As a result of the two-day (Tuesday and Wednesday) weakening of the dollar, yesterday the DXY dollar index, which evaluates the value of the dollar against a basket of 6 major currencies, fell to 4-week lows, reaching 97.73. As we noted in our yesterday's review, the reason for this was the results of negotiations between representatives of Russia and Ukraine, which ended in Istanbul on Tuesday. The parties announced progress in the negotiations.

As a result, the dollar, which is currently in active demand as a protective asset, fell sharply, and the DXY dollar index lost 1.2% in 2 days.

Meanwhile, military tensions in Ukraine persist, while significant differences remain between the parties.

Today the dollar is strengthening again, and the DXY dollar index is growing. As of this writing, DXY futures are traded near 98.20, up 33 points from yesterday's close.

The main shares in the DXY dollar index belong to the euro (57.6%) and the yen (13.6%). The active weakening of the euro, which resumed after its strengthening the day before, contributes to the growth of the DXY dollar index.

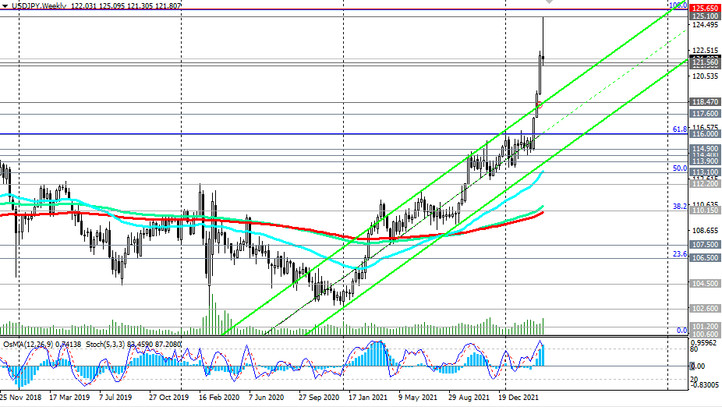

The strengthening of the dollar against the yen is minimal today, although the decline in the USD/JPY pair, which was observed on Tuesday and Wednesday, also stopped. In general, the pair USD/JPY maintains a positive momentum, trading on a strong positive momentum above the key support levels 107.50, 110.15, 113.90.

Meanwhile, the US dollar is rising as hopes for a diplomatic solution to the Russian-Ukrainian conflict are fading, supporting demand for safe-haven assets.

Yesterday's macro data from the US is also reassuring for investors. Thus, according to ADP data, the number of jobs in the US private sector increased by 455,000 in March (the forecast assumed an increase in their number by 450,000).

"Job growth was wide-ranging across all sectors in March, contributing to growth of nearly 1.5 million jobs in Q1 2022", ADP said.

On Friday (at 12:30 GMT) the Department of Labor will release its March employment report and investors appear to be regaining their dollar buying positions in anticipation of its growth. Economists expect 490,000 non-farm payrolls to rise and the unemployment rate to fall to 3.7%, which could fuel expectations for a more aggressive Fed rate hike.

During his speeches last week, Fed Chairman Jerome Powell confirmed the possibility of a one-time increase in interest rates by 50 basis points at once. In total, the Fed leaders are planning 6 more interest rate hikes this year. Thus, by the end of the year, the Fed interest rate should be at least 2% or more if it increases at Fed meetings not by 0.25%, but by 50%. It is also expected that the US central bank may soon begin to reduce its balance sheet, which is approximately $9 trillion.

The Bank of Japan, unlike the Fed, is likely to continue its loose policy and keep interest rates at extremely low levels. This week, the Bank of Japan confirmed unlimited purchases of 10-year government bonds and a promise to continue such transactions in the coming days.

At the same time, Japan is one of the largest importers of energy and other minerals, and rising oil prices provoke an increase in dollar purchases by Japanese importers.

However, there is also an opposite point of view. According to some economists, the yen may begin to strengthen again, and USD/JPY to decline, if the Bank of Japan reconsiders its attitude towards the excessive weakening of the yen. "Stability in exchange rates is important, and rapid changes are undesirable", Japan's Deputy Finance Minister Masato Kanda said on Tuesday, echoing earlier statements made by a government spokesman and finance minister. The reasons for the normalization of the policy of the Bank of Japan, according to economists, may be a weakening of concern about the spread of the omicron strain, public dissatisfaction with inflation, a decline in the yen and upcoming changes in the management of the central bank.

In the meantime, the most likely trajectory for USD/JPY is its further growth. USD/JPY briefly rose above 125.00 this week for the first time since August 2015. Since the beginning of the year, the yen has decreased against the US dollar by 5.6%, and economists expect the USD/JPY pair to break through the 125.00 level in the 2nd quarter amid further divergence of the monetary policy trajectories of the Fed and the Bank of Japan.

Today, market volatility in dollar and USD/JPY quotes may increase again at 12:30 (GMT), when a block of important macro statistics for the US will be published, as well as at 23:50 with the publication of the Tankan index of large producers. This index reflects general business conditions for Japan's large manufacturing companies and is an indicator of the current state of Japan's export-oriented economy, which is heavily dependent on the industrial sector. The index is forecast at 12 (for 1Q 2022) after rising to 14 in 2Q and 3Q 2021 and 18 in 4Q 2021, which is likely to support the yen despite relative decline in the indicator (a value above 0 is a positive factor for the JPY).