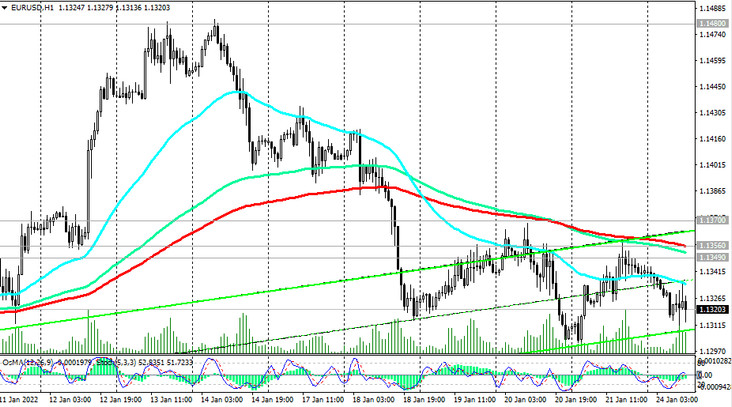

Returning to the dynamics of the euro and the EUR/USD pair, it failed to develop an upward correction after the publication of the HIS Markit report, and continues to decline, remaining within the descending channels on the daily and weekly charts. Their lower borders are currently passing near the 1.1100 and 1.1000 marks, respectively. A break of support at 1.1285 (Fibonacci 23.6% of the upward correction in the pair's decline from 1.3870, which began in May 2014, to 1.0500) will take EUR/USD out of the range between 1.1285 and 1.1370 (EMA50 on the daily chart) and send a pair to the lower border of a wider range formed between the levels 1.1235 and 1.1370. After its breakdown, the road will be open towards the 1.1100 and 1.1000 marks.

In an alternative scenario, the first signal for buying will be a breakdown of the important short-term resistance levels 1.1349 (EMA200 on the 1-hour chart), 1.1356 (EMA200 on the 4-hour chart), and the confirming one will be a breakdown of the resistance level 1.1370.

However, in the current situation, at least until 19:00 (GMT) on Wednesday, when the Fed's decision on interest rates will be published, short positions remain preferable.

Support levels: 1.1300, 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.1000, 1.0900, 1.0730

Resistance levels: 1.1349, 1.1356, 1.1370, 1.1480, 1.1500, 1.1540, 1.1600, 1.1700, 1.1760, 1.1780

Trading Recommendations

Sell Stop 1.1295. Stop Loss 1.1375. Take-Profit 1.1285, 1.1235, 1.1200, 1.1170, 1.1100, 1.1000, 1.0900, 1.0730

Buy Stop 1.1375. Stop Loss 1.1295. Take-Profit 1.1400, 1.1480, 1.1500, 1.1540, 1.1600, 1.1700, 1.1760, 1.1780