The dollar continues to strengthen after the Fed meeting ended on Wednesday. As is known, and widely expected, Fed officials have kept the current target range for federal funds rates unchanged. The main key interest rate remained at 0.25%. However, the dollar strengthened sharply on expectations of the start of a cycle of Fed interest rate hikes. Fed leaders have confirmed their intention to start raising rates in March. Fed Chairman Jerome Powell also said that "there is considerable room to raise rates without jeopardizing the labor market", as "labor market conditions are in line with full employment". In regards to accelerating US inflation, Powell said that "the Fed's policy will have to respond in case of further deterioration of the situation”.

As a result, by the time this article was published, the DXY dollar index has grown since the beginning of this week by 1.8%, adding to the current mark of 97.38 171 points and returning to June 2020 levels. Even if, closer to the middle of the American trading session, profit-taking begins in long dollar positions, it is obvious that this week, the second in a row, the DXY dollar index will end in positive territory, with a noticeable increase.

The trigger for profit-taking may be the publication at 13:30 (GMT) of the indexes of spending on personal consumption of Americans. Household spending rose 0.5% in November after the same increase in October, while personal income increased 0.4% compared to October. The Core Personal Consumption Expenditure Index (Core PCE) rose 4.7% (annualized) in November, the highest since 1991. This index is the Fed's preferred indicator of inflation and excludes volatile food and energy prices. Consumer spending in the US, as well as household incomes, is rising, which contributes to the overall recovery of the economy, while companies increase investment. With inflation accelerating to a 30-year high, other macro data suggests continued momentum for the recovery of the US economy as labor demand rises and unemployment falls. The core personal consumption expenditure index (Core PCE) is expected to rise again in December, by +4.8% (in annual terms). This is a positive factor for the dollar. However, if other articles of the report of the Bureau of Economic Analysis of the US Department of Commerce are not as strong and disappoint market participants, then this may become, as we noted above, a trigger for profit-taking in long positions on the dollar, which may cause its quotes to fall. However, it is probably not worth waiting for a deeper weakening of the dollar. In the current situation, a more correct trading strategy would be to bet on the strengthening of the dollar than on its weakening.

The yield of US government bonds remains high and is in the zone of 2-year highs. Thus, last week the yield on 10-year US bonds exceeded 1.900%, and today it is 1.836%. The volume of sales of government bonds remains high, while the reduction in the volume of their purchases by the Fed is accelerating, causing an increase in their yield and, accordingly, demand for the dollar.

At the same time, market participants are betting that the Fed may reach a 2% rate level this year, which will further increase the divergence in interest rate curves in the US and other economically developed countries.

Participants of the oil market will pay attention today to the publication at 18:00 (GMT) of the report of the oil service company Baker Hughes on active oil platforms in the US.

Previous data from Baker Hughes showed an increase in the number of active rigs to 491 units (vs. 492, 481, 480, 475, 471, 467, 461, 450, 445, 433, 428, 421, 411, 401, 394, 410, 405, 397 in previous reporting periods). Obviously, the number of oil producing companies in the US is growing again, which is a negative factor for oil prices. Their next growth will also have a negative impact on oil prices, however, it will only have a short-term character.

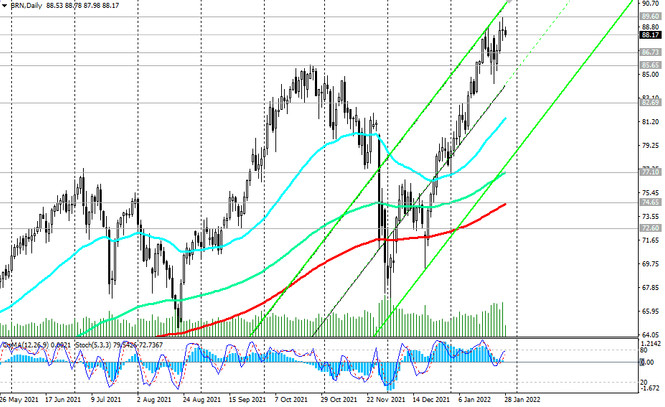

At the time of publication of this article, Brent crude is traded near $88.20 per barrel. Yesterday, its quotes came close to $90 per barrel for the first time since 2014, after the release of the Energy Information Administration (EIA) report of the US Department of Energy on Wednesday. According to the Ministry of Energy, although commercial oil reserves increased by 2.377 million barrels in the reporting week (analysts expected them to decline by -0.728 million barrels), the total volume of oil and petroleum products reserves in the United States, including strategic reserves, fell to 1.78 billion barrels, the lowest since 2014.

In general, oil market analysts believe that energy prices will remain positive, staying above current levels, and oil prices may rise for the sixth week in a row. OPEC oil production remains below quotas as tensions between Russia, a major gas and oil producer, and Ukraine, through which large volumes of natural gas are shipped, fuel energy prices growth. In the event of interruptions in their supply, oil prices can accelerate their growth, even if the dollar further strengthens.