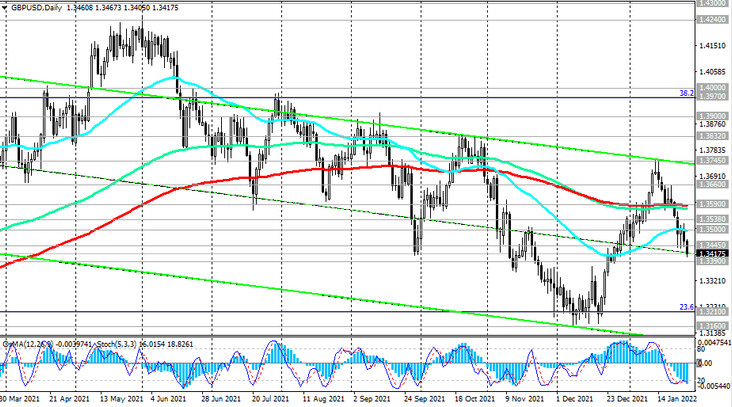

On the weekly chart, the GBP/USD has come close to the key support level 1.3390 (200-period moving average). If the rhetoric of statements by the leaders of the Bank of England regarding the prospects for monetary policy is considered by market participants as soft, then the pound may react with a weakening, and a breakdown of the support level 1.3390 may accelerate further decline in the GBP/USD, especially if the divergence of the monetary policy trajectories of the Fed and the Bank of England increases.

Today, the focus of market participants will be on a block of important macroeconomic statistics from the US, including reports on annual GDP dynamics for the 4th quarter, on the number of applications for unemployment benefits and the volume of orders for durable goods in December. These data will be published at 13:30 (GMT), which is why a sharp increase in volatility is expected on the financial market at this time, primarily in dollar quotes, and especially if the data differs greatly from the forecast values.

In an alternative scenario, the first signal for the beginning of a new wave of upward correction will be a breakdown of the local resistance level 1.3445, and the confirming one will be a breakdown of the resistance level 1.3500 (EMA50 on the daily chart). The first target of the upward correction is the key resistance level 1.3590. A breakdown of the local resistance level 1.3745 may again increase the risks of breaking the GBP/USD bearish trend, sending it towards the highs of 2021 and the 1.4200 mark.

However, so far this is only an alternative scenario. In the current situation, short positions on GBP/USD are preferable.

Support levels: 1.3390, 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Resistance levels: 1.3445, 1.3500, 1.3538, 1.3590, 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000

Trading recommendations

Sell Stop 1.3385. Stop Loss 1.3455. Take-Profit 1.3300, 1.3210, 1.3160, 1.3000, 1.2865, 1.2685

Buy Stop 1.3455. Stop Loss 1.3385. Take-Profit 1.3500, 1.3538, 1.3590, 1.3660, 1.3700, 1.3745, 1.3832, 1.3900, 1.3970, 1.4000