Among other important events of this week is the publication on Friday of the US Department of Labor's monthly report on employment in January, which is of key importance for the Fed when planning monetary policy parameters. In view of this, tomorrow, market participants who follow the quotes of the US dollar and US stock market indices will follow the publication (at 13:30 GMT) of weekly data on the US labor market. They are expected to point to a decline in initial jobless claims to 245,000 after their unexpected rise to 260,000 the week before last and 290,000 three weeks earlier. One way or another, this is still a low number of applications for unemployment. It remains at the lowest level for several decades - about 200 thousand. This is a positive factor for the dollar, after it became clear from the previous report of the US Department of Labor that unemployment in the country is at the minimum pandemic and multi-year level of 3.9%.

If the data turns out to be better than the forecast, then the US dollar should strengthen in the short term.

The American labor market is strengthening at the same time as inflation is rising rapidly, which is becoming a key factor in determining the decisions of Fed leaders on how quickly and how much to raise the key rate.

In Friday's employment report, economists and market participants will pay special attention to whether the number of active labor market participants has increased after the state stimulus has ended. The authorities are unlikely to return to stimulus payments and higher unemployment benefits, which could force more number of people return to the labor market.

On Friday (at 13:30 GMT), the next monthly report from the US Department of Labor will be released, according to which, in January, 150,000 new jobs were created (outside the agricultural sector), hourly wages increased by another 0.5%, and the unemployment rate remained at 3.9%, the lowest since March 2020, when millions of Americans were laid off amid massive business closures due to the coronavirus pandemic.

Labor market data (along with inflation and GDP data) are key to the Fed's decision on monetary policy. The U.S. job market will continue to strengthen in the coming months, according to most economists, despite a rise in Covid-19 infections, while there is a clear shortage of workers and the spread of the coronavirus is forcing some consumers and the temporarily unemployed to stay at home.

And today, market participants will follow the publication (at 13:15 GMT) of the ADP report on employment in the private sector, which, as a rule, has a strong impact on the market and dollar quotes. An increase in the value of this indicator has a positive effect on the dollar. It is expected that the growth in the number of employees in the US private sector in January amounted to +207,000 (against an increase of 807,000 in December, 534,000 in November, 571,000 in October, 568,000 in September, 374,000 in August, 330,000 in July, 692,000 in June, 978,000 in May, 742,000 in April, 517,000 in March, 117,000 in February, 174,000 in January 2021). A relative decrease in the indicator and worse-than-expected data may have a negative impact on dollar quotes.

Although the ADP report does not have a direct correlation with the official data of the US Department of Labor, which will be published on Friday, however, it is often its harbinger, having a noticeable impact on the market.

Meanwhile, the DXY dollar index has been declining for the third day in a row today. At the time of publication of this article, the DXY dollar index was near the mark of 96.10, corresponding to the levels of July 2020, 130 points below the local maximum reached last week near the mark of 97.44. At the same time, the yield of 10-year US government bonds remains close to the highs of 2 years ago, currently standing at 1.785% and supporting the dollar.

Market participants are also preparing for tomorrow's trading day, when during the European trading session there will be meetings of the ECB and the Bank of England. We wrote about market expectations regarding the actions of the ECB in our yesterday's article with trading recommendations for EUR/USD.

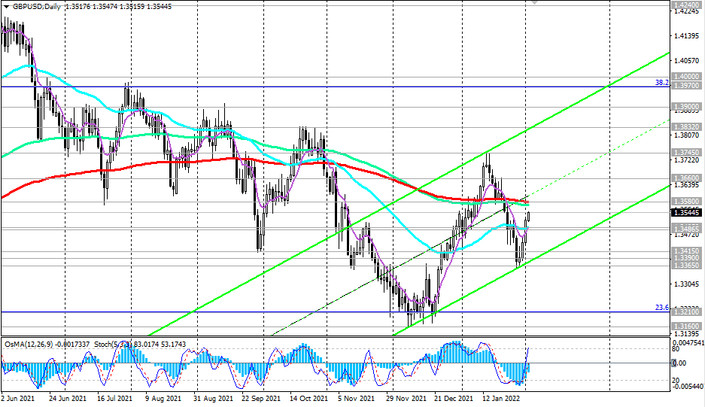

As for the GBP/USD and expectations regarding the actions of the Bank of England, it can be noted that, most likely, the bank's leaders will raise the interest rate by 0.25% to 0.50%, and this is already largely taken into account in the pound quotes. The accompanying statements by the Bank of England management will be more important for market participants. If market expectations that interest rates in the UK will be raised again this year (as expected four times) do not materialize, then the pound may come under pressure, despite the increase in interest rates at tomorrow's meeting.

Despite the vaccination campaign, the UK still has a high level of coronavirus infections, while rising energy prices and disruptions in supply chains are accelerating inflation in the country. Given the uncertainty of the situation in the government and the unwillingness to take risks amid growing tensions with Russia due to events in Ukraine, the Bank of England may pause the cycle of further tightening of monetary policy after tomorrow's meeting.