After a significant decline in the middle of last week against the background of the publication of fresh data on inflation in the US, last Friday the dollar was able to regain some of the lost ground.

Moreover, the dollar was able to recover, despite the weak statistics from the US, published at the beginning of the American trading session. US export and import prices fell 1.8% and 0.2%, respectively, while the core retail sales unexpectedly dropped 2.3% (vs. +0.2% expected in December), according to released data. US industrial production also fell by -0.1% in December (against the forecast of +0.4%), while the consumer confidence index from the University of Michigan fell to 68.8 in January (against the forecast of 70.0 and the previous value of 70.6).

However, Friday's strengthening was not enough for the dollar to close the past week in positive territory. It turned out to be negative for the DXY dollar index. Since the opening of today's trading day, DXY futures are falling again. As of this writing, DXY futures are traded near 95.10, 6 pips below Friday's close. The sharply increased yield of US government bonds is keeping the dollar from a stronger decline today. Thus, the yield on US 10-year bonds jumped today to 1.793% from Friday's low of 1.694%.

Moreover, it has been actively growing over the past 3 weeks, after the Fed meeting ended in mid-December, at which its leaders expressed their inclination to more actively curtail the stimulus policy. This suggests that investors are actively selling protective government bonds, counting on the growth of the dollar. Perhaps they are right, since the Fed's interest rate hike (which is planned to be done 3 times in 2022) should (in theory) help the dollar rise in price. But here, too, there is one significant moment of uncertainty. The Fed may simply not be able to keep up with inflation. US consumer prices rose 7.0% year-over-year in December, the highest since June 1982 (6.8% annual price growth in November), according to data released last week. Inflation continues to grow at the same rate, while the Fed may not keep up with it, steadily raising interest rates, which creates the threat of hyperinflation, and this directly affects the value of the dollar.

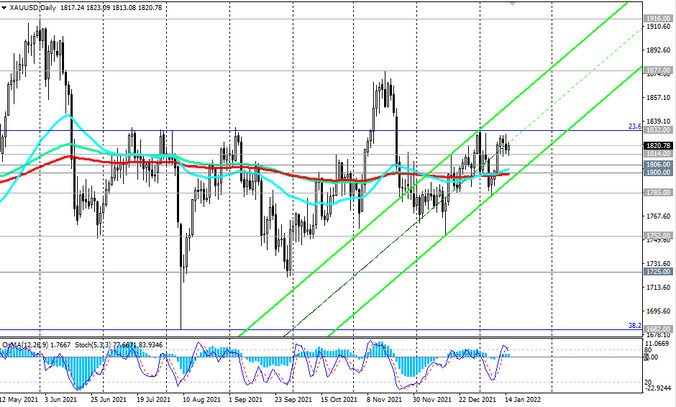

The traditional defensive asset in times of uncertainty and rising inflation is gold, and its dynamics perfectly demonstrates this uncertainty. Since the beginning of 2021, XAU/USD has been trading in a range between the levels 1916.00 and 1682.00. A narrower range is located between the levels 1832.00 and 1752.00.

Developing a more confident upward momentum for the XAU/USD pair is not given by the statements of the Fed leaders. Some, like St. Louis Fed chief James Bullard, are in favor of more aggressive monetary tightening. Bullard said last week that to contain high inflation, it now looks like it will need to raise interest rates four times this year. "We want to get inflation under control in a way that doesn't harm the real economy, however, we are also determined to bring inflation back to our target of 2% over the medium term", Bullard said.

As you know, gold does not bring investment income, but its quotes are very sensitive to changes in the monetary policy of the world's central banks, especially the Fed. And now, when investor confidence that the Fed will start actively raising interest rates (at least 3 times in 2022) is growing, gold's uptrend is in danger of being broken.

However, if the Fed is inactive, and inflation in the US continues to grow at the same pace, then the demand for gold, as a defensive asset, may push its quotes towards the upper limits above the indicated ranges. By the way, between the marks of 1877.00 and 1916.00 there is also an upper limit of the rising channel on the weekly XAU/USD chart. In case of its breakdown, XAU/USD has a chance to rise towards multi-year highs near the 2000.00 mark. We also note that at the height of the pandemic crisis in August 2020, XAU/USD quotes rose to 2074.00. Perhaps this is an overly negative scenario. But it can also be realized if any negative events of a global geopolitical scale occur, for example, military clashes in a wide theater of military operations.

In an alternative scenario, and after a retest of the key long-term and psychologically important support level 1800.00, XAU/USD will head towards the lower border of a wide range passing through 1682.00 (Fibonacci 38.2% retracement to the growth wave from December 2015 and 1050.00). A breakdown of the support levels 1635.00 (200-period moving average on the weekly chart), 1560.00 (50% Fibonacci level) will increase the risks of breaking the long-term bullish trend of XAU/USD.

In our view, XAU/USD will remain upside for the time being, remaining mostly in the area above 1800.00, while investors assess the prospects for Fed policy and the threat from hyperinflation risks and the strengthening of the coronavirus pandemic (for more details, see Technical Analysis and Trading Recommendations).