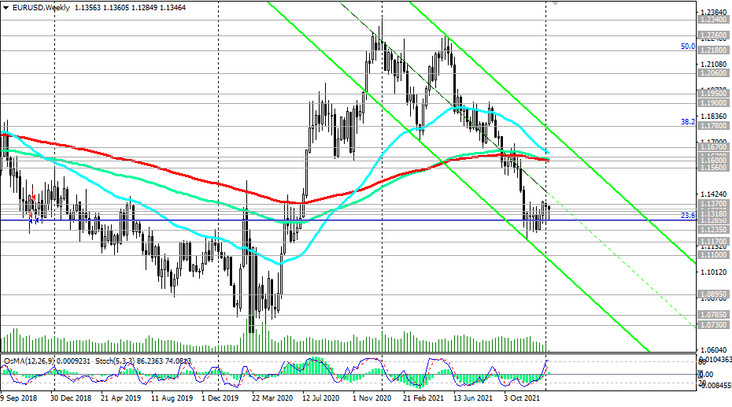

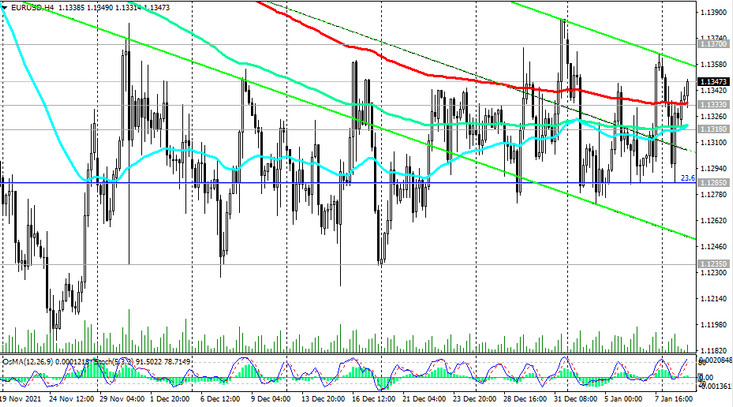

For the second month in a row, the EUR / USD pair has been demonstrating flat dynamics, trading in a range limited by the support levels 1.1285, 1.1235 and resistance level 1.1370, and the main tone in the pair's dynamics is set by the dollar. So, if you look at the chart of the DXY dollar index, you can see that its dynamics are in many ways similar to the dynamics of EUR / USD. This is not surprising, since over 55% of the basket of 6 major currencies of the DXY dollar index is held by the euro.

Macro statistics from the Eurozone released yesterday did not provide the euro with any significant support (unemployment in the Eurozone in November fell by 0.1% to 7.2%, and the Sentix investor confidence indicator in January rose to 14.9 from 13.5 in January). But yesterday's EUR / USD volatility amounted to almost 75 points (in a 4-digit quotation), about the same as last Friday, when the key monthly data for the Fed from the US labor market was published. The dollar fell sharply on Friday, as the NFP fell short of market expectations and was worse of the forecast. As you know, the number of new jobs created outside of agriculture amounted to 199,000 in December, while an increase of +400,000 was expected. Meanwhile, other data from the report of the Ministry of Labor turned out to be very positive. Thus, the unemployment rate fell in December to 3.9%, a new pandemic minimum, from 4.2% in the previous month, and the average hourly wage increased by 0.6% against the forecast of +0.4% (in annual terms, the growth of wages of Americans and even amounted to +4.7%). The data indicate a shortage of hired workers, and in order to keep them, employers are more willing to raise their wages, and this, in turn, leads to an acceleration in inflation. Ultimately, the excessive acceleration of inflation growth entails, as a rule, a tightening of the monetary policy of the central bank of the country. According to the head of the Federal Reserve, Jerome Powell, the rise in inflation in the United States is no longer temporary. At the same time, as we can see, the situation in the American labor market continues to improve. If the number of jobs in the US economy is still 3.6 million less jobs than before the pandemic, then the number of initial applications for unemployment benefits in the US remains at its lowest level in several decades - about 200 thousand.

At the same time, despite the increase in the number of coronavirus infections and high inflation rates, consumer sentiment in the United States remains generally positive. Thus, the final consumer sentiment index in December was 70.6, which is higher than the preliminary value of 70.4 and the November value of 67.4.

And as follows from the report of the US Bureau of Economic Analysis, published at the end of December,

the country's GDP in the 3rd quarter of 2021 grew by 2.3%, which is 0.2% better than previous preliminary estimates.

The market remains confident of investors that the Fed will raise interest rates at least three times in 2022 and will outpace other major banks in the world in this process. This remains one of the main drivers of the dollar strengthening against its main competitors in the foreign exchange market, including the euro.

In view of this, a further fall in the EUR / USD pair should be expected, and a breakout of the support level 1.1285 will be a signal for the resumption of short positions in EUR / USD. The breakout of the lower border of the range at 1.1235 will become a confirmation signal for the pair's sales.

In the alternative scenario, EUR / USD will break through the upper border of the range and the resistance level 1.1370 (the 50-period moving average on the daily chart also passes through this mark), and the corrective growth will continue towards the zone of strong resistance levels 1.1560, 1.1600 (ЕМА200 on the weekly chart), 1.1620 (ЕМА200 on the daily chart). A break of the long-term resistance level 1.1760 (ЕМА200 on the monthly chart) will return EUR / USD to the long-term bull market zone.

In the meantime, short positions remain preferable. The first signal for short-term sales (until EUR / USD breaks out of the above range) will be a breakdown of the important short-term support level 1.1333.

Returning to the macro statistics for the Eurozone, there will be very little of it this week. At the same time, although one should follow the speech of the head of the ECB Christine Lagarde (today at 10:20 GMT and on Friday at 13:15 GMT), it is likely that her speech will have little effect on the dynamics of the euro and the EUR / USD pair (most likely, she will confirm the propensity of the ECB leadership to continue pursuing a soft monetary policy). But today's speech by Jerome Powell (at 15:00 GMT) may again significantly shake the markets if he touches on the topic of the Fed's monetary policy and makes unexpected statements. Market participants expect additional signals from him regarding the Fed's plans for this year.

Support levels: 1.1333, 1.1318, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Resistance levels: 1.1370, 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700

Trading Recommendations

Sell Stop 1.1330. Stop-Loss 1.1380. Take-Profit 1.1318, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Buy Stop 1.1380. Stop-Loss 1.1330. Take-Profit 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700