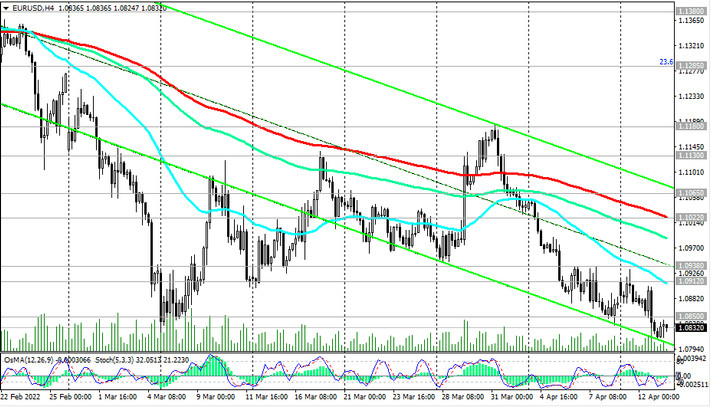

EUR/USD continues to decline on the back of strong fundamentals. The pair is traded in the bear market zone, declining within the descending channels on the daily and weekly charts. The lower border of the descending channel on the weekly chart is below 1.0700, near the lows of March 2020.

Probably, this mark can become a reference point for short positions on the pair with intermediate targets at 1.0800, 1.0765.

In the area below the resistance levels 1.0912 (EMA200 on the 1-hour chart), 1.1022 (EMA200 on the 4-hour chart), 1.1065 (EMA50 and the upper line of the descending channel on the daily chart), nothing threatens short positions.

In an alternative scenario, corrective growth may begin after the breakdown of the resistance level 1.0850 (EMA200 on the 15-minute chart and local lows) with targets at the resistance levels 1.0912, 1.0938, 1.1022, 1.1065, near which new pending sell orders can be placed.

Below resistance levels 1.1285 (EMA144 on the daily chart and Fibonacci 23.6% level of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014, to 1.0500), 1.1380 (EMA200 on the daily chart), EUR/USD is in the bear market zone. Downward dynamics prevails, making short positions preferable.

Support levels: 1.0800, 1.0765, 1.0700, 1.0500, 1.0350

Resistance levels: 1.0850 1.0912 1.0938 1.1000 1.1022 1.1065 1.1130 1.1180 1.1200 1.1285 1.1300 1.1380 1.1500 1.1540 1.1740

Trading Recommendations

Sell Stop 1.0805. Stop Loss 1.0870. Sell Limit 1.0912, 1.0938. Stop Loss 1.0955. Sell Limit 1.1000, 1.1022, 1.1065. Stop Loss 1.1085.

Buy Stop 1.0870. Stop Loss 1.0805. Take-Profit 1.0912, 1.0938, 1.1000, 1.1022, 1.1065, 1.1130, 1.1180, 1.1200, 1.1285, 1.1300, 1.1380