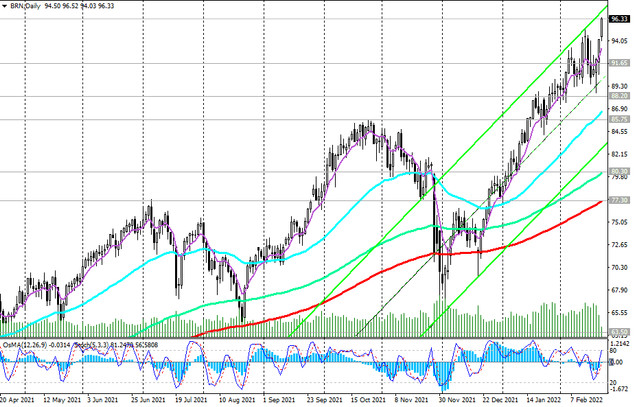

Oil prices have risen significantly over the past few weeks, staying in the bull market and trading above long-term support levels. At the time of publication of this article, Brent oil futures are traded above 96.00, remaining in the zone of multi-year highs.

A breakdown of the local resistance level 96.52 (today's high) will lead to further price growth, despite the fact that oil market analysts predict that the positive dynamics of the oil market will continue against the backdrop of increased demand for energy and limited oil supplies by OPEC+ countries.

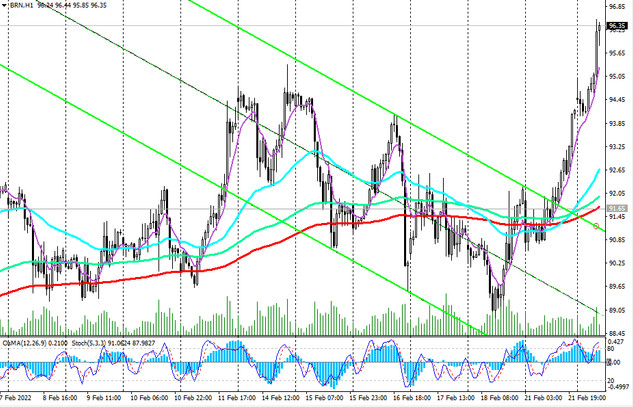

In an alternative scenario, and in case of a breakdown of the support level 91.65 (EMA200 on the 1-hour chart), the price may first fall to the important support level 88.20 (EMA200 on the 4-hour chart), and then, after the breakdown of the local support level 85.75, to long-term support levels 80.30 (EMA144 on the daily chart), 77.30 (EMA200 on the daily chart). Breakdown of the key long-term support level 63.50 (ЕМА200 on the weekly chart) will increase the negative dynamics and the likelihood of a return to the long-term downtrend.

Support levels: 91.65, 88.20, 85.75, 80.30, 77.30, 63.50

Resistance levels: 96.52, 97.00, 98.00, 99.00, 100.00

Trading recommendations

Brent: Sell Stop 93.90 Stop-Loss 97.10. Take-Profit 91.65, 88.20, 85.75, 80.30, 77.30, 63.50

Buy Stop 97.10. Stop Loss 93.90. Take Profit 98.00, 99.00, 100.00