 76.70, 75.94, 74.92, 72.15, 61.30

Buy Stop 80.25. Stop-Loss 77.90. Take-Profit 82.00, 84.00, 85.65, 86.00