And yet, the Fed management justified the expectations of market participants. As a result of the meeting that ended on Wednesday, the leaders of the central bank raised the interest rate by 0.25% and announced their intention to raise interest rates another 6 times in 2022, also allowing for the possibility of a tougher decision. The Fed will also start cutting its balance sheet "at the next meeting", that is, potentially as early as early May. “Every meeting is a lively discussion”, Fed Chairman Jerome Powell said at a press conference. “We will look at changing conditions. And if we come to the conclusion that it is appropriate to act faster and remove easing measures, then we will do so”.

The first reaction of market participants to such a decision by the Fed was positive, and the dollar strengthened immediately after the publication of the decision. The yield on 10-year US Treasury bonds also continued to rise, hitting 2.24% yesterday, a new almost 3-year high after the Federal Reserve (for the first time since 2018) raised the key interest rate (prior to this decision by the Fed, the yield of 10-year bonds was 2.19%).

However, subsequently the dollar and US bond yields started to decline, and during today's Asian trading session, the dollar also remained under pressure.

The DXY dollar index was at the beginning of today's European session near 98.34, 76 points below yesterday's local high of 99.10.

Obviously, the Fed's decision to raise the rate by 0.25% and the expectations of tightening monetary policy at the planned pace have already been taken into account in dollar quotes.

Economists and market participants are now evaluating how effective the Fed will be in dealing with inflation, which has reached its highs in the past 40 years. The growing readiness of investors to buy risky, but profitable, assets against the backdrop of ongoing negotiations between representatives of Russia and Ukraine also contributes to weakening the demand for the dollar as a defensive asset. As we can see, in recent days there has been an increase in the American and European stock markets.

It seems that now, after the Fed meeting ended yesterday, the determining factors on the market will be the situation in Ukraine and the actions of other major world central banks. This week, market participants will also evaluate the results of the meetings of the central banks of Great Britain and Japan, and next - China and Switzerland. If the Bank of England (its meeting ends today at 12:00 GMT) is expected by market participants to raise interest rates, then the Bank of Japan, the People's Bank of China and the Swiss National Bank will probably not change their monetary policies.

As a result of the meeting that ended in December, the Swiss Central Bank kept its current policy unchanged, leaving the key interest rate on demand deposits at -0.75%. The target range for the 3-month Libor rate was also left unchanged at -1.25% / -0.25%. The SNB statement once again, already traditionally, said that the Central Bank is still ready for foreign exchange interventions with the sale of the franc, if necessary, in order to withstand upward pressure on its rate. According to the leaders of the SNB, the franc remains highly overvalued. According to the head of the Central Bank of Switzerland, Jordan, "inflation in Switzerland has reached peak levels and will now decline next year", and "forecasts for inflation in the country remain within the range of price stability". The National Bank of Switzerland will continue to monitor the situation with the franc exchange rate and "will take appropriate measures if necessary", Jordan promised.

The SNB said last week that the bank "remains ready to intervene in the foreign exchange market if necessary". According to the SNB management, "the franc is currently in demand as a safe-haven currency", but it "still remains highly overvalued".

The threat of foreign exchange intervention, which the Swiss NB does not report either before or after, is certainly a strong deterrent to the strengthening of the franc, although it will retain its safe haven status, which will support demand for it.

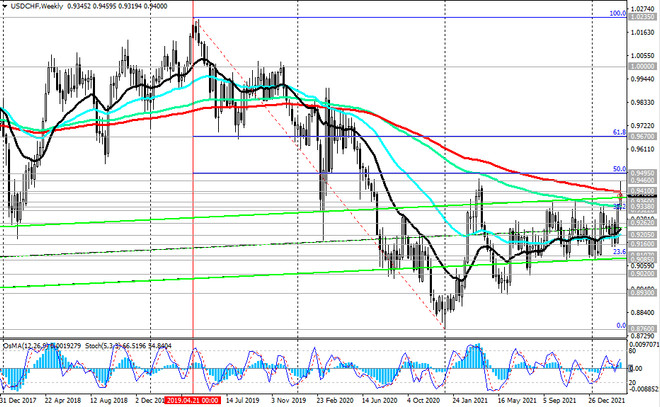

Against the backdrop of the recent sharp strengthening of the dollar, which actively used the status of a protective asset due to a sharp deterioration in the geopolitical situation (investors preferred it among other traditional protective assets - gold, yen, franc), the USD/CHF pair rose sharply, reaching a zone of 12-month highs near 0.9460.

The weakening of the franc, primarily against the dollar, reduces the likelihood of foreign exchange intervention by the SNB and maintains the likelihood that the leadership of the Swiss central bank will leave the current monetary policy unchanged at the March 24 meeting.

One way or another, the dollar and the threat of foreign exchange interventions from the SNB continue to play a dominant role in determining the dynamics of USD/CHF.