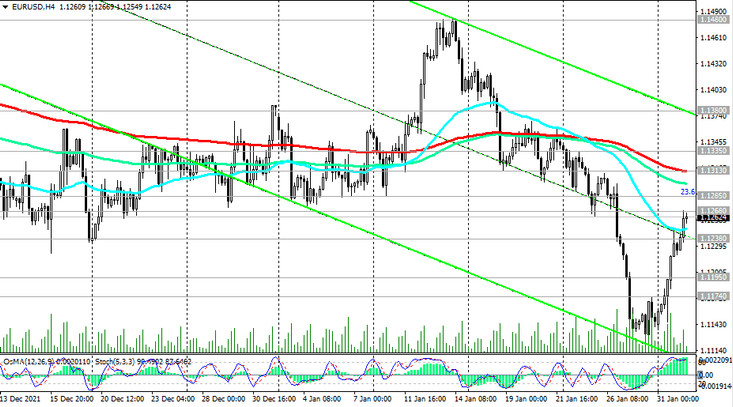

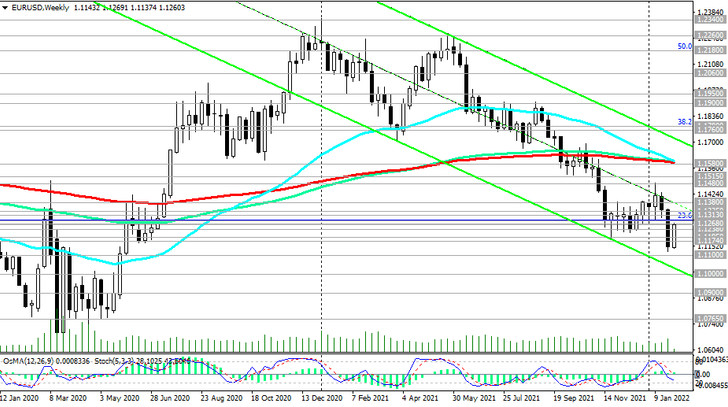

As we said above, today is the second day in a row that EUR/USD is developing upward dynamics, reaching an intraday high at 1.1268. In case of breakdown of this local resistance level, the upward correction may continue towards the resistance levels 1.1285 (Fibonacci 23.6% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, to the level 1.0500), 1.1300, 1.1313 (EMA200 at 4-hour chart), 1.1335 (EMA50 on the daily chart), 1.1380 (upper line of the range between 1.1380 and 1.1240).

Further growth will depend on the decisions taken at the ECB meeting on Thursday and on the dynamics of the dollar. Although, in our opinion, corrective growth will be limited by the resistance level 1.1335.

In the main scenario, the first sell signal will be a breakdown of important support levels 1.1247 (EMA200 on the 1-hour chart), 1.1240. Downward targets are located at the levels 1.1195, 1.1174, 1.1100, 1.1000 (lower limit of the descending channel on the weekly chart).

One way or another, short positions are still preferable.

Support levels: 1.1247, 1.1240, 1.1195, 1.1174, 1.1100, 1.1000, 1.0900, 1.0730

Resistance levels: 1.1285, 1.1300, 1.1313, 1.1335, 1.1380, 1.1480, 1.1515, 1.1580

Trading Recommendations

Sell Stop 1.1220. Stop Loss 1.1290. Take-Profit 1.1195, 1.1174, 1.1100, 1.1000, 1.0900, 1.0730

Buy Stop 1.1290. Stop Loss 1.1220. Take-Profit 1.1300, 1.1313, 1.1335, 1.1380, 1.1480, 1.1515, 1.1580