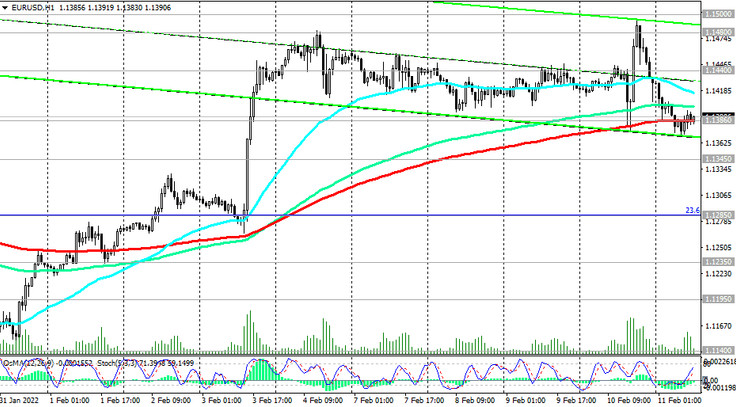

EUR/USD failed to develop an upward trend above the resistance levels 1.1480, 1.1500 (EMA144 on the daily chart). Today the pair is falling again, moving inside the descending channel on the daily chart. A sell signal will be a breakdown of the important short-term support level 1.1386 (EMA200 on the 1-hour chart). The immediate downside targets are at support levels 1.1360 (EMA50 on the daily chart), 1.1345 (EMA200 on the 4-hour chart).

Their breakdown will strengthen the downward dynamics and send EUR/USD towards 1.1140 (local and January lows), 1.1100 (lower limit of the downward channel on the weekly chart).

In an alternative scenario, EUR/USD will again attempt to grow towards the key resistance levels 1.1560 (EMA200 on the daily chart), 1.1590 (EMA200 on the weekly chart). In turn, their breakdown may return EUR/USD to the zone of a long-term bull market with the prospect of growth to the resistance levels 1.1760 (EMA200 on the monthly chart), 1.1780 (Fibonacci level 38.2% of the upward correction in the wave of the pair’s decline from the level of 1.3870, which began in May 2014, to 1.0500).

In our main scenario, the growth of EUR/USD will still be limited by the resistance levels 1.1500, 1.1560, 1.1590, while short positions remain preferable.

Support levels: 1.1386, 1.1360, 1.1345, 1.1285, 1.1235, 1.1195, 1.1174, 1.1100, 1.1000, 1.0900, 1.0730

Resistance levels: 1.1440, 1.1480, 1.1500, 1.1560, 1.1590

Trading Recommendations

Sell by market. Stop Loss 1.1450. Take-Profit 1.1360, 1.1345, 1.1285, 1.1235, 1.1195, 1.1174, 1.1100, 1.1000, 1.0900, 1.0730

Buy Stop 1.1450. Stop Loss 1.1365. Take-Profit 1.1480, 1.1500, 1.1560, 1.1590