Although the dollar's growth has stalled, and since the end of November, the DXY dollar index futures have been trading in a range between local highs near 96.94 and local lows near 95.54, reached at the end of November, in general, the dollar remains positive and has the potential for further growth. Markets are taking into account the Fed's three interest rate hikes this year. As you know, at the end of the meeting, which ended on December 16, the leaders of the FRS announced the acceleration of the pace of curtailing the program to stimulate the economy. This will allow it to be completed by March and to start raising the interest rate in the spring of 2022. This prospect led to an increase in the yield on US bonds. Since December, the yield on US 10-year bonds has risen by 22.5%, reaching 1.636% today. As you know, the dollar almost always strengthens with an increase in the yield of government bonds, because the growth in yield indicates continued sales of government bonds, and, accordingly, increases the demand for the dollar as the national currency of the United States.

Thus, despite the volatility and fluctuations in the financial market, the dollar remains positive in anticipation of a series of Fed interest rate hikes.

The publication of important macro statistics on the US expected this week, which will be generally positive, as predicted by economists, should also support the dollar.

So, on Friday, the next monthly report of the US Department of Labor will be released, according to which, in December, 400,000 new jobs (outside the agricultural sector) were created, and the unemployment rate fell to a new low (since March 2020) of 4.1%, when millions of Americans were laid off amid the massive closure of businesses due to the coronavirus pandemic.

Labor market data (along with inflation and GDP data) are key for the Fed when deciding on monetary policy. According to most economists, the US labor market will continue to strengthen in the coming months, despite the increase in the number of cases of infection with Covid-19, while there is a clear shortage of workers, and the spread of the coronavirus is forcing some consumers and temporarily unemployed to stay at home.

And today, market participants will pay attention to the publication at 15:00 (GMT) of the ISM PMI from the US manufacturing sector, which is an important indicator of the state of the American economy as a whole. A result above 50 indicates an acceleration of activity and strengthens the USD, below 50 - as negative for the US dollar. Forecast: 60.2 in December (versus 61.1 in November, 60.8 in October, 61.1 in September, 59.9 in August, 59.5 in July, 60.6 in June, 61.2 in May, 60.7 in April, 64.7 in March, 60.8 in February, 58.7 in January, 60.7 in December). The index is above the 50 level and has a relatively high value, which is likely to support the dollar. If the indicator drops below the forecast, and especially below the value of 50, the dollar may sharply weaken in the short term.

IHS Markit's final purchasing managers' index (PMI) released yesterday for the manufacturing sector fell to 57.7 points in December from 58.3 points in November. However, this did not stop the DXY dollar index from rising noticeably on Monday. Anyway, readings above 50 indicate an increase in activity in this important sector. At the same time, manufacturing companies noted the easing of supply tensions, which is also generally positive for this sector of the American economy.

Meanwhile, among the main competitors of the dollar in the foreign exchange market, the British pound also demonstrates good upward dynamics.

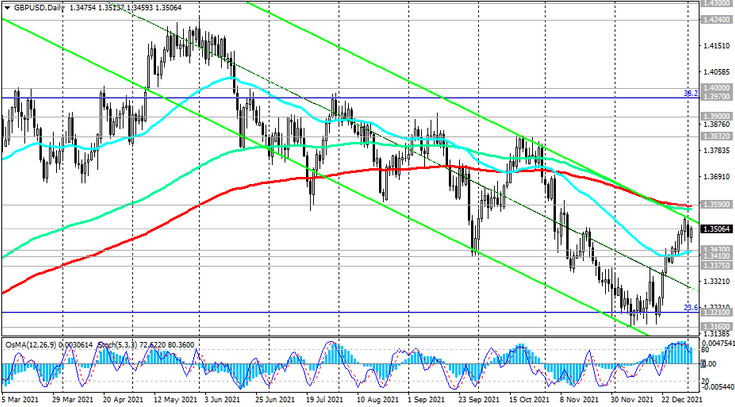

Markit Economics' Manufacturing PMI released this morning, which measures the business climate and conditions in the UK manufacturing sector, indicated that activity is picking up. This sector forms a significant part of the total British GDP, and its growth (up to 57.9 in December) is an important positive indicator of the business environment and the general state of the UK economy, and this, in turn, along with high inflation creates conditions when the Bank England may consider raising interest rates again. Economists believe that the pound has the potential to strengthen further amid easing concerns over Covid-19 and the prospect of new interest rate hikes by the Bank of England. In their opinion, the GBP / USD may well break through the resistance level 1.3590 (200-period moving average on the daily GBP / USD chart). If the pair manages to gain a foothold in this zone of the bull market, then the next targets may be the marks close to resistance levels 1.700, 1.3800, 1.3900. However, on condition - if the Bank of England really decides to raise the interest rate at its meeting on February 3, and the Fed will not do this at its meeting on January 25 - 26.