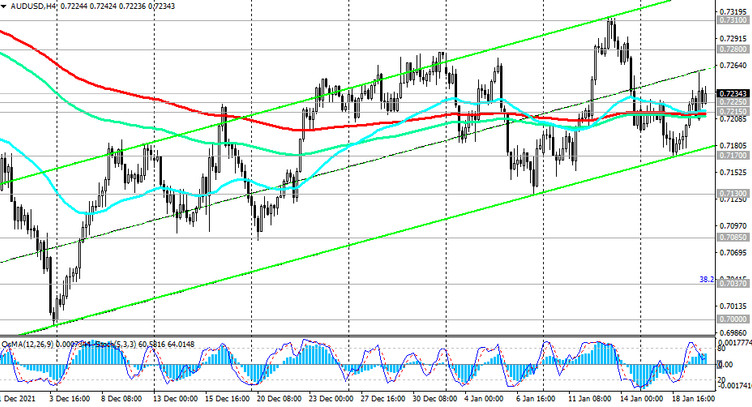

In response to the publication of fresh data on the dynamics of the Australian labor market today, the AUD has strengthened, and the pair AUD / USD has grown, breaking through the important resistance level 0.7215 (EMA200 on the 1-hour and 4-hour charts, EMA50 on the daily chart). The potential for corrective growth remains to the key resistance levels 0.7280 (EMA144 on the weekly chart and the upper limit of the descending channel on the daily chart), 0.7310 (EMA144 on the daily chart), 0.7335 (EMA200 on the daily and weekly charts).

However, AUD/USD remains in the global bearish trend zone, trading below the key resistance levels 0.7310, 0.7335.

Therefore, when a sell signal appears, it is worth giving preference to short positions. The first such signal will be a breakdown of the support level 0.7215, and the confirming one - of the local support levels 0.7170, 0.7130. A breakdown of the local support level 0.7130 will confirm this opinion and send AUD/USD inside the downward channel on the daily chart, the lower limit of which is close to 0.6800.

Support levels: 0.7215, 0.7170, 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Resistance levels: 0.7280, 0.7300, 0.7310, 0.7335

Trading Recommendations

Sell Stop 0.7205. Stop Loss 0.7260. Take-Profit 0.7170, 0.7130, 0.7085, 0.7037, 0.7000, 0.6900, 0.6800

Buy Stop 0.7260. Stop Loss 0.7205. Take Profit 0.7280, 0.7300, 0.7310, 0.7335