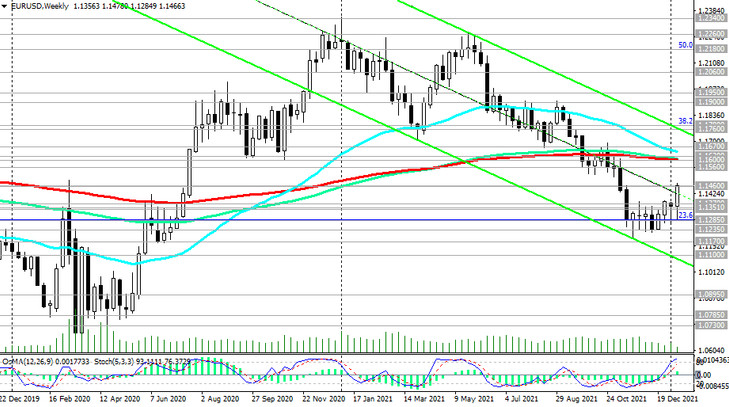

Even its main competitor in the euro currency market is strengthening against the dollar, despite the more restrained position of the ECB in relation to its monetary policy than in the Fed. As we noted in our previous review for 01/11/2022, “in an alternative scenario, EUR/USD will break through the upper limit of the range and the resistance level 1.1370, and corrective growth will continue towards the zone of strong resistance levels 1.1560, 1.1600 (EMA200 on the weekly chart), 1.1620 (ЕМА200 on the daily chart).

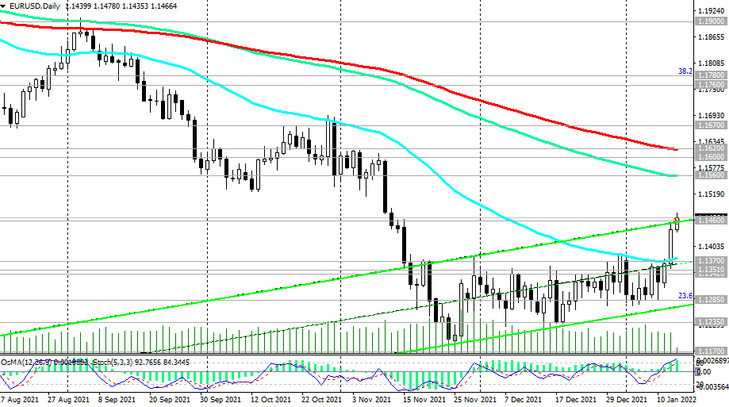

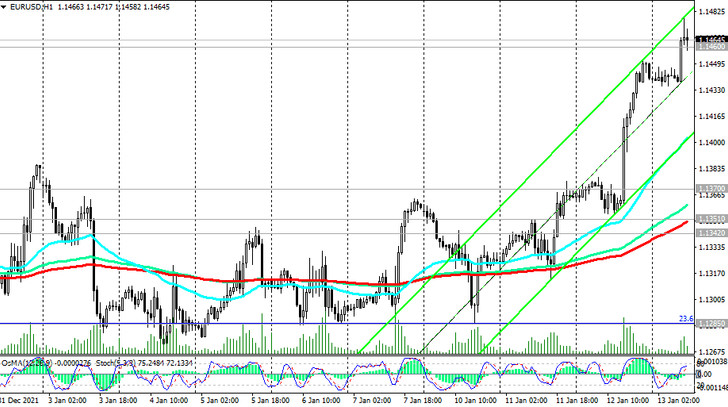

As we can see, events are developing according to an alternative scenario: EUR/USD has broken through the resistance level 1.1370 and continues to develop an upward correction today, heading towards the nearest strong resistance level 1.1560 (EMA144 on the daily chart). If the in the current situation of the dollar weakening the turn of the tide does not happen in the coming days, then “a break of the long-term resistance level 1.1760 (EMA200 on the monthly chart) will return EUR/USD into the long-term bull market zone”.

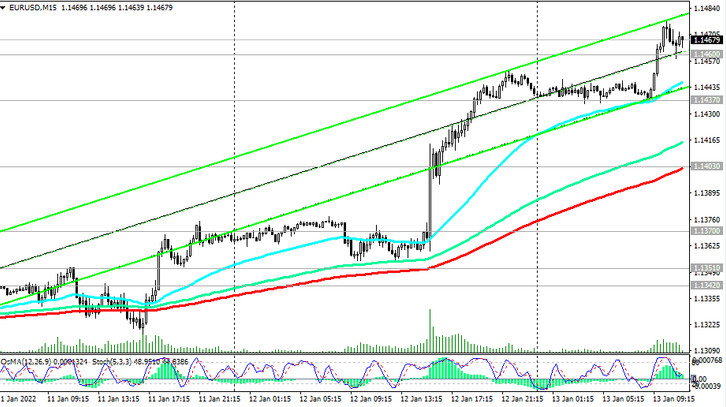

And at the current moment and the time of publication of this article, the EUR/USD pair is trying to break through the local resistance level 1.1460 (the upper limit of the ascending channel on the EUR/USD daily chart also passes through this mark).

The signals for the resumption of EUR/USD sales will be a breakdown of the local support level 1.1437 (today's lows) and 1.1403 (EMA200 on the 15-minute chart). A return into the zone below the support level 1.1370 will indicate the resumption of the EUR/USD bearish trend.

Important data on the US retail sector and consumer confidence will be published on Friday, and today the dollar may receive short-term support at the beginning of the US trading session, if the weekly US labor market data, due at 13:30 (GMT), indicates for a low number of applications for unemployment. Despite the fact that the number of jobs in the US economy is still 3.6 million less than before the pandemic, the number of initial jobless claims remains at the lowest level in several decades - about 200 thousand. This is a positive factor for the dollar, after it became clear from the recent report of the US Department of Labor that unemployment in the country is at the minimum pandemic and multi-year level of 3.9%.

At the same time, despite the increase in the number of coronavirus infections and high inflation rates, US consumer sentiment remains generally positive. Thus, the final index of consumer sentiment in December amounted to 70.6, which is higher than the preliminary value of 70.4 and the November value of 67.4. In January, this index is also expected to remain at a relatively high level near the value of 70.0.

Support levels: 1.1437, 1.1403, 1.1370, 1.1351, 1.1342, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Resistance levels: 1.1460, 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700, 1.1760, 1.1780

Trading Recommendations

Sell Stop 1.1430. Stop Loss 1.1485. Take-Profit 1.1400, 1.1370, 1.1351, 1.1342, 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.0900, 1.0800, 1.0700

Buy Stop 1.1485. Stop Loss 1.1430. Take-Profit 1.1500, 1.1560, 1.1600, 1.1620, 1.1670, 1.1700, 1.1760, 1.1780